Takeaways from Tokyo

Figuring out what to focus on can be hard for those in the business of financial markets and prediction. From Federal Reserve policy to hedge fund flows, synthesizing all the data points and determining their potential real-world implications is complicated at best, and often truly perplexing. Stepping back from the barrage of data for a minute can be helpful. For me, two weeks in Japan offered an opportunity to gain perspective and make a few observations.

Key Takeaways

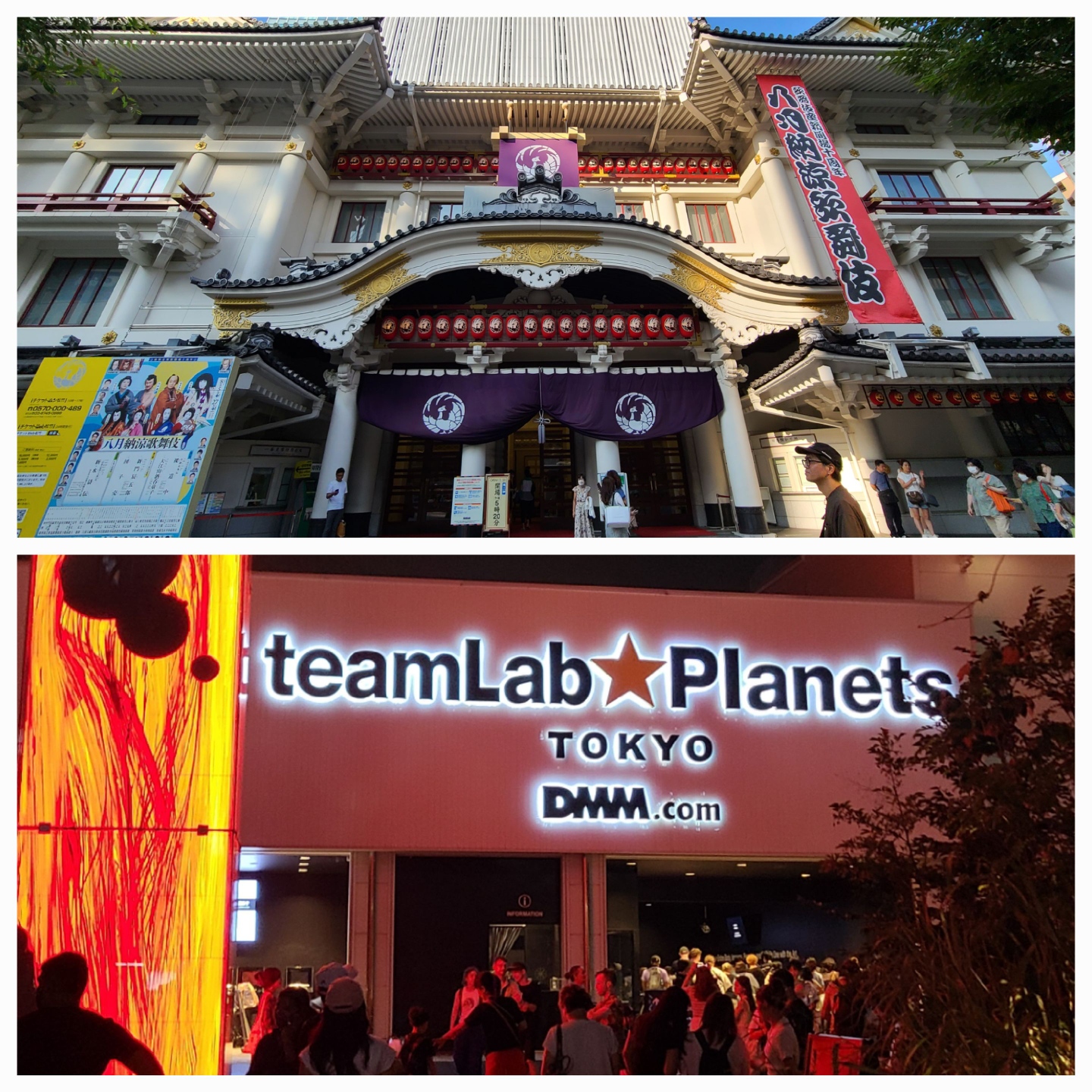

- Whether at a traditional kabuki theater or augmented reality art, Japanese consumers are out and about, reminding that consumer behaviors offer telltale economic signs.

- Even in technology-forward economies, cash is king and financial innovation is still in the early stages.

- AI has the glitz, but automating small things will be big business.

- Markets are like gachapon machines. Investors insert their coins in the machine, and they get a prize in return. Whether it’s the prize that they want is a different story.

Kabuki Theater to AR in Two Miles

Featuring dramatic costumes and storytelling, kabuki stage art dates to the 17th century in Kyoto. There aren’t many kabuki theaters left in Japan, but those still in operation are revered. Throughout history, kabuki provided a means of entertainment and social commentary. Today, social media platforms like X, née Twitter, offer something of a comparison. Their shared trait is consumer interest in entertainment, which gets lost in many economic discussions.

When thinking about technological adoption, the two miles from Tokyo’s main kabuki, Kabukiza Theater in Ginza, and teamLab Planets seems relatively short. Located in Odaiba, a neighborhood famed for its futuristic aesthetic, teamLab Planets offers a fully immersive, multi-sensory augmented reality (AR) experience that takes visitors through various art displays. There are many headwinds to technological adoption, but consumers will spend on what entertains them and what they deem necessary, as they have for centuries.

For market participants, perhaps the best recent example of a modern kabuki performance is the Jackson Hole Economic Symposium. Once a venerated venue for big and elaborate ideas, now the annual August event simply serves as a modest touch point on the pulse of the global economy. The good news is that policymakers were humble at this year’s gathering. Despite what the media may say, central banks and policymakers don’t set interest rates, the economy does.

Two Miles Seems a lot Shorter than Four Centuries: Consumers Will Continue to Spend on What Entertains Them, Whether Kabuki or Innovative Technologies Like AR

Coin Culture

When its 95 degrees and 80% humidity, you want two things: a hand towel and a cold drink. In Japan, they’re easy to find. On every other street corner there’s an automated vending machine with cold water, cold tea, and iced coffee, and towels, and quite frankly, just about anything. But there’s a catch: cash only. Japan is a model of the modern economy, but you still need a pocket full of coins.

The further I ventured from Tokyo, the more I was reminded that cash is still king around the world. The global financial system remains fragmented and the fintech industry still has much work to do to make a sustained dent. The challenge for fintechs is that large financial institutions have ample resources to invest in technology. The David and Goliath dynamic in fintech is troubling, but there is room for innovation and growth. Exchange rates and transfers costs for international customers remain oddly high. While daily transaction volume dropped in the digital currency market in theQ2 2023 to $10 billion from $18 billion in Q1, the largest central banks continue to grapple with the best way to roll out digital blockchain currencies.1

Cash Is Still King: Vending Machines Filled with Consumer Goods Reflect Japan’s Commitment to Automation, But Many are Yen Only

Automating the Little Things

From cold drinks to electronic toilets, Japan thinks about how to automate even mundane activities. Efficiency is an imperative for Japan, which has been in a demographic bubble since the 1980s with its aging population. According the U.S. Census Bureau, the United States will be in a similar situation in the 2030s.

With the boom in AI stocks this year and increased emphasis on exploring AI applications across industries, we may have tendency to forget that innovation isn’t always groundbreaking. To be sure, we believe in the long-term potential of AI, and the timing of its emergence is fortuitous as the combination of a tight labor market and onshoring inflates business expenses. That said, not every solution has to be a silver bullet. Yaskawa Company introduced a robot for sorting industrial parts based on color and shape.2 Many small innovations can deliver meaningful improvements in productivity.

Investing by Gachapon Machine

Forest Gump immortalized the phrase “Life is like a box of chocolates, you never know what you’re gonna get.” Market prognosticators aren’t afforded so much whimsy, but the gachapon machine does offer an apt metaphor, and they are everywhere in Japan. The concept is much like the old toy vending stores in supermarkets. You put coins in and get a toy or some sort of prize after a few twists of the dial. Each machine has a theme, and they display the six or eight prizes that you can win.

Financial markets are not all that different from gacha machines. You put coins in and wait for a couple turns of a dial to see what prize comes out, typically from a likely set of outcomes. With valuations high, investors may feel like they’re putting coins in a gacha at the top of Mount Fuji, but it’s worth reminding that investors who top-ticked the market in 2007 still made approximately 200% to the end of August 2023 and annualized almost 7.5%.3 Investors should remember that there’s a prize for playing the game even if it’s not exactly the one they hope for.

Market Tops Aren’t Mountain Tops: The Peak Isn’t the End of the Investment Journey, It’s Only the Next Step Towards Identifying Return Potential and Positioning Portfolios Accordingly