An Investor’s Guide to Smart Contract Blockchains

Editor’s Note: Please see the glossary at the end for all terms highlighted in sea green found in the order that they appear.

Smart contracts’ value proposition is well-founded, as we discussed in our previous blog post Exploring the Disruptive Potential of Smart Contracts. They bring programmability to a value transfer infrastructure and have low-cost, fast, secure, and trustless properties. Despite being a technology in its infancy, the potential to disrupt sectors such as financial services, tech, and gaming is palpable, with applications across all areas gaining user activity.

Smart contracts are deployed in compatible distributed ledger networks, typically smart contract blockchains, often referred to as layer 1 blockchains. Today there are a growing number of smart contract blockchains hosting ecosystems of composable applications that offer specific utilities, varying levels of throughput, security, and decentralization.

The native assets of these platforms function as the common medium of exchange within the network and can represent a revolutionary shift toward a user-owned economy. In this piece, we introduce the major smart contract blockchains, the value behind their native assets, and the growing investment case for these disruptive platforms.

Key Takeaways

- Ethereum achieved a successful formula between cryptographic functions, blockchain technology, and smart contract programmability. The introduction of such a concept opened the gates for other developers to create alternative smart contract blockchains based on varied throughput, decentralization, and security features.

- The monetary value within these platforms is significant, highlighting their utility and the growing user conviction in the decentralized applications (dapps) ecosystem.

- Smart contract blockchains’ native assets present opportunities to invest in a user-owned economy, a medium of exchange, and a potential store of value opportunity.

The Smart Contract Platform Landscape Continues to Develop

We covered how Ethereum introduced smart contract functionality into a blockchain platform in our Ethereum: The Basics report.

Its growth, developer activity, and user adoption paved the way for other smart contract blockchains. Ethereum remains the most prominent player and has significant upgrades in the pipeline, such as proof-of-stake (PoS) and shard chains.

However, the playing field has expanded well beyond Ethereum. Other platforms offer compelling solutions related to throughput, security, and decentralization. Today, the market cap of smart contract blockchains totals around $247 billion, or roughly 27% of the total crypto landscape.1

On the surface, these platforms aim to serve a similar purpose, but they are increasingly unique. Compared to peers, different platforms can offer different consensus mechanisms, different block sizes, higher processing speeds, burning mechanisms, and can require more powerful node hardware, among other attributes.

Below we break down the leading smart contract blockchains by market cap:

Ethereum

Native Asset: ETH | Market Cap: $130 billion USD | Genesis Block: July 30th, 20152

The first of its kind, Ethereum is the largest decentralized computing platform for decentralized applications (dapps). Ethereum introduced smart contract programmability within blockchain ecosystems and hosts the majority of active dapps today. Ethereum is shifting to PoS and significant scalability resources are being built to foster greater throughput powered by Ethereum’s native security features.

BNB Chain

Native Asset: BNB | Market Cap: $36 billion USD | Genesis Block: April 18th, 20193

BNB Chain is the native smart contract chain from Binance. Its native asset is used for powering dapps within the ecosystem and as a transactional currency within Binance’s leading centralized exchange. BNB Chain is an EVM-compatible blockchain that offers greater scalability to users than Ethereum, but at the cost of being more centralized BNB Chain is the second leading blockchain in terms of dapp activity.

Cardano

Native Asset: ADA | Market Cap: $15.5 billion USD | Genesis Block: September 29th, 20174

Cardano aims to be a sustainable, decentralized, and scalable blockchain platform for running smart contracts. Hydra, a layer 2 solution, is expected to go live this year to help scale the Cardano network. Cardano features a few proprietary smart contract coding languages that differ from Ethereum’s popular Solidity script.

Solana

Native Asset: SOL | Market Cap: $11.4 billion USD | Genesis Block: March 15th, 20205

Solana optimizes for scalability and high throughput by allowing larger block sizes that require a more potent node infrastructure. Solana can process up to 50,000 transactions per second while requiring insignificant transaction costs. However, these throughput advantages come at a cost. Decentralization in Solana is not as prominent as with other blockchains considering their node requirements. Solana programs are written in general-purpose languages such as Rust or C++.

Avalanche

Native Asset: AVAX | Market Cap: $4.6 billion USD | Genesis Block: September 20th, 20206

Avalanche aims to increase scalability and security without compromising decentralization. It features multiple chains, including core blockchains and non-core, application-specific networks. Application-specific networks in Avalanche are known as subnets and are Avalanche’s proposed scaling solution. Subnets are compatible with any smart contract package and any virtual machine, including Ethereum’s popular Ethereum Virtual Machine (EVM).

The Investment Case for Smart Contract Native Assets

Native assets in these platforms are not only a potential share of the network but also a medium of exchange used for peer-to-peer transfers, paying for network fees, trading on-chain assets, and engaging with the dapp ecosystem. Acting as the settlement currency, these cryptocurrencies derive their value from network demand. Thus, the easiest way investors can invest in smart contract platforms is to gain exposure to these assets. There are three main reasons to invest in a chain’s native asset:

- A network’s native asset is typically used to pay for block space, including peer-to-peer transfers and smart contract interactions. As the ecosystem of a chain grows and users execute more transactions, the demand for a chain’s native asset increases. Therefore, investing in that cryptocurrency means exposure to the growth of the entire network, including indirect exposure to dapps in an ecosystem.

- A network’s native asset is often used as the currency to exchange for other on-chain assets. For example, non-fungible tokens (NFTs) in the Solana network are commonly bought with SOL.

- A native asset can potentially act as a store of value. Most of these cryptocurrencies have a limited supply or a fixed issuance rate. Assets like ETH, BNB, and AVAX could even become deflationary due to the burning mechanisms of these platforms, potentially offsetting the issuance rate if transaction demand is high while earning yield through a portion of transaction fees and block rewards.

Most of these ecosystems rely on a proof of stake (PoS) consensus mechanism that requires locking the native cryptocurrency in order to secure the network in exchange for a portion of transaction fees. This process is called staking. Staking can be attractive because participants can potentially receive mid-single-digit to lower double-digit Annual Percentage Yields (APY), depending on the platform.7 The easiest way to participate in staking is by delegating cryptocurrencies to a validator, who typically charges a small percentage of the total yield obtained. Choosing a trusted network validator is essential because if a validator node decides to tamper with the network, a stake can be slashed. If the validator behaves correctly, the risks of staking are low. When staking, it is also important to consider lock-up periods.

Moreover, investors with exceptional risk tolerance could seek exposure to decentralized finance (DeFi) within these smart contract ecosystems and participate in its developing user-owned economy.

Overall, smart contract platforms have clever incentive mechanisms that can create positive network effects as follows:

- The native asset is needed to pay for block space/transactions

- Network validators get rewarded with fees and block rewards, which attracts more validators.

- More validators boost the security of the network.

- A more secure network with a bigger user base may attract more developers to build dapps and utility. Developer-created dapps and their utility attract users.

- With a secured and utility-rich network, demand for the native asset increases, which may boost the asset value.

Each of these participants is important to the other: without developers, there is limited utility; without users, there is no activity nor value creation, and without validators, there is low security. While the underlying ethos among smart contract blockchains evolves around the goal of onboarding smart contract-powered applications, the method of achieving such a goal varies across these ecosystems.

Today the number of smart contract platforms has increased, with each offering different characteristics. We can compare these platforms’ technology and activity to identify investment opportunities.

Evaluating Smart Contract Blockchains

As with any novel technology, the cryptocurrency space moves fast and changes quickly, so it is important to stay on top of developments and understand the value proposition among platforms.

The main questions to ask when evaluating smart contract blockchains are:

- What dapps are on the platform? What is the platform’s activity like?

- How does the native asset accrue value?

- What are the supply dynamics of the native asset?

- How scalable is the platform?

- Is it secure and decentralized?

- Are there any prominent upgrades currently under development?

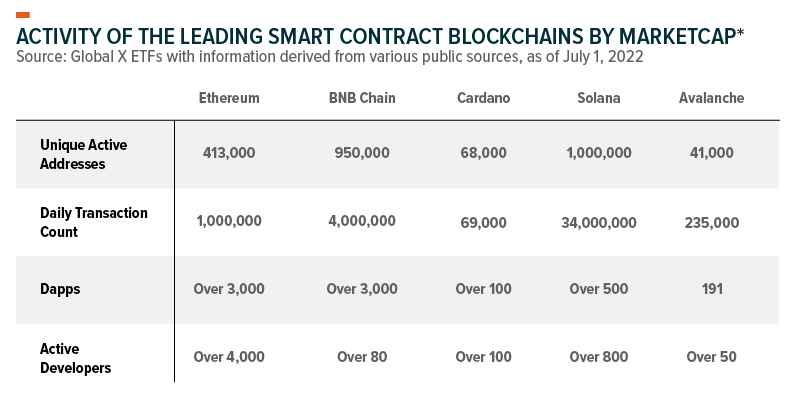

The Developments, Activity, and Dapp Ecosystem

Ideally, a smart contract blockchain’s dapp ecosystem is rich, user activity is high, transaction activity is growing with time, and developers are working toward bringing novel and enhanced utility to the network.

* Leading Smart Contract Blockchains by Market Cap.

For Ethereum numbers shown are only in the Ethereum mainnet. It doesn’t consider active addresses in layer 2s such as Arbitrum or Optimism. For Avalanche, the figures shown are only for the C-chain, the general-purpose chain for smart contract interaction and dapp deployment. The figure doesn’t count addresses on subnets. For Solana, we only consider non-vote transactions. All numbers are a 7-day average.

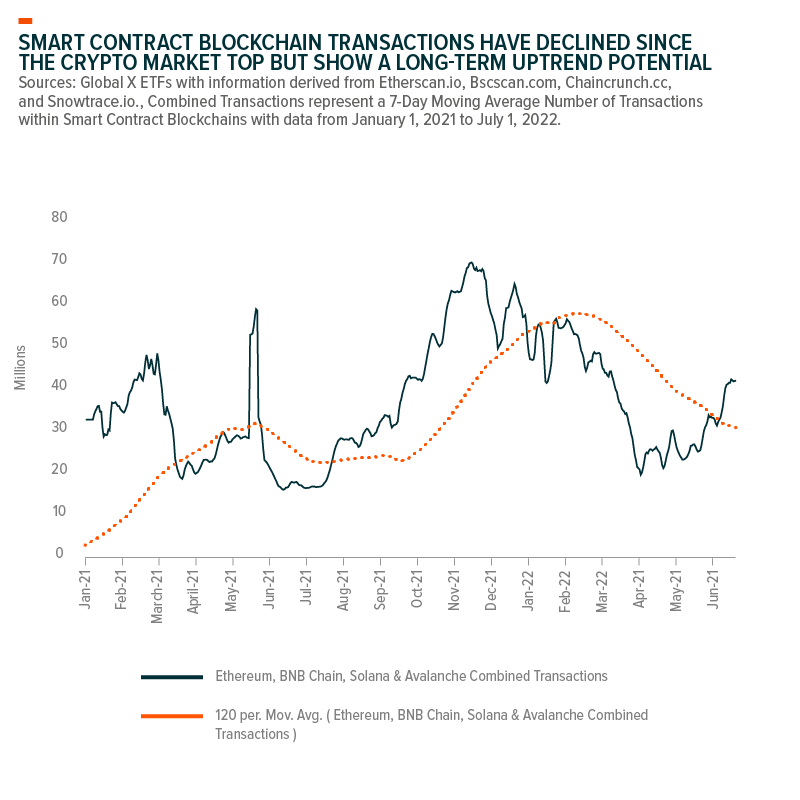

Transaction count may include peer-to-peer transfers, smart contract deployments, and dapp interactions. Transactions show a long-term uptrend potential, although it has dropped since November 2021 with the decreasing interest in the digital asset space due to bearish price action amid challenging macro conditions.

Regardless of current conditions, developers are building more utility on top of these platforms. This is highlighted by the user wallets interacting with the various buckets of dapps available in these ecosystems, shown in our Exploring the Disruptive Potential of Smart Contracts piece.

Transactions are important because these ecosystems generate revenue through transaction fees. Participants who secure the network and validate blocks may earn a portion of the transaction fees in the form of yield, earn newly issued cryptocurrencies via block rewards, or might benefit from the reduction in supply triggered by burning mechanisms.

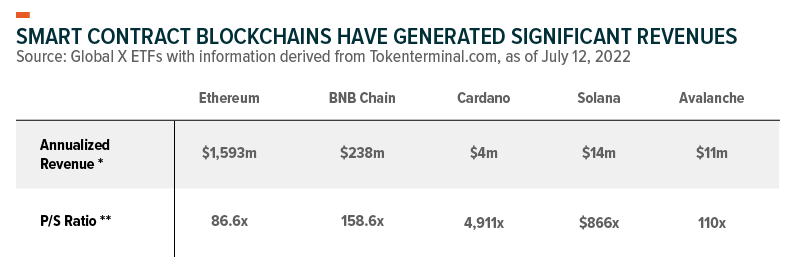

* Annualized Revenue reflects the total fees paid in the last 30 days annualized.

** Price/Sales ratio is calculated by dividing the fully diluted market cap by the annualized revenue. It is intended to show how a project is valued in relation to its revenues.

Note that higher revenue is not necessarily entirely positive as this may arise from excessive transaction fees. However, it is an indicator that highlights how much users are willing to pay to use a smart contract blockchain. The P/S ratio for smart contract platforms might seem high compared to traditional equities, however, it is intended to serve as one potential valuation metric of block space demand considering the multi-dimensional characteristics of smart contract blockchain utility.

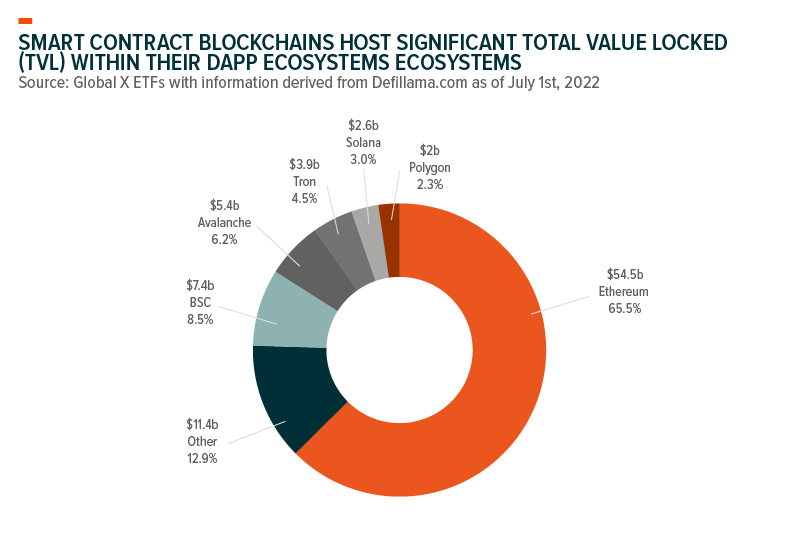

The total value locked (TVL) within these ecosystems can also be a useful indicator. TVL can be a rough measure of the monetary value of the protocols, with changes in the metric serving as a potential barometer of user conviction in these ecosystems. Some of the leading dapps by TVL include DeFi applications such as decentralized asset exchanges (DEX) and decentralized money markets that allow for borrowing and lending. Note that not all dapps require locking assets in a smart contract, therefore TVL should be used combined with other metrics, such as transaction count and active wallets.

The Supply Mechanics or “Tokenomics”

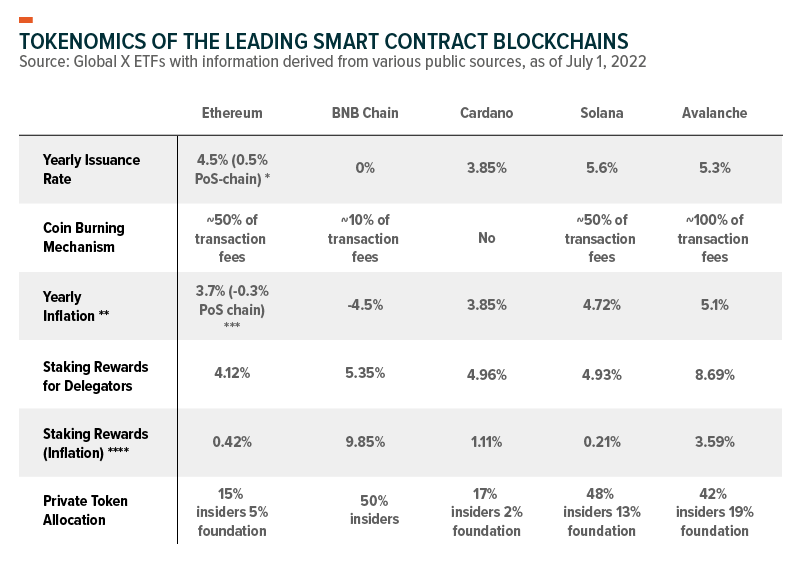

The supply mechanics dictate how much of a store of value an asset has the potential to be. A limited supply asset or an asset with controlled inflation and a burning mechanism is typically desirable.

* Ethereum is transitioning from Proof-of-work (PoW) to Proof-of-stake (PoS), a new consensus algorithm.

** Inflation reflects issuance minus burnt assets; therefore, positive means the cryptocurrency is inflationary and negative deflationary. Vesting is not included in our calculations of inflation.

*** Note that Ethereum’s inflation rate post-merge (PoS) is an estimate based on current network usage.

**** Inflation indicates new cryptocurrencies issued to secure the network in the form of block rewards.

Proof-of-stake assets are usually inflationary in that they distribute newly issued native assets to staking participants. This is because the network needs to pay for security, hence incentivizing block production with new cryptocurrencies creates inflation. This fosters economic activity while incentivizing staking due to its ability to offset the issuance rate while simultaneously securing the network. Generally speaking, cryptocurrencies in their infant stages have higher inflation rates to boost security while the network is at its most vulnerable stage. Additionally, it is possible for a smart contract blockchain to mitigate the dilutive effects of inflation via burning mechanisms, reducing supply, and creating value for asset holders.

When assessing tokenomics, one should also consider the initial allocation and vesting periods of foundations and insiders, which encompasses the team, venture capital firms (VCs), and purchased cryptocurrencies. The token allocation may also be a decisive factor in how a cryptocurrency may stand in the eyes of regulators. Crypto’s regulatory landscape is still largely a work in progress across the globe, and initial allocation could be a key factor in deciding how a cryptocurrency may be regulated.

The Scalability of Smart Contract Blockchains

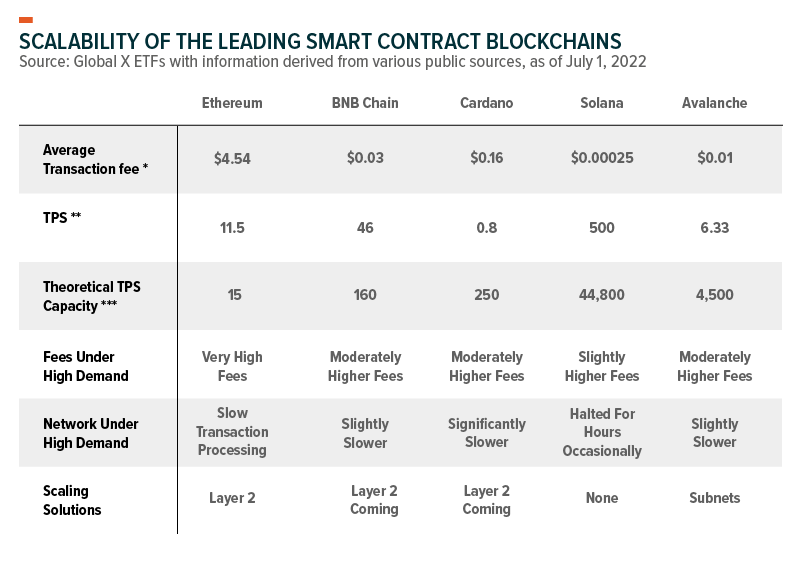

Scalability refers to the ability of a network to onboard new users, and support increasing transaction volume while maintaining low fees. Without scalability, these blockchains are unable to support internet-scale dapps efficiently, thus potentially falling off the competitive landscape.

* For Ethereum, the numbers shown are only in the Ethereum mainnet. It doesn’t consider active addresses in layer 2s such as Arbitrum or Optimism. For Avalanche, the numbers shown are only for the Avalanche C-chain, the general-purpose chain for smart contract interaction and dapp deployment. The figure doesn’t count addresses on subnets.

** TPS is the average number of transactions per second these chains process.

*** Theoretical TPS capacity is the average number of transactions the network can process at its peak usage.

It is important to note that layer 1 blockchains may have layer 2 solutions that can boost transaction throughput. For instance, Ethereum layer 2 solutions can boost transactions per second (TPS) to 1000-4000. These scaling solutions are a fundamental part of Ethereum’s roadmap, however, they have yet to prove themselves as the ultimate general-purpose scaling design. This is because their infancy might introduce some drawbacks and centralization concerns currently unsolved. Therefore, despite being a strong scaling solution, the suitability for all applications has not yet been proven through layer 2 solutions, thus highlighting the importance of layer 1 scalability plans.

Security & Decentralization of the Blockchain

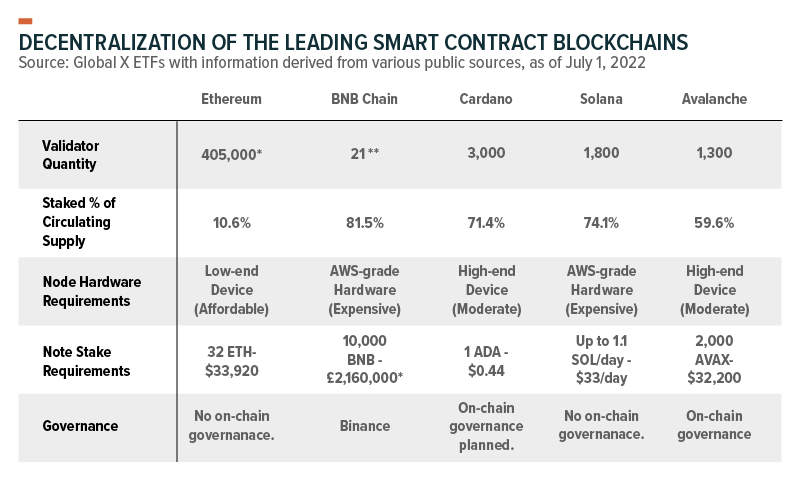

Blockchains must have strong security traits, as they ultimately serve as the settlement layer for value across many users and transaction types. Decentralization is crucial as it plays a key role in censorship resistance and security. As decentralization exists on a spectrum, it is difficult to quantify, but we gauge it by measuring the number of nodes that validate blocks, the mechanism by which assets are distributed among staking participants, and the accessibility of running a node. Decentralization’s goal is to remove single points of failure and enhance security, as distributed ledgers require a majority agreement, or consensus, to enact changes. Generally speaking, blockchains which are secured by a larger number of validators, incentivize a larger number of parties to validate the chain, and which do not rely on cost-prohibitive hardware to participate in validation efforts are considered to be more decentralized.

* On Ethereum’s Beacon Chain.

**For BNB, only the top 21 validators participate in securing the network.

Generally speaking, a low number of validators can signal less decentralization however, this might be a trade-off in exchange for greater scalability through faster transactions and reduced costs due to singular greater node capacity. Additionally, the initial token allocation should also have an effect on decentralization. Insiders may have significant decision-making power in what blocks get added to the blockchain if they were allotted a large percentage of token allocation, which may be a censorship concern. Moreover, a blockchain’s development may be controlled by a centralized organization or the community of token holders. Token allocation can play an important role in governance as insider organizations that control a large portion of the tokens may be able to influence votes heavily, and even be able to make unilateral decisions.

There is no right or wrong stance on whether centralized or decentralized governance is best for a blockchain’s development. Centralized control may bring faster technological upgrades with the downside that the community is subject to the decisions made by a few, which may not always be in everyone’s best interest. Often, a project will pursue further decentralization as the project matures and technology evolves. This leads us to another important area to note when assessing smart contract platforms – upcoming upgrades, and compatibility.

Upgrades and Compatibility

In such a fast-paced industry, it is crucial for a platform to be able to adapt to the latest consumer demands and accommodate technological advancements. We believe most smart contract platforms are far from their final form and have significant upgrades planned down the line. As distributed ledger technology is at a nascent stage, upgrades are immensely potent and can improve features by several orders of magnitude in some cases. Additionally, the features built on top of smart contracts are evolving, such as the aforementioned Ethereum layer 2 scaling solution landscape.

Ethereum:

- The Merge: Ethereum will fully transition to PoS, potentially as early as Q3/Q4 2022. This will lower energy consumption 200-fold and decrease the issuance rate of new ETH by around 90%.

- EVM compatible ZK-rollups: So far, ZK-rollups are application-specific. However, general-purpose ZK-rollups are coming to Ethereum. This will allow for greater scalability via layer 2 solutions.

- Sharding: Ethereum will also scale via sharding, which will launch in several stages and allow up to 100,000 TPS when paired with rollups on layer 2 solutions.

BNB Chain:

- Increase validator count: The number of validators will go up to 41 which is expected to increase stability and decentralization.

- Sidechains and ZK-rollup: App-specific chains using ZK-rollup tech for scaling that don’t have to compete for block space with the main chain.

Cardano:

- Scaling: Cardano will launch EVM-compatible sidechains, and a state channel framework called Hydra. Hydra could be compared to the bitcoin lightning network with added smart contract functionality.

Solana:

- Smartphone: Solana Labs has a strong commitment to crypto mass adoption. They recently announced the launch of “Saga”- an Android smartphone. Saga will feature crypto wallet functions and a software development kit for Web3 programs, designed to enable the development of native Android apps built around the Solana blockchain.

Avalanche:

- Subnets: The first Avalanche Subnets have rolled out, with the two most popular ones being application-specific blockchains for GameFi. We could see more subnets coming to the network that can benefit from horizontal scaling.

Another important feature that can accelerate the growth of a blockchain is compatibility. Compatibility gives blockchains the ability to bring in dapps, attract liquidity, and even interoperate. A great example of a platform that has benefited from compatibility is Avalanche. Avalanche is EVM compatible, which enables Ethereum dapps to onboard the Avalanche blockchain with minimum coding work. Being able to use leading dapps with lower fees than Ethereum has onboarded users and assets and has been the main contributor to Avalanche’s growth.

Because of the massive value potential and the adaptability of these blockchains, we expect builders and users to continue to drive innovation and growth. Talent and innovation are the largest assets within these platforms, and we believe they are just getting started.

Smart Contract Blockchains Show Investment Potential, Performance, and Risks

Smart contracts’ runway for growth is significant. In our view, smart contract blockchains could make significant inroads into sectors like the financial services market. Technology continues to disrupt the traditional financial services industry and give further rise to fintech, where the two intersect. Smart contract code and dapp composability could accelerate the pace of development of software dedicated to finance, and this is exemplified by the rise of decentralized finance (DeFi). Smart contracts could be the next step toward making finance even more software-centric. The primary activities in financial services include lending and payments, insurance, reinsurance, insurance brokerage, investments, and foreign exchange services; all likely to be disrupted by DeFi dapps hosted on smart contract blockchains.

Other prominent areas of possible disruption include the gaming industry which is forecasted to reach a $257 billion valuation by 2025, decentralized social media, verifiable credentials and digital identifiers, and real-world asset ownership, among a plethora of other sectors.8

Smart contract blockchains made a significant jump in recent years in their development, return performance, and investability. They have outperformed Bitcoin since the start of 2021 and given smart contracts’ disruptive properties and upcoming upgrades, we anticipate that investor interest will continue to increase with the growing number of dapps, active users, and developers being onboarded.

Due to the high volatility of the digital asset class and the current macroeconomic uncertainty, it is important for investors to manage macro and systemic market risks. Bitcoin, as the cryptocurrency with the longest track record, dictates the broad movement of the digital asset market, and recently its correlation with equities has become quite high, as we highlighted in The Case for Digital Assets in a Portfolio.

Past performance is not a guarantee of future results.

* Max Drawdown measures the difference between the peak and trough within the specified timeframe as a percentage. It measures how much an investment is down from its peak.

** Annualized Volatility represents the Standard Deviation in prices. Standard Deviation measures how prices are dispersed from the average price.

*** Sharpe Ratio indicates the average return minus the risk-free return divided by the standard deviation of return on investment.

Large drawdowns and volatility are not surprising considering the nascency of the space. Historically, these drawdowns have been proven to be very attractive buying opportunities. For example, Ethereum has had drawdowns as high as 95%, followed by all-time highs. Since 2021, the maximum drawdown of smart contract platforms ranged between 65% and 90%. While investors should be mindful of the drawdowns, we expect that as the space grows and adoption rises, volatility across the most successful of these platforms will decrease as they further integrate into the global economy and exit their early-stage silo.

The Investment Case for Smart Contract Blockchains Continues to Mature

We believe that investing in smart contract blockchains offers exposure to a formidable disruptive force. These distributed ledger ecosystems can be the infrastructure for more efficient financial systems, Web 3.0, a user-owned internet, and more. Considering dapp development, utility, and network transactions, we expect greater demand for the native assets within these platforms. Also, the value locked within the ecosystems, the utility and interoperability of tokens and smart contracts, and the growing transaction count can continue to drive value for the underlying assets. While we believe these platforms have a long way to go in order to capture their total addressable market, we expect upgrades to network scalability, the growth of developer talent, and the expansion of novel concepts and applications to continue to drive user demand for smart-contract blockchain solutions.

Related ETFs

BKCH: The Global X Blockchain ETF seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.