Liquid Biopsy: A Pathway to Earlier and Less Invasive Cancer Detection

Audio PlayerEditor’s Note: Hover over terms in sea green for a pop-out glossary definition. Full glossary also included at the end with terms listed in the order that they appear.

Liquid biopsies provide hope for quicker and more accurate early-stage cancer detection across a wider range of cancer types with a simple blood test. Using current standard of care, only about 25% of cancers are detected via screening.1 The remaining 75% are detected when the patient is symptomatic, and most likely in a later stage of cancer.2 Largely as a result, cancer accounts for 609,000 deaths a year in the United States, making it the second leading cause of death.3 Liquid biopsies, however, provide hope. This approach can be particularly beneficial for detecting cancers that currently do not have proven screening methods and thus require invasive tissue biopsies. In this piece, we introduce liquid biopsy technology and examine what it will take for it to become a prominent standard of care.

Key Takeaways:

- Liquid biopsy offers a screening option to diagnose early-stage cancers via a single blood test.

- To drive clinical adoption, multi-omic approaches will help improve test accuracy.

- Industry winners will address the entire cancer diagnostic continuum, from diagnosis to remission.

Biomarkers at the Heart of Liquid Biopsy’s Potential

Biomarkers are biological molecules found in a patient’s sample that serve as medical signs to specific illnesses.4 For a long time, finding biomarkers for solid tumors was limited to tissue samples, collected via a tissue biopsy. Tissue biopsies can be particularly challenging when a tumor is difficult to access, such as a tumor in the brain or lung. New methods, however, now allow scientists to use biomarkers in non-invasive liquid samples, like blood or urine, to detect cancer. The most studied biomarkers so far for liquid biopsy include:

- Circulating Tumor Cells (CTC): CTCs are cancer cells that split away from a tumor and circulate in the bloodstream.5 CTCs can sometimes exit the bloodstream and enter other organs, growing into new, metastatic tumors.6 This tumor shedding in the blood can be measured to determine if a patient has cancer. The more shedding found in the blood, the higher the likelihood of the patient having late-stage cancer. As a result, CTC-based tests can have lower specificity in early-stage settings.7

- Circulating Tumor DNA (ctDNA): ctDNA is DNA that circulates in the bloodstream and derives from cancerous cells and tumors. As tumors grow, cancerous cells die and are replaced by new ones. The dead cells get broken down and their contents, including DNA, are released into the bloodstream. Like CTCs, ctDNA can be measured in a patient sample to determine if a patient has cancer. ctDNA is known for its higher sensitivity relative to alternative biomarkers, though noise from normal cell shedding is a potential disadvantage to this method.8

- Exosomes: Exosomes are extracellular vesicles responsible for cell-to-cell communication and the transmission of diseases.9 Exosomes are particularly useful as a basis for liquid biopsy, as they are secreted by living cells rather than secreted during cell death. As a result, exosome-based assays offer a more comprehensive real-time window into the patient’s health and have higher sensitivity. They also offer logistical benefits because exosomes are highly stable and easy to obtain and distinguish.

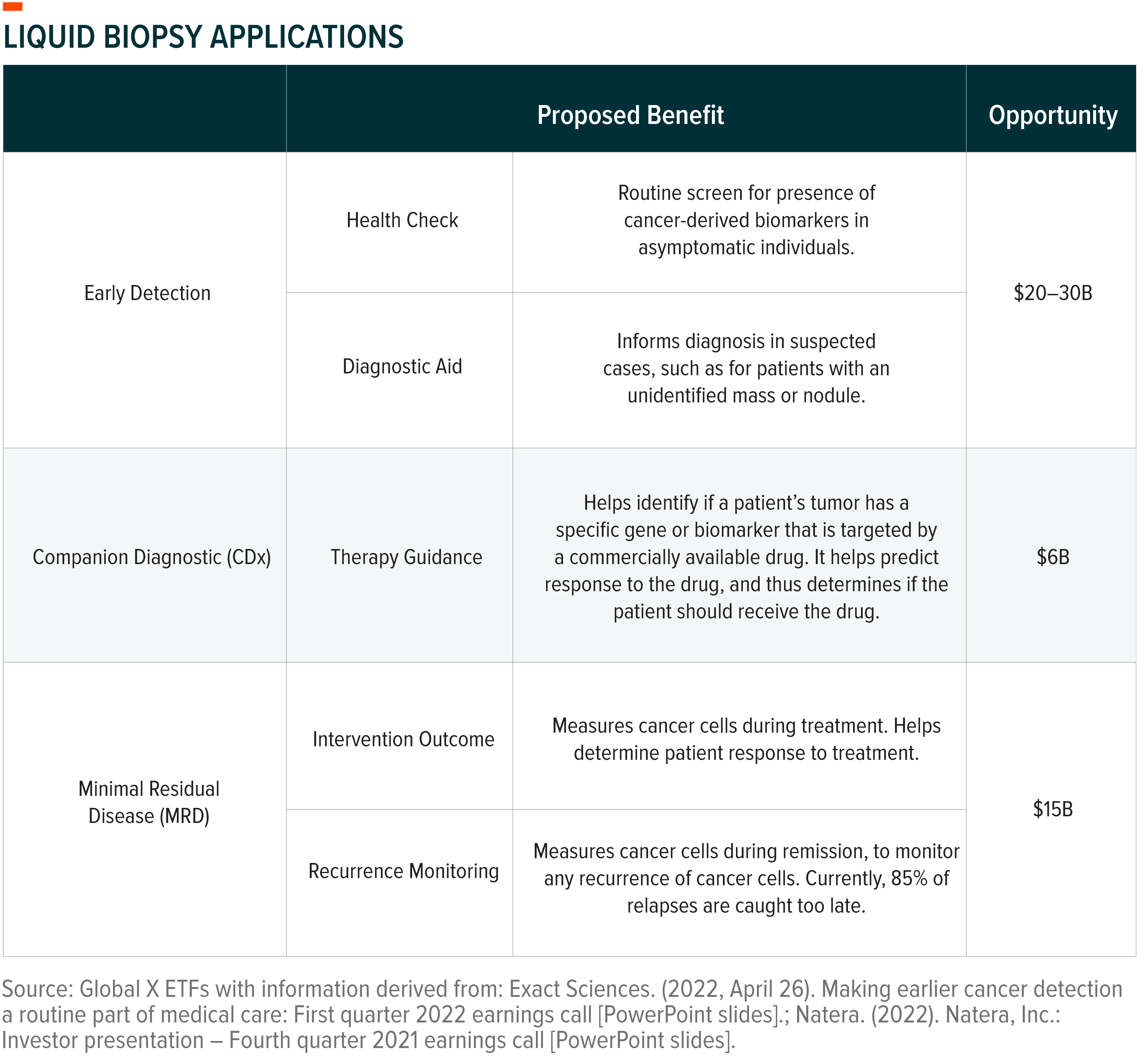

The genetic information obtained from these biomarkers spans multiple uses and can aid in patient care across their diagnostic and treatment journey.

Tumor-Specific and Multi-Cancer Assays Show Promise

For early cancer detection, tumor-specific assays solely focus on diagnosing one type of cancer. Exact Sciences’ Cologuard, for example, is a Food and Drug Administration (FDA)-approved test that can help detect colon cancer via cancerous particles in stool. Though colonoscopies remain the standard of care for colon cancer diagnosis, a liquid biopsy test such as Cologuard can help rule out colon cancer. Exact states that 84% of Cologuard patients test negative, with a 99.94% negative predictive value.10 If Cologuard patients test positive, it indicates potential signs of colon cancer and the patient should schedule a colonoscopy. Ruling out patients is valuable, particularly now, as the COVID-19 pandemic resulted in patients putting off elective procedures that resulted in a years-long backlog of colonoscopy procedures.11

Recent work in the multi-cancer early detection (MCED) space looks for a wider net of cancer-derived biomarkers. MCED tests, sometimes also referred to as pan-cancer early detection tests, simultaneously screen for and localize multiple cancers. Meant to be used in complement with existing diagnostic options, MCEDs signal that the patient requires more in-depth examination. Illumina’s Grail launched the first commercially available MCED in 2021.12 The test detects 50 types of cancer with 99.5% specificity and 89% cancer signal origin accuracy.13 Overall sensitivity for the test was 51.5%, with a steady improvement in detection across cancer stages: 17% at stage I, 40% at stage II, 77% at stage III, and 90% at stage IV.14

Firms Seek Increased Test Accuracy Using Omics, Combined Approaches

The liquid biopsy space is still quite nascent compared to other cancer screening alternatives and firms continue to pursue improved test accuracy. Two possibilities are multi-omic and combined biomarker approaches. Omics are used to better understand the roles, relationships, and actions of different types of molecules that make up human cells.15 Combining approaches is expected to lead to increased insights gathered from a single liquid biopsy assay and improved accuracy rates. For pan-cancer tests, combined approaches could also improve the accuracy rate for detecting cancer origin.

Firms also want to provide multiple sample options for tumor-specific assays. Exact Sciences is developing a blood-based test for colon cancer that would complement its stool-based Cologuard test.16 For detection or monitoring of other cancer types, sample types like urine and saliva might be in play. For example, urine might be an appropriate sample for detecting kidney cancer due to increased tumor shedding in the sample compared to blood.17 In instances where multiple tests come to market with different sample options, we expect adoption to be largely determined by test accuracy and patient preference.

Establishing Clinical Guidelines Key to Liquid Biopsy Adoption

The Centers for Disease Control and Prevention (CDC) recently found that cancer deaths decreased 27% from 2000 to 2020, given more effective and widely available cancer screening options for asymptomatic patients.18 Overwhelming evidence shows that earlier detection of colon cancer will improve patient outcomes significantly. As a result, firms used colon cancer to validate liquid biopsy and forge a pathway towards FDA approval and reimbursement coverage for tests. Crucial questions, however, remain unanswered about how expanded use of liquid biopsy will be implemented and what clinical best practices should be followed after a positive test result.

In our view, establishing robust downstream guidelines for diagnostic and post-diagnostic care is essential to ensure increased adoption of liquid biopsies. Currently, it’s customary for specialists to perform cancer screening, if available, and diagnosis. For example, when a patient is screened for cervical cancer, an OB-GYN most likely makes the diagnosis via a Pap test. Conversely, MCEDs, could serve as a screening aid as a part of annual blood work. Physicians will need a clear workflow, which must be built from the ground up. Robust downstream guidelines can ensure that patients have a seamless experience with the product and aid in the medical community embracing liquid biopsy’s clinical utility. For example, the commercial strategy should include ideal patient characteristics. Illumina’s GRAIL suggests that patients with an elevated risk of cancer and those over 50 are the ideal group to benefit from such a test.19

Competition Grows, Firms Look to Address the Full Cancer Care Continuum

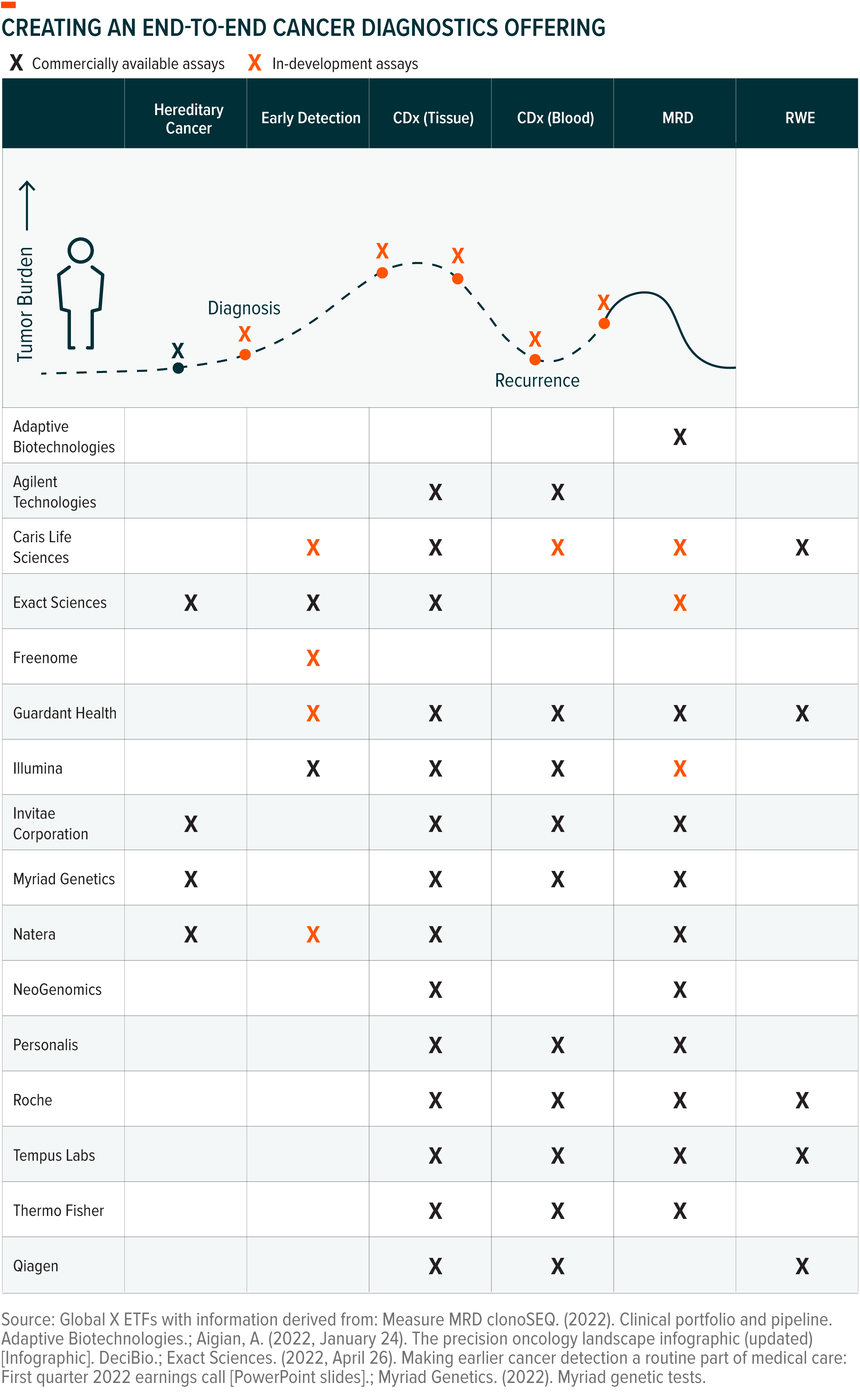

The more late-stage clinical trial data and commercial adoption continue to validate liquid biopsy technology, the more companies enter the market. In our view, test accuracy and result comprehensibility will be the primary determinants of success for any company or test. Other factors, like reimbursement level and company reputation within the physician community, will also play important roles.

In this increasingly competitive market, firms are taking steps to differentiate themselves. Guardant Health, for example, recently announced that it formed a partnership with electronic health records (EHR) firm Epic. The partnership will integrate Guardant’s portfolio of cancer tests into the Epic system. Epic is one of the two major EHR providers in the United States.20

In our view, the firms best positioned to drive test adoption will be those that have comprehensive portfolios with diagnostic options at each step along the entire cancer care continuum, from diagnosis through remission. In addition, we believe having both tissue and liquid-based diagnostic options will help validate the benefit of this new diagnostic approach and drive long-term adoption. Breadth of portfolio will also aid firms in gaining reimbursement coverage, which will ultimately make the technology accessible to a greater patient population.

Beyond traditional points along the cancer care continuum, we anticipate that hereditary cancer testing and real-world evidence (RWE) will increasingly converge with the segments of traditional oncology diagnostics that liquid biopsy addresses:

- Hereditary Cancer Testing: This blood-based test searches for specific genetic mutations that can help identify patients at a higher risk of developing cancer in their lifetime.21 For example, if a patient has a BRCA mutation, physicians might recommend more frequent screening tests, such as mammograms and MRIs.22 One in eight cancer patients has an inherited gene mutation.23

- Real World Evidence (RWE): RWE can take the shape of robust databases offered by healthcare companies that can be used to accelerate research and development (R&D) of cancer medications. Liquid biopsy companies are increasingly partnering with pharmaceutical and biotech firms to offer de-identified clinical information and genomic data collected from their liquid biopsy tests. These partnerships give drug developers insights into tumor evolution, treatment resistance, and anti-cancer therapy use.24 In practice, these insights can help pharmaceutical firms prioritize development of cancer drugs by level of unmet need, shape the design of clinical trials to better determine drug effectiveness, and evaluate success of approved drugs.25

Conclusion

Liquid biopsy technology has momentum as an increasingly viable early-stage cancer detection tool. We’re seeing that momentum play out as firms expand their portfolios and established life sciences companies enter the space. Increased acquisition activity is another telltale sign of liquid biopsy’s growth potential, including Exact Sciences’ $2.15 billion acquisition of Thrive Earlier Detection, Illumina’s $8 billion re-acquisition of Grail, and Agilent’s $550 million acquisition of Resolution Sciences.26, 27, 28 In our view, these developments can accelerate research in the industry and shift the oncology landscape as patients and providers begin to experience the benefits.

Related ETFs

AGNG: The Global X Aging Population ETF seeks to invest in companies positioned to serve the world’s growing senior population through exposure to health care, pharmaceuticals, senior living facilities and other sectors that contribute to increasing lifespans and extending quality of life in advanced age.

GNOM: The Global X Genomics & Biotechnology ETF seeks to invest in companies that potentially stand to benefit from further advances in the field of genomic science, such as companies involved in gene editing, genomic sequencing, genetic medicine/therapy, computational genomics, and biotechnology.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.