Four Japanese Companies Leading Robotics and Automation

In 2023, the structural readjustment of supply-chains and the generative AI boom are creating new opportunities for robotics and automation. As countries pursue nearshoring and re-evaluate geopolitical risk in their supply chains, the construction of factories could become a source of demand for automation technologies, with capital spending on robotics and automation expected to make up 25% of all capital spending between 2023 and 2028.1 Meanwhile, generative AI is creating a new paradigm for how human users interact with and give instructions to tech products, which will likely translate into new forms of both industrial and service robots.

Within the global robotics ecosystem, Japanese robotics companies occupy an indispensable position.

Key Takeaways

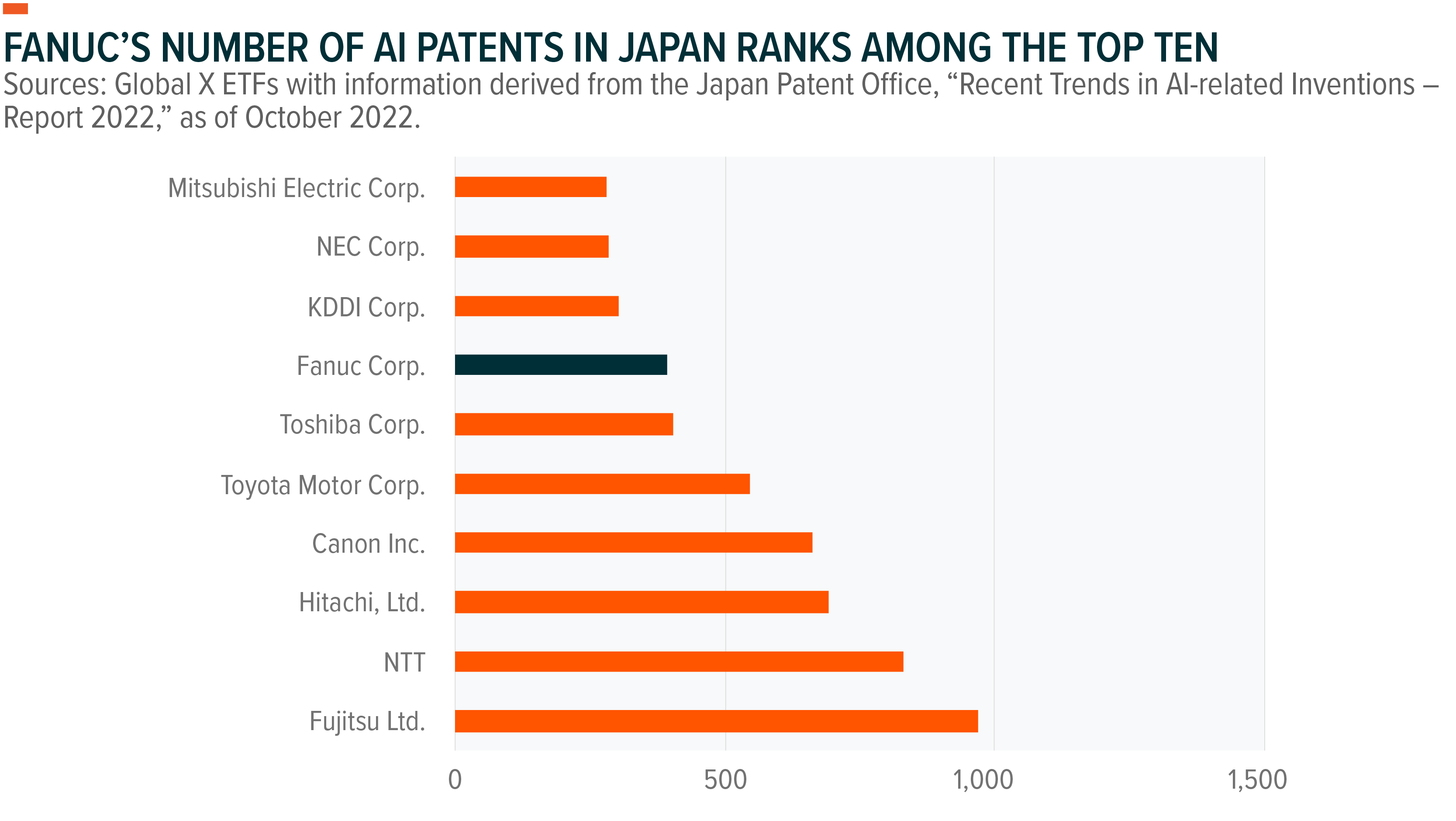

- Fanuc: As masters of FA (factory automation), Fanuc’s efforts to automate its own factories opens space for a massive research and development (R&D) team.

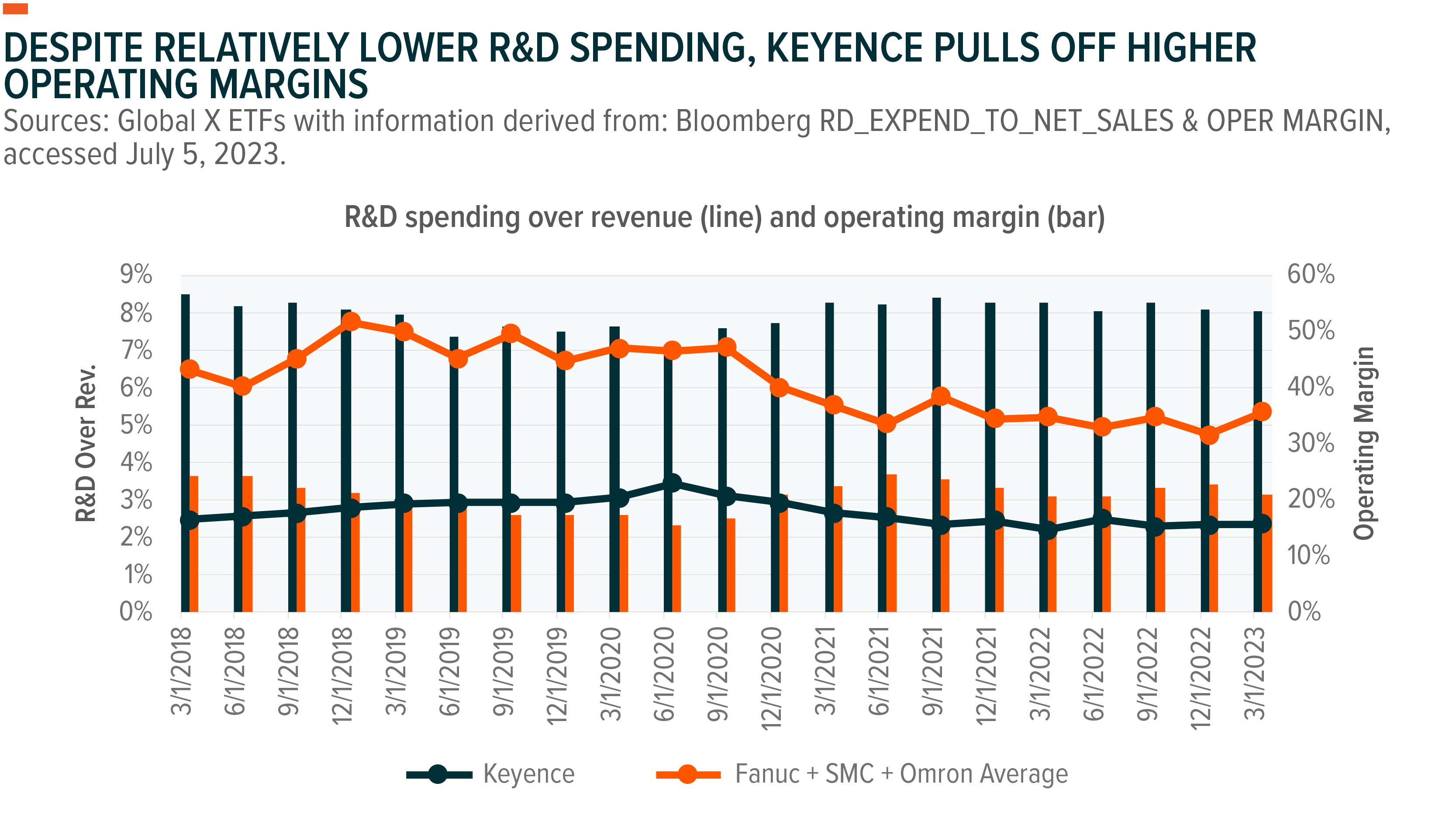

- Keyence: By outsourcing manufacturing of its products, Keyence differentiates itself by proactively identifying and proposing needs to customers, and thus far has been able to achieve large margins against R&D spending.

- Omron: With its product line-up of sensors, switches and controllers that inform robots of their external environment and guide their movements, Omron’s main line of business provides robots with their “nervous system.”

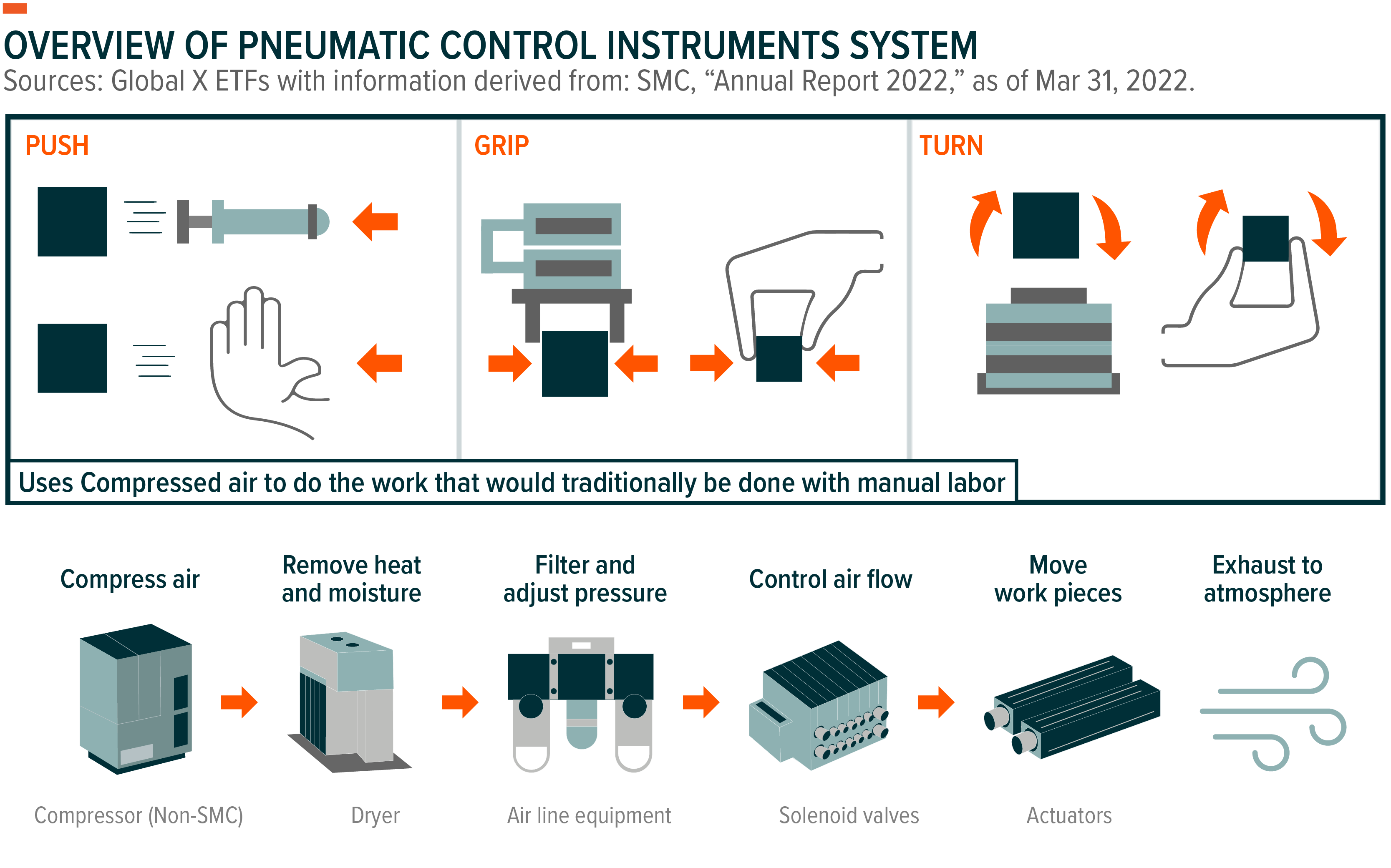

- SMC: Pneumatics, or the use of pressurized gas in automation systems, is the bread and butter of SMC’s business, in which it controls 64% of the Japanese market and 29% of the global market.2

Fanuc: Self-Automated Factories Leave Room for R&D Advantage

Fanuc’s history goes back to 1955, when it was founded by Dr. Seiuemon Inaba, a pioneer in the field of numerical control (NC). Computerized Numeric Control (CNC), which is used to create movement patterns that robots follow to manufacture objects, continues to be major source of revenue for Fanuc, with 30.9% of its Fiscal Year 2022 revenue coming from the FA segment, that primarily revolves around CNCs.3 However, Fanuc’s most iconic product is its yellow industrial robot arms, which can be found in factories around the world. In total, Fanuc generated $6.5bn of revenue in FY2022.4

As a master of automation, it naturally follows that Fanuc can automate its own factories. Fanuc’s production is concentrated in highly automated factories all of which are based in Japan. This opens room for Fanuc’s R&D unit, which makes up around one third of the company’s staff, enabling it to maintain a technological edge over competitors.

Going forward, Fanuc is working to stay in touch with the needs of EV makers.5 Japan’s robotics industry has a historical connection to the automobile industry and that is true for Fanuc as well, making the shift to EVs top of mind for Fanuc. Fanuc is also making a push into industries traditionally underserved by automation and robotics, namely the three “hin” industries of food (shokuhin), medicine (yiyakuhin), and cosmetics (keshouhin). The Japanese Ministry of Economy, Trade and Industry (METI) notes that the standardization of manufacturing in the three “hin” industries are particularly behind.6

Keyence: Proactively Identifying Customer Needs While Outsourcing Production

Keyence is a veritable giant, with a market cap of $122.7bn USD (17.18tn JPY), ranking number three in terms of market cap among Japanese companies listed both domestically and abroad. Keyence’s product line-up includes sensors, measurement systems, microscopes, vision units, marking units, and more recently a data analysis platform.

A significant part of what makes Keyence different is its efforts to attract top talent for sales and strategy, while outsourcing its production to third parties. As a testament to those efforts, Keyence frequently tops rankings for average salary in Japan, with a March 2023 ranking by Toyou Keizai putting it at number two in the country with 21,820,000 Japanese Yen ($155,076.22) per year.7The mythos cultivated by Keyence is often the subject of articles in the media, which dissect the factors that differentiate Keyence’s talent from the rest.

Underpinning this success is Keyence’s proactive strategy, in which its engineers and sales team attempt to identify potential needs instead of waiting to be approached, while also conducting on-site demonstrations. The uniqueness of the Keyence approach has manifested itself in Keyence’s income statement, where relatively lower R&D spending has not stopped it from producing operating margin’s significantly higher than the other three companies in this piece.

Omron: Providing the Nervous System for Robot and FA Systems

Put simply, much of what Omron does is making the “brain” or “nervous” system for robots and factory automation sensors. This includes logic controllers, human machine interfaces, safety systems, machine vision, and software. In FY 2022, the IAB (Industrial Automation Business) segment comprised 57% of Omron’s revenue.8

In addition to Factory Automation, Omron derives a portion of its revenue, roughly 17% in FY2022, from healthcare products. Just as many of Omron’s robotics products monitor factory automation workflows and robots, many of its healthcare products focus on monitoring the human body. Furthermore, Omron’s social services unit, while far from being its main revenue stream at only 14% of revenue in FY2022, brings automation out of factories and into spaces are very close to consumers.9 A lot of this business segment involves making automatic gates for subway/train stations, a market that Omron grasps a large share of.

With Omron’s presence in FA, it is likely in a good position to benefit from capital expenditure (CapEx), namely funds used to acquire, maintain or upgrade physical assets, and the burgeoning demand for automated factories. An important caveat is that this will depend more on CapEx trends happening in Asia rather than Europe and the Americas, as 74% of Omron’s sales are concentrated in Japan, Greater China, and Southeast Asia as of FY2022.10

SMC: A Strong Position in the Global Pneumatics Market

Electricity is not the only way to move robots and automated systems. Pneumatics is the use of pressurized air to move physical components. This is the area of the market that SMC occupies, with an estimated 64% market share in Japan and 39% worldwide for pneumatic instruments in 2022.11

A simplified example of what a pneumatics workflow may look like is as follows: 1) air is compressed, cooled down and moved to an air tank, 2) the air is sent down a network of tubes leading to the factory line where valves and switches dictate the direction of air flows, 3) the air is pushed into air cylinders, which push a robot arm outwards, or make it grip or turn an object.12 Full pneumatics systems are complex and are often used in concert with hydraulic systems, which manipulate liquid pressure.

A highly relevant topic of late for SMC is the current state of the semiconductor industry, which is experienced a downturn due to falling demand for consumer electronics in 2022 but is also closely linked to the AI boom. In 2023, SMC foresees the downturn in semiconductor demand keeping revenue roughly below 2022’s level.13 However, as it aims for 1tn JPY (7.1bn USD) in sales in the year 2026, SMC sees demand for chillers, gate valves and vacuum products as a beneficiary of the secular rise of semiconductor needs, providing 2% out of the 8% CAGR (compound annual growth rate) needed for SMC to hit its target.14

Conclusion: Japan is an Indispensable Part of the Automation Story

In the first half of 2023, the excitement over generative AI and a strong rally in Japanese equities drew attention towards Japanese robot makers. Looking beyond 2023, in our view, automation is here to stay. With the large market shares of various segments of the global robotics supply chain held by Fanuc, Keyence, Omron and SMC, understanding the leading Japanese robot makers is crucial to understanding the bigger picture of automation.