Risk Management Strategies for a Volatile Market Environment

As inflationary pressures persist and the Federal Reserve (Fed) continues its rate hiking regime, economic uncertainty has grown more prevalent, making matters difficult for investors. For income-driven accounts, traditional instruments like corporate, government, and municipal bonds have offered the potential to preserve capital. However, they come at the expense of lower yields and sensitivity toward interest rate moves. High dividend paying equities, on the other hand, can generate better yields and might be less sensitive to rates, but they also tend to exhibit wider ranges of volatility. Taking this backdrop into account, it is understandable that investors might have some apprehensions regarding how they augment their portfolios. Risk management strategies that harness options, like those that exist in the Global X suite, may provide an alternative solution for investors seeking protection from downside moves across the market. In this report, we highlight several such Global X derivatives-based strategies that investors may want to consider.

Key Takeaways

- Income investors face difficult capital allocation decisions with lingering uncertainty about the Fed’s path to tame inflation. Fears of an earnings recession are mounting, and market volatility remains elevated.

- Risk management strategies tailored around options have grown in popularity, and for outcome-based objectives multiple solutions are available for investors to express their views or pursue their goals.

- Option strategies can be dual purpose. For those investors targeting risk management specifically, incorporating covered calls and protective puts in a single wrapper can serve as a risk management strategy, either for income purposes or a total return agenda.

Framing Income Investors’ Challenges in the Current Landscape

The macroeconomic environment and the market’s response to a somewhat hawkish tone from the Fed creates challenges for income-oriented investors. Data being released around the globe is providing mixed signals, and the rate backdrop in which individuals and institutions are now forced to operate represents the opposite end of the spectrum relative to what has been experienced in recent years. Broad market themes like softening headwinds on the global supply chain provide confidence that some semblance of relief is on the way. However, this may not come to fruition until late 2023.

Contributing to investor uncertainty are conflicting data sets like those suggesting that capital expenditures will increase some 6% in 2023 even though companies are going to be facing higher costs.1 Specifically, margin pressure from a recovering labor market should remain evident after U.S. labor participation rates checked in at 62.6% in March of this year. Data released that month also showed that weekly jobless claims fell, and the proxy for layoffs also signaled ongoing labor market strength. Pockets of weakness exist, no doubt, due in part to recently elevated levels of inflation, but on the whole U.S. consumer demand remains robust.

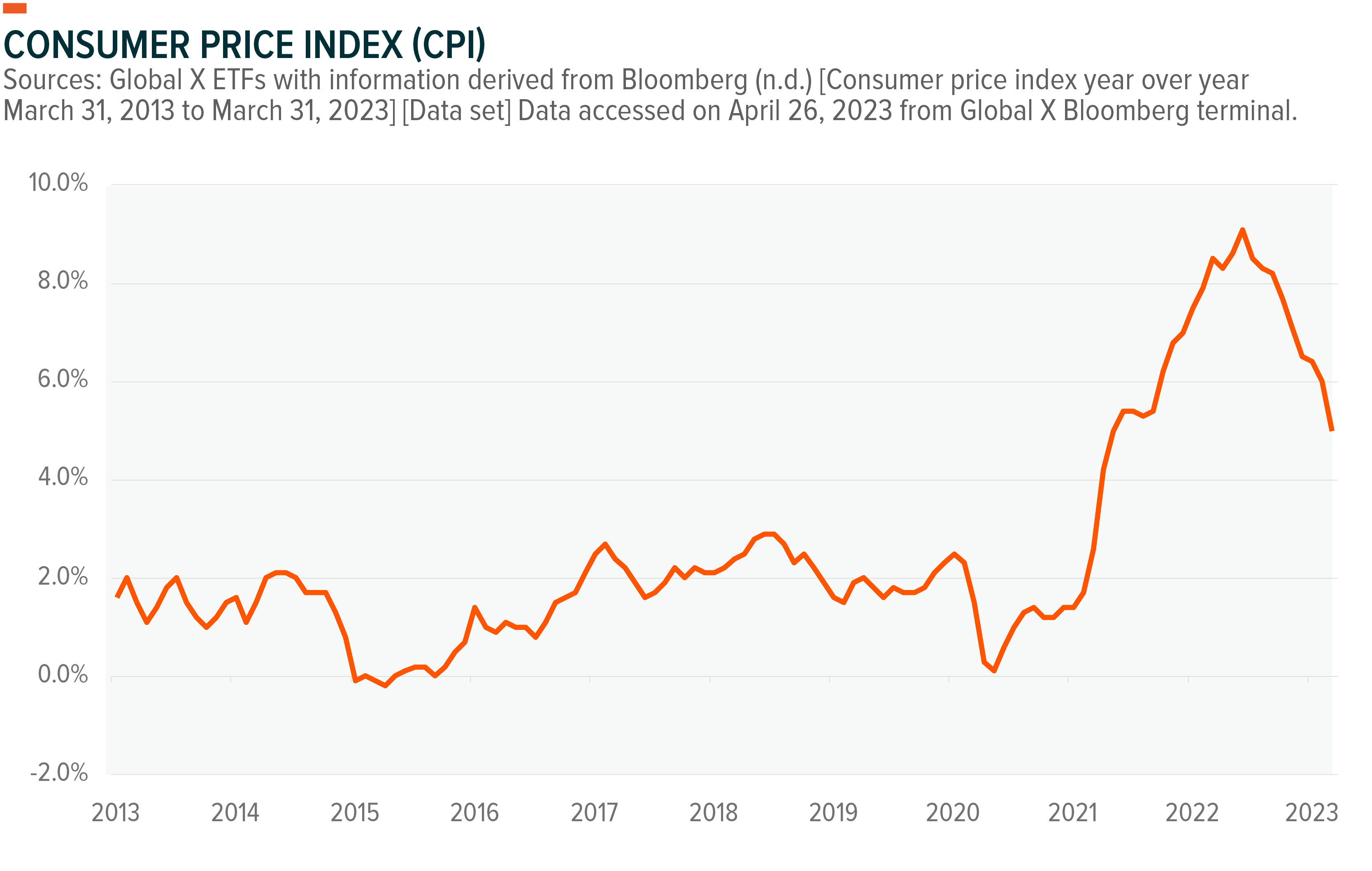

How long this consumer strength will last is a question that is on the mind of most investors. Recent data has illustrated the difficult path for the Federal Reserve as the April Consumer Price Index ticked down 0.1% month to month, to 4.9%. Still, this figure sits well above the Fed’s inflation target of 2%. Meanwhile, wage pressures and higher input costs may well result in a deep economic contraction as they take a hit on the consumer. A prolonged descent could have a meaningful impact on savings and, consequently, late-age income levels.

With recent CPI readings acting as a reminder that the path to lower inflation won’t be a straight line, uncertainty is building. Fears of lower economic growth have led to higher levels of market volatility as exhibited by The Chicago Board Options Exchange Volatility Index, or VIX. This proverbial “fear” index tracks the implied volatility of the S&P 500, typically rising sharply when the S&P 500 falls in value.

Options Can Help Investors Navigate Event-Driven Market Movements

Traders have driven volumes higher of late in an effort capitalize on rising interest rates and higher levels of volatility. The implementation of put options has grown particularly popular in order to provide a degree of downside protection and hedge portfolio risk. In 2022, trading in put options, which are contracts that give the holder the right but not the obligation to sell a security at a predetermined price within a certain period or on a specific date, soared by more than 30% year-over-year (YoY).2 In Q4 2022, short-term contracts increased as trading deep in-the-money contracts more than doubled to nearly 11% of daily average stock options volume from a multiyear average around 5%.3

In recent history, investors have turned to this strategy more and more in preparation for events such as important data releases and central bank press conferences. These investors often sell out their positions shortly after the event, contributing to increased volatility of the reference asset. With more uncertainty surrounding the market, investors have made use of shorter-dated calls in an effort to take advantage of market rallies. In 2023, roughly 46 million contracts changed hands on an average day as of Feb. 10, 2023, an increase of about 12% from 2022.4

Investors Have a Lot of Options When Addressing Volatility

A variety of factors can bring about turbulence in the marketplace. In recent years we have seen intervention from geopolitical undertakings, rising interest rates, and even black swan events like the COVID pandemic. Harnessing multipurpose option strategies that offer some degree of downside protection can represent key additions to a portfolio when attempting to address these systematic risks. Strategies like that which we outline below can also bring about equity diversification for income-driven portfolios, which are often underweight certain growth sectors like technology.

Global X Risk Managed Income Strategies: Seeking to Generate Capital with a Net-Credit Collar

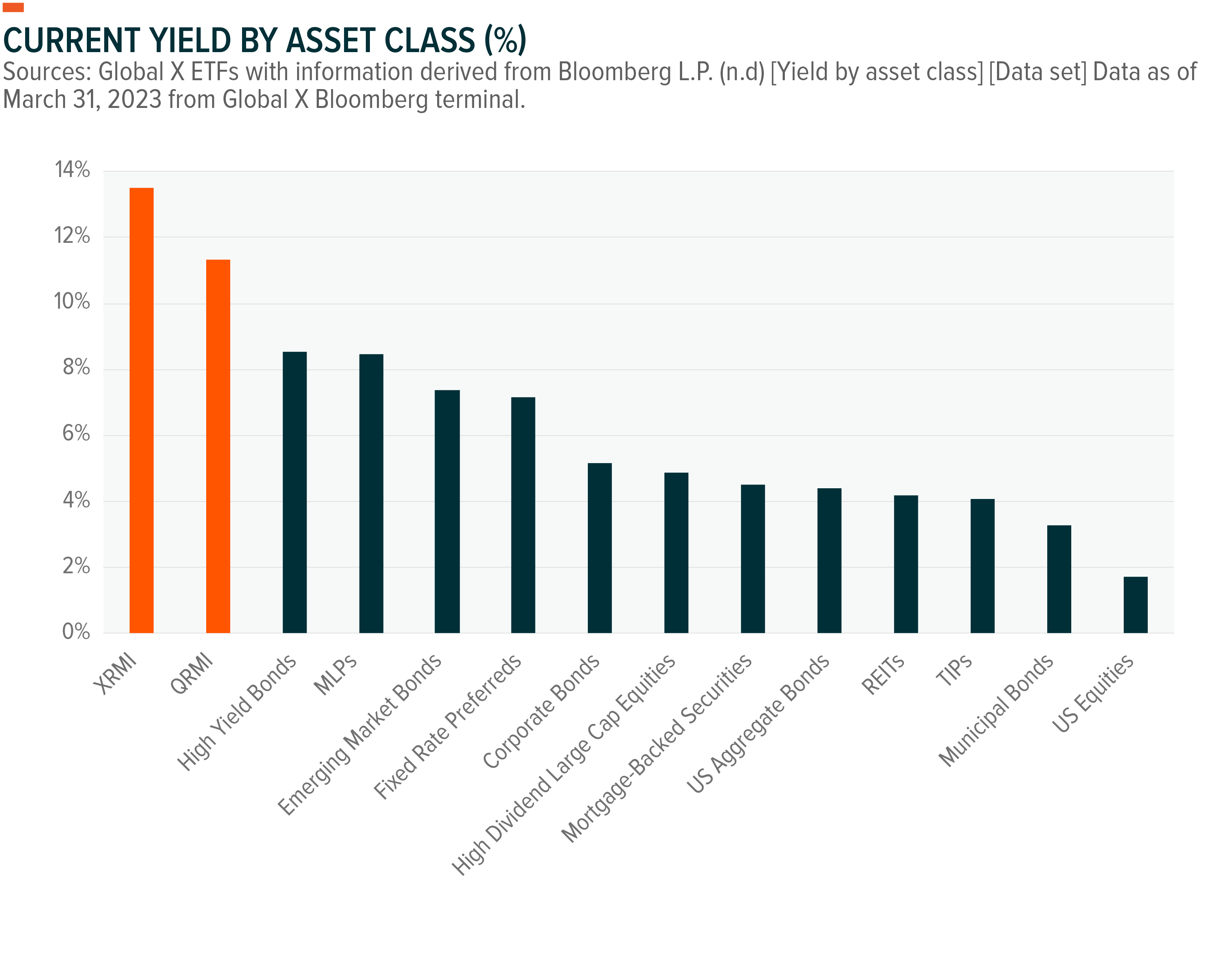

Naked option strategies can provide investors with levered exposure to an underlying instrument. However, they come with an elevated level of risk. Equity covered strategies may help limit that risk and, when rolled into a multi-pronged strategy like the net credit collar, can also deliver an income component. The net credit collar combines the properties of a covered call with a protective put, where the premiums received from the sale of the call options will be greater than the premium being paid when buying the put options. Simultaneously, they position the investor to potentially take on fewer losses. Below we highlight how the current yields provided by Global X’s Risk Managed Income ETFs, which harness a net credit collar strategy, compared to other typically defensive investments over the trailing twelve-month period.

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month- or quarter-end, please click on the fund names below.

Asset class representations are as follows: High Yield Bonds, Bloomberg US Corporate High Yield Total Return Index; Fixed-Rate Preferreds, ICE BofA Fixed Rate Preferred Index; US Aggregate Bonds, Bloomberg US Aggregate Bond Index; Emerging Market Bonds, Bloomberg EM USD Aggregate Total Return Index; TIPS, Bloomberg US Treasury Inflation Notes TR Index; Corporate Bonds, Bloomberg US Corporate Bond Total Return Index; REITs, FTSE Nareit All Equity REITs Index; U.S. Equities, S&P 500 Index; MLPs, S&P MLP Index; Mortgage-Backed Securities, Bloomberg US MBS Index; High Dividend Large Cap Equities, S&P 500 High Dividend Index; Municipal Bonds, Bloomberg Municipal Bond Index.

The Global X Nasdaq 100 Risk Managed Income ETF (QRMI) and the Global X S&P 500 Risk Managed Income ETF (XRMI) fit the mold of a net credit collar strategy by combining covered calls with protective puts. They aim to retrieve net premiums by owning underlying securities of an equity index then selling at-the-money call options and buying 5% out-of-the-money (OTM) put options on the same index. This strategy sacrifices some yield. However, because it seeks to generate an income stream, it can serve as a solid complement to other fixed income allocations.

Distributions are subject to change.

QRMI & XRMI typically earn income dividends from stocks and options premiums. These amounts, net of expenses, are typically passed along to shareholders as dividends from net investment income. Both funds realize capital gains from writing options and capital gains or losses whenever it sells securities. Any net realized long-term capital gains are distributed to shareholders as “capital gain distributions.’’ A portion of the distribution may include a return of capital. These do not imply rates for any future distributions.

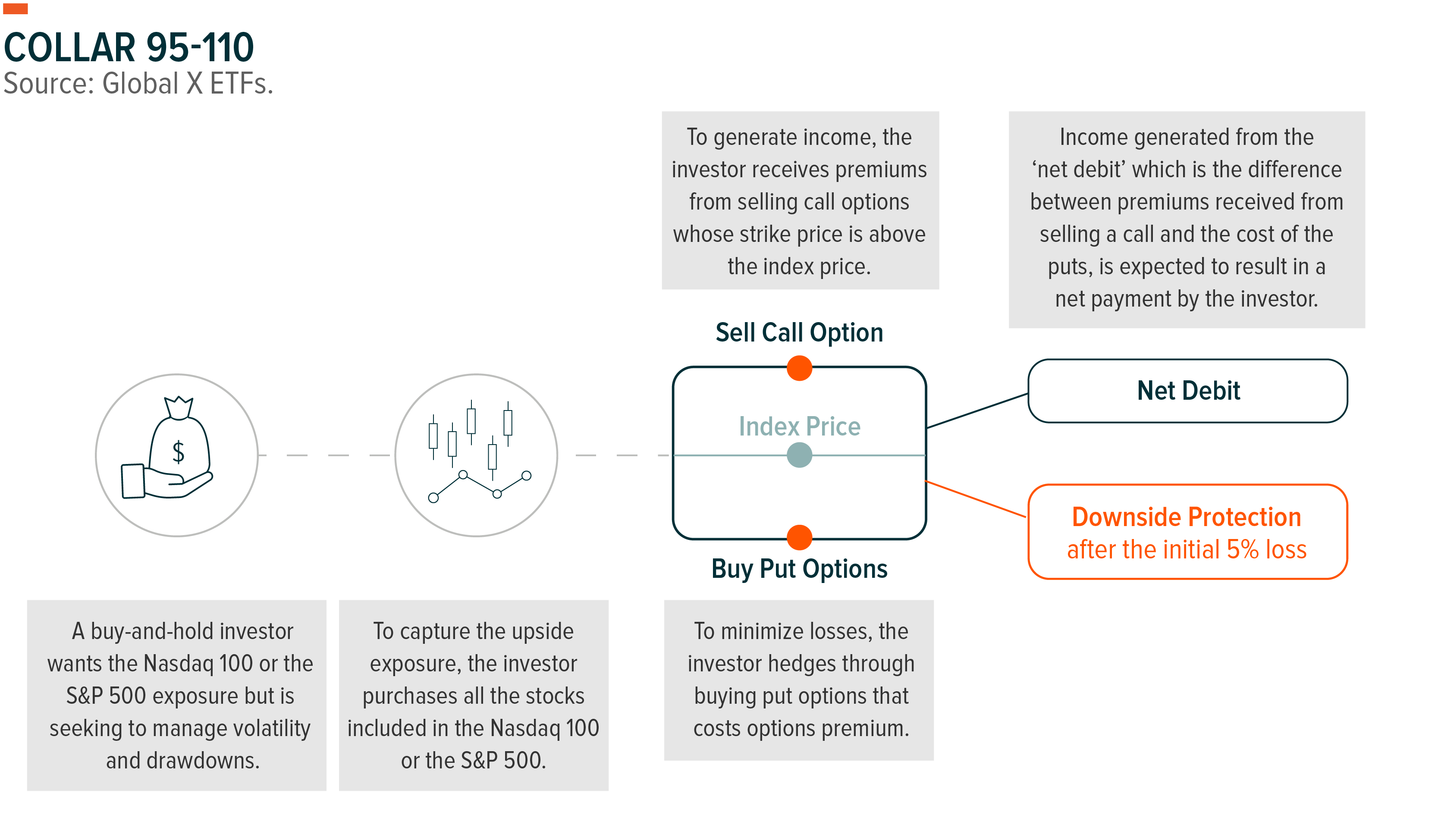

95-110 Collar Strategies: Helping Investors Achieve Range-Bound Returns

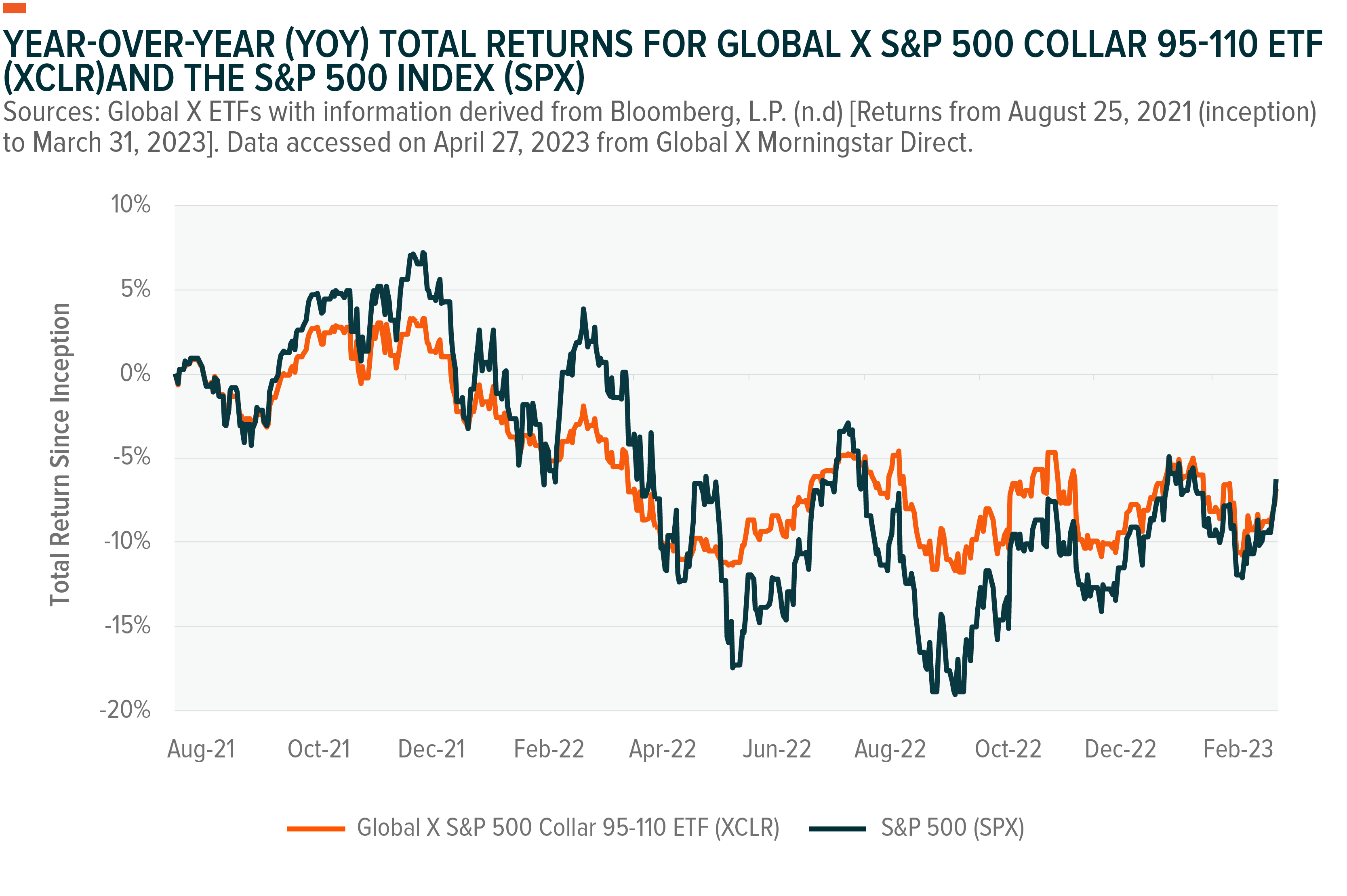

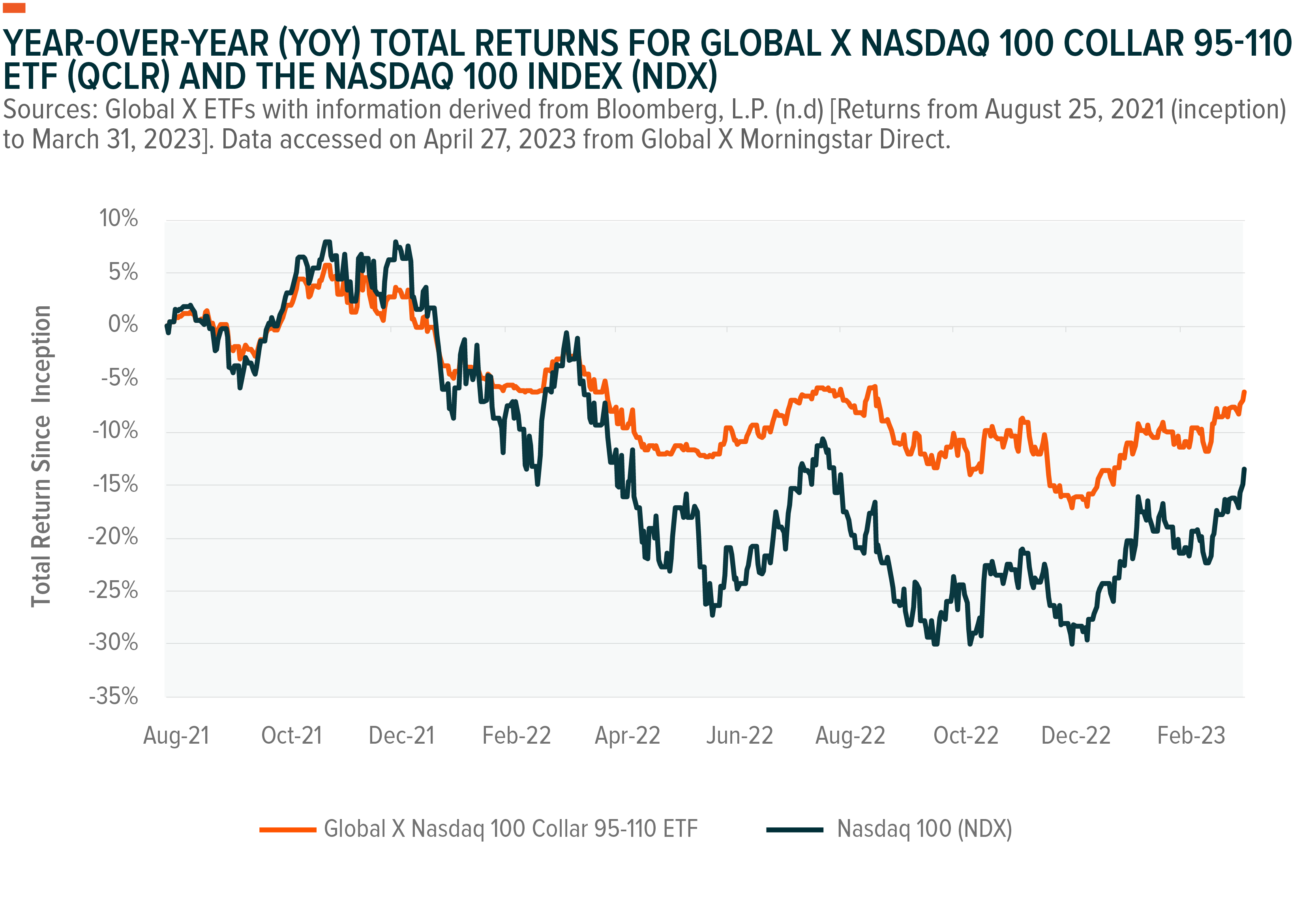

Collar strategies also use their multiple legs to help investors set their expectations. The 95-110 collar strategy employed by Global X is specifically designed to mitigate losses of more than 5%, while gaining exposure to 10% of the potential gains on the underlying asset. A key difference between 95-110 collar strategies and net-credit collar strategies are that 95-110 strategies are not always designed to generate income. Indeed, the cost of the protective put option can exceed the premiums received from the sale of the call option. This design lends the strategy more so to risk management rather than income generation. Two examples of collar strategies are the Global X Nasdaq 100 Collar 95-110 ETF (QCLR) and the Global X S&P 500 Collar 95-110 ETF (XCLR). These funds purchase 5% OTM put options while simultaneously selling 10% OTM call options, thus creating the collar.

Collar strategies typically own the underlying asset and then overlay the purchase of a put option and the sale of call option on the same asset. Combining the payoffs for a protective put and a covered call brackets, or collars, returns between a lower floor and upper cap over the length of the option contracts. Compared to the risk income strategies that are net credit collars, these 95-110 strategies create a net debit because they cost capital to implement.

Fund returns represent NAV returns. Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month- or quarter-end, please click on the fund names above.

Fund returns represent NAV returns. Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month- or quarter-end, please click on the fund names above.

Conclusion: Options Are a Strong Risk Management Tool That Offer Potential for Diversified Income

The ultra-low interest rate environment that preceded the current hiking cycle left meaningful income-generating investment vehicles in short supply. Now, investors must manage the risk and the accompanying volatility of a macroeconomic backdrop characterized by high inflation and the Fed’s rate response. Amid this turbulence, we believe that risk managed income and collar options strategies may be appropriate for certain investors. These strategies offer an opportunity to create diversified income while reducing exposure to equities and the associated risks that they carry.