Data Centers: A Critical Facilitator in Cloud and AI Adoption

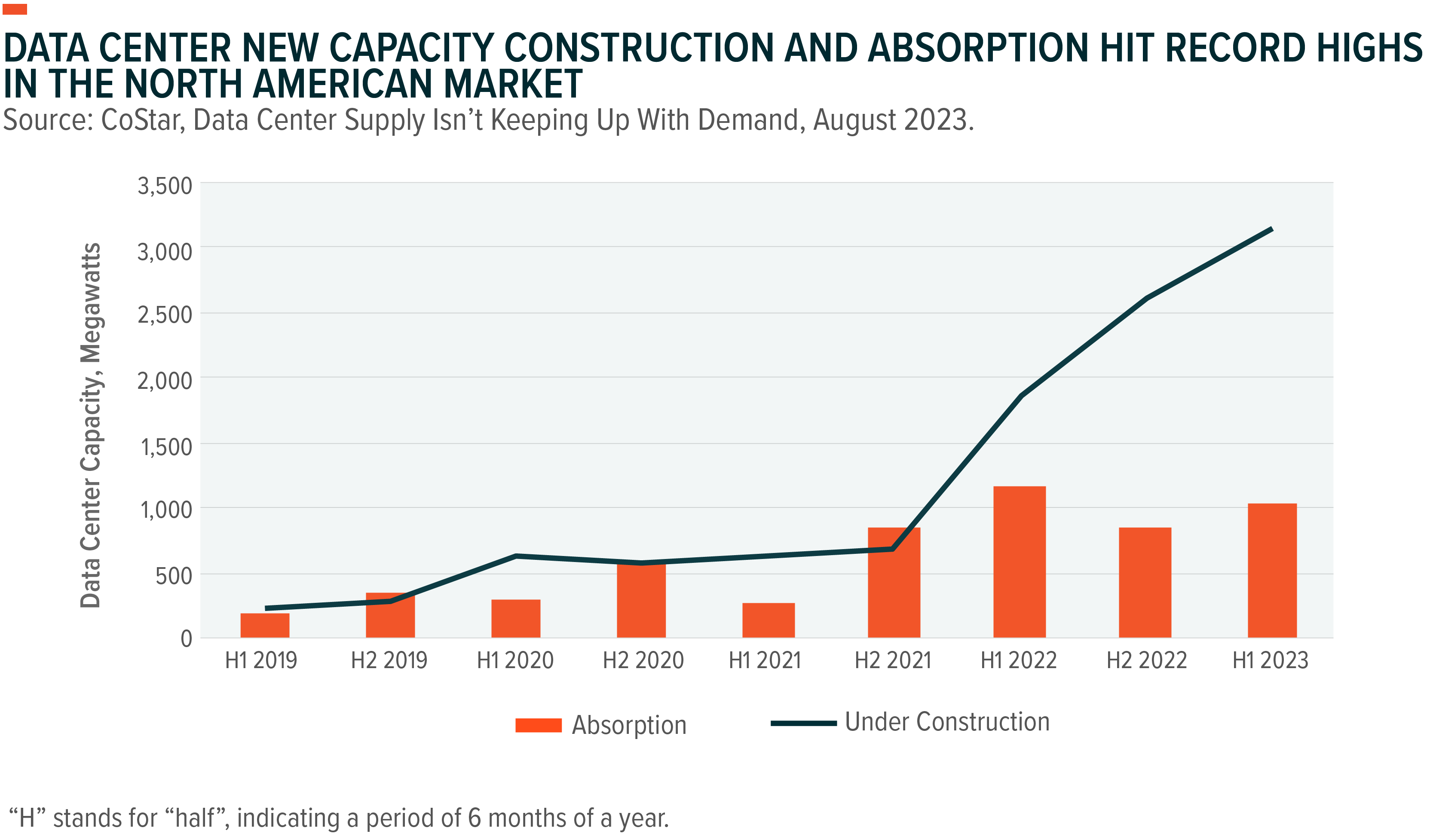

Data center investment in new capacity construction and absorption is surging in North America.1 With data center vacancy rates at unprecedented lows, the meaningful uptick in new construction projects in 2023 comes at a critical point.2 Data center capacity and pricing for space are at a premium, and we believe that demand is only likely to increase as cloud services adoption and generative AI-based products and services continue to gain traction. In our view, these dynamics can bolster revenue and profits for the entire data center ecosystem, including large cloud giants, colocation service providers, and suppliers of essential components such as chips, storage, and networking equipment.

Key Takeaways

- Data Center construction in North America increased 25% year-over-year (YoY) in H1 2023, propelled by AI and capital expenditures from leading tech giants.3

- Constrained data center capacity contributed to a 20–30% YoY asking price increase in the eight U.S. primary data center markets for colocation services.4 Growing demand for computational power for AI, automation, and the internet of things (IoT) is projected to amplify this pricing trend.

- The potential to command a premium for emerging services can boost earnings for data center companies in the near to midterm, in our view.

Hyperscalers Ramp Up Data Center Investments

In the last year, capital expenditures from Microsoft, Amazon, Google, Meta Platforms, IBM, and Oracle collectively topped $154 billion.5 Spending for the group is down 2.1% relative to last year but remains up over 25% from 2021 levels.6 Currently, hyperscalers own and operate close to 900 data centers, accounting for 37% of worldwide data center capacity, according to one estimate.7

Capacity expansion is a major target, and in 2023, hyperscalers and colocation service providers are expected to add a staggering 26 million square feet of data center space.8 For hyperscalers, Microsoft leads the pack with 24 projects underway in eight countries, Google has 15 projects across seven countries, and Amazon has 15 projects in the works in nine countries.9,10 Also, the trend of optimizing data centers for AI is set to continue. Meta, for example, is reimagining its data center architecture to cater to AI workloads and expects investments to accelerate in the coming quarters.11 Meta is increasing the footprint of its custom in-house built AI accelerator chip in new data centers, building new dedicated AI training clusters, and is investing to deploy supercomputers designed to support augmented reality, content understanding systems, and real-time translation technology.12

Growing downstream applications of generative AI has demand for AI-first infrastructure rising, whether in the original designs of new buildouts or as part of infrastructure optimization. These efforts create opportunities for chip vendors exposed to AI processing and data intensive hardware.13 A prime example is Nvidia, which supplies AI chips to data centers. The company reported total revenue growth of 60.3% YoY over the last 12 months.14 Also, spending on data center accelerators is expected to grow at a nearly 30% annual growth rate to top $165 billion by 2030.15

Colocation Service Providers Positioned to Capitalize on Price Dynamics

Colocation data center service providers, which serve multiple large enterprises out of a single facility, form another major part of the data center market. Colocation providers manage 23% of total data center capacity and another 18.5% on behalf of hyperscale giants globally.16

Colocation providers such as Digital Realty, Iron Mountain, Equinix, DataBank, and NextDC help stabilize the data center market because they can bring capacity to market much faster than hyperscalers.17 In H2 2022, colocation providers added 4.6 million square feet of new capacity in the North American data center market, a 9.5% YoY increase.18 In the eight primary data center markets in the United States, total data center supply increased 19.2% YoY in H1 2023, while data center vacancy remained at just 3.3%.19

The surge in capacity might give rise to questions concerning potential oversupply and the intricacies of rental pricing. Yet, the limited availability of data center capacity was a driving factor in the notable 20–30% YoY increase in rental prices across the primary U.S. data center markets during the first half of 2023.20 Across data centers of all sizes, average asking rental rates jumped 14.5% YoY in 2022 and another 7.2% YoY in H1 2023.21

Simultaneously, the global data explosion is expected to enter another phase—and keep data center demand high—due to generative AI models creating data alongside humans, machines, and system-based data generation. Also, we expect favorable pricing dynamics, which allow colocation providers to monetize at healthy rates, to offset pressures of higher borrowing costs.22

Two additional positive industry trends are high merger and acquisition (M&A) activity boosting the premiums for leaders in the space. Some of the largest deals in 2022 included the buyout of CyrusOne by a group of private equity investors for $15 billion, and the acquisition of Switch by DigitalBridge for $11 billion.23,24

Conclusion: Data Center Industry Has Palpable Momentum

Hyperscalers and colocation service providers are investing heavily to build infrastructure that can help them capitalize on the growing demand for nimble cloud computing and AI services. The recent surge in construction activity and data center AI optimization work, despite high borrowing costs and tight economic conditions, demonstrates the urgency for this infrastructure and the growth potential behind the services that it facilitates. With borrowing costs stabilizing and data-heavy AI applications becoming mainstream, we believe data centers and their broader ecosystem are likely poised for a multi-year secular growth run.