The Case for Digital Assets in a Portfolio

Editor’s Note: We include a glossary at the end for all terms underlined and highlighted in sea green.

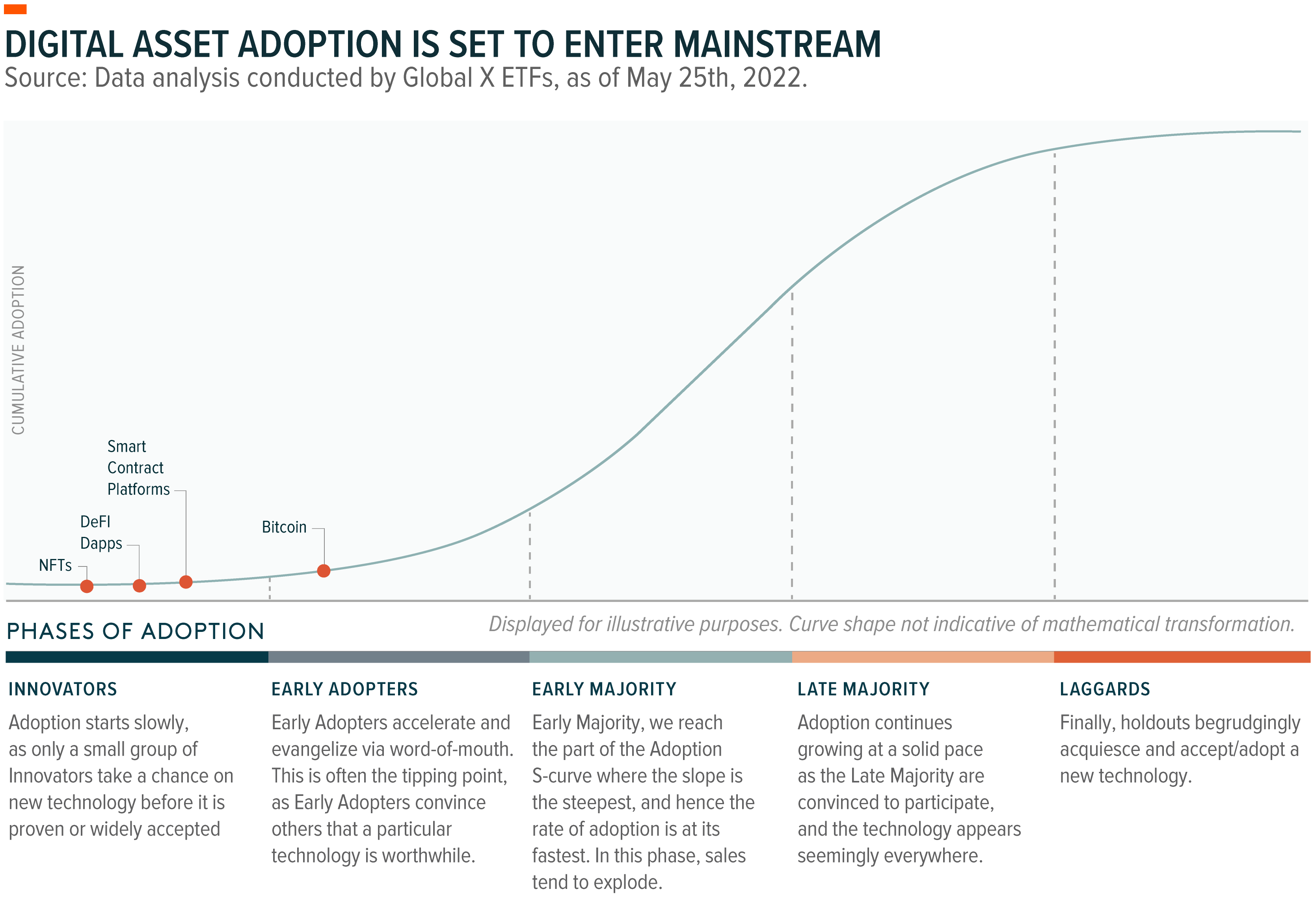

Digital assets, such as cryptocurrencies, traveled the long road to investability in a short time. In our view, they now present a compelling case for allocation in certain portfolios as their adoption curve continues to rise. Ease of access, rising liquidity levels with increased utility, and a deeper understanding of their value not only increase the case for including digital assets in a portfolio but also expands their credibility in the investment community.

In this report, we outline some of the investable buckets digital assets fall into and explain how cryptocurrencies can be integrated into a portfolio. More than just a currency play, the space now comprises rich ecosystems of decentralized applications (dapps) that offer utility powered by smart contract platforms . Additionally, we believe that cryptocurrencies can provide diversification benefits, which for some investors, represents a compelling opportunity within the current macroeconomic environment.

Digital assets are in the early stages of the adoption curve, but they are gaining momentum. Factors that could propel user adoption further up the curve include updates and innovation within these platforms, retail and institutional interest as the technology evolves, and economic acceptance by governments.

Many leading platforms continue to drive innovation and build utility in areas such as decentralized finance applications (DeFi) , governance voting, the creator economy, asset management of sectors such as real estate, GameFi , and the overall enhancement of settlement channels. These innovations can create network effects for users and developers, and thus increase the value of these platforms.

Rising institutional participation highlights the growing conviction in the digital asset landscape. Historically a space led by early believers and retail investors, the market now garners significant interest and inflows from institutional funds and large corporations, due in part to customer demand. The chart below shows that the volume of capital flow from institutions into centralized exchanges (CEX) , such as Coinbase, has continued to grow.

In addition, governments show sincere interest in integrating cryptocurrencies into their economies. Cryptocurrencies offer a unique ability to democratize the financial infrastructure by leveling the playing field and providing access to underbanked and unbanked populations, particularly in emerging markets. For example, El Salvador is a pioneer in the crypto space, becoming the first country to recognize bitcoin (BTC) as legal tender in September 2021. Elsewhere, other countries, are exploring the feasibility and regulatory framework of integrating cryptocurrencies into their economic infrastructure. At the local level, in the United States, the city of Miami is pushing to become a leader in crypto innovation and Fort Worth’s city government is mining BTC. Lastly, Brazil’s Rio De Janeiro allocated 1% of its Treasury reserves to BTC.1,2,3

Cryptocurrencies continue to prove their value as an accessible global financial infrastructure. Ukraine has raised over $60 million worth of various cryptocurrency donations to support its fight against Russia.4 With banks closed and ATMs out of money, Ukrainians with access to cryptocurrencies can still transact and distribute funds worldwide, offering a glimpse into the multi-faceted uses of digital assets.5

Catalysts Show Digital Asset’s Growth Potential, Regulatory Talk Shows Its Maturation

The 2021 Chainalysis Global Crypto Adoption Index studied cryptocurrency adoption among ordinary people within countries and across global regions. Factors triggering consumer adoption include peer-to-peer transactions within emerging markets, remittances, and the rise of DeFi usage in the developed world. The global market overall showed an increase in adoption year-over-year.6 Cryptocurrency as a form of peer-to-peer payment continues to gain traction. Recently, Stripe partnered with Polygon to facilitate payments using the USD Coin (USDC) stablecoin.7 Also, projects like the Flexa network are increasingly integrating with leading retailers in order to power cryptocurrency transactions with low fees.

The Bitcoin Lightning Network continues to see an increase in BTC amounts under user payment channels, this highlights greater traction in peer-to-peer global transactions. From a supply perspective, BTC’s next halving event, which is expected sometime in 2024, will reduce mining rewards from 6.25 to roughly 3.125 per mined block.8 Considering the reduction in block reward, miners may be further incentivized to seek green, otherwise discarded, and alternative sources of energy in order to reduce their largest cost driver while adapting to today’s sustainability standards. The reduction in supply, the growing interest from governments and traditional institutions to acquire BTC as a monetary reserve, the Lightning Network’s increasing popularity, and BTC’s overall ethos around powering a scarce asset able to serve as a global financial channel could be important catalysts for BTC.

As for smart contract platforms, we outlined in Ethereum: The Basics how the Ethereum network should improve significantly with upcoming upgrades. Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake and its introduction of shard chains are two of the most anticipated upgrades in digital asset history.

PoS is expected to increase network security, lower energy use by roughly 2,000-fold, and draw new users to the network due to the benefits it provides.9 Among the benefits, staking participants receive a yield on their assets in exchange for securing the network, increasing the incentive to hold Ether (ETH), Ethereum’s native cryptocurrency, long-term.10 Securing the network will not require expensive hardware, and it will be open to all users. Also, ETH’s issuance rate is expected to drop from 4–5% to 0.4–0.5%, reducing the newly created supply. Assuming network demand stays high, this reduction could lead to ETH becoming a deflationary asset because of the burning mechanism discussed in our Ethereum piece.11 Lastly, sharding, which will come at a later stage, and layer 2 scaling solutions will increase the transaction per second count Ethereum can validate. The highly anticipated general-purpose ZK-rollups , which offer faster finality and lower costs than other layer 2 scaling solutions, are also arriving soon. All these updates are expected to increase demand, and with demand comes potential investment opportunities.

Additionally, we expect other platforms such as Avalanche, Solana, Cardano, Cosmos, and Polkadot to follow suit and continue to build and attract developers due to their respective competitive advantages around speed, scalability, and economic incentives. Furthermore, dapps, which are built on top of these smart contract platforms, provide novel use cases and utility posed to disrupt many of today’s leading sectors.

The constant improvements and the expansion of participants enhance and present novel utility while minimizing the costs of accessing DeFi applications, GameFi, non-fungible tokens (NFTs) , and more, which could bring many more users into these ecosystems.

These catalysts can trigger significant growth, but investors should be aware of looming regulations in the digital assets space. Governments for the world’s most influential economies have yet to develop a formal stance on digital assets regulation. On March 9, 2022, the United States passed a first-of-its-kind executive order that acknowledged the virtues of distributed ledger technology and digital assets. The order was a constructive step, but its long-term implications remain uncertain. Comprehensive regulatory frameworks could ease skepticism and attract users, or if overly restrictive, they could hinder growth in certain markets. At this stage of the adoption curve, we believe that regulatory frameworks could be positive and bring some investors off the sidelines, but evaluating the introduction of these regulations is key.

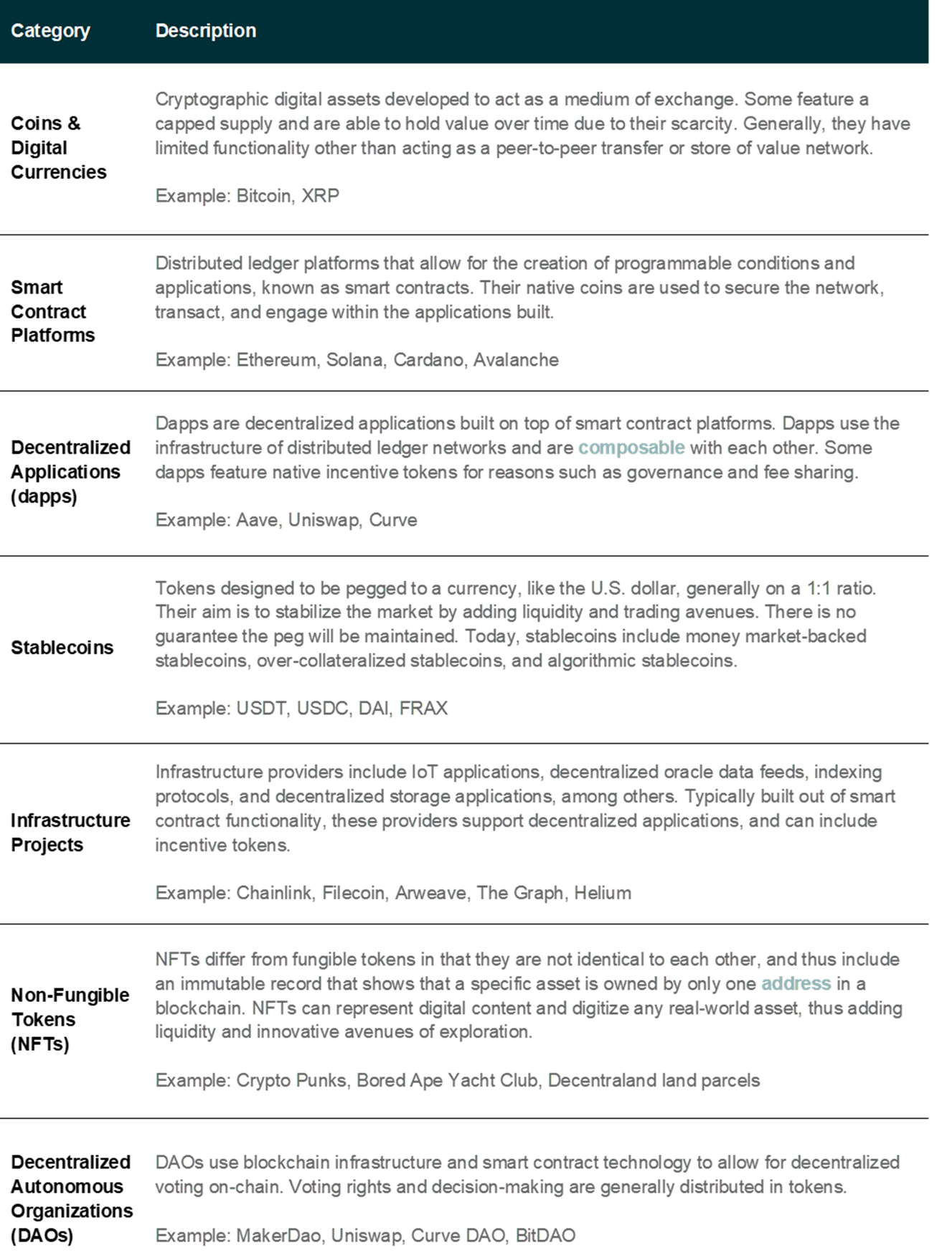

Digital Assets Have Expanded to Investable Buckets

Today, we can classify digital assets into buckets according to their purpose and functionality. Their expansion beyond decentralized currencies and store of value assets broadens their investability and growth potential significantly.

In addition to these buckets, new categories emerged as more applications were built on top of smart contract platforms, such as layer 2 scaling solutions, exchange tokens, GameFi projects, and metaverse platforms, among others.

Centralized entities build the vast majority of applications today, so exposure to the infrastructure that enables a new digital framework and the creation of user-owned decentralized applications means exposure to technological disruption. Digital assets and their applications are a particularly novel asset class, in that their infrastructure is user-owned. Needless to say, the more novel the application, the greater the risk/reward potential for investors as the theme gains adoption, utility, and liquidity.

Cryptocurrency Correlations Continue to Evolve

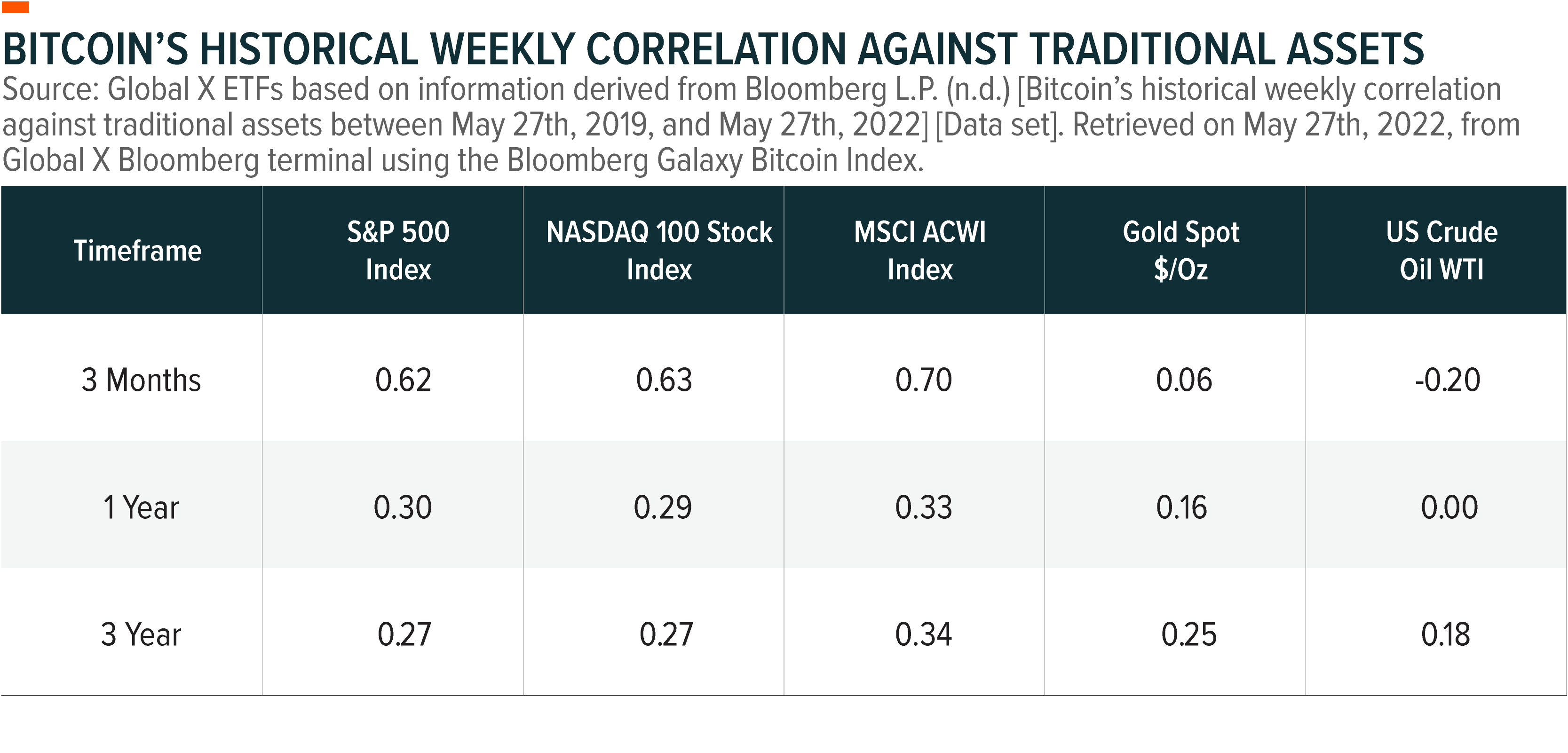

Historically, BTC, the most developed cryptocurrency, has shown low correlations with traditional assets, such as equities and gold, over medium-term horizons. BTC’s 1-year and 3-year correlation with the MSCI ACWI are roughly 0.33, which indicates that it has diversification potential. However, when negative sentiment dictates the market outlook, correlations to “risk-on” assets tend to increase in the short term, as illustrated by our three-month analysis.

Recently, BTC has shown increasing risk-on-asset behavior due to the macro conditions, including hawkish monetary policy, geopolitical uncertainty, and high inflation. Its current 3-month correlation with the MSCI ACWI is at 0.70.

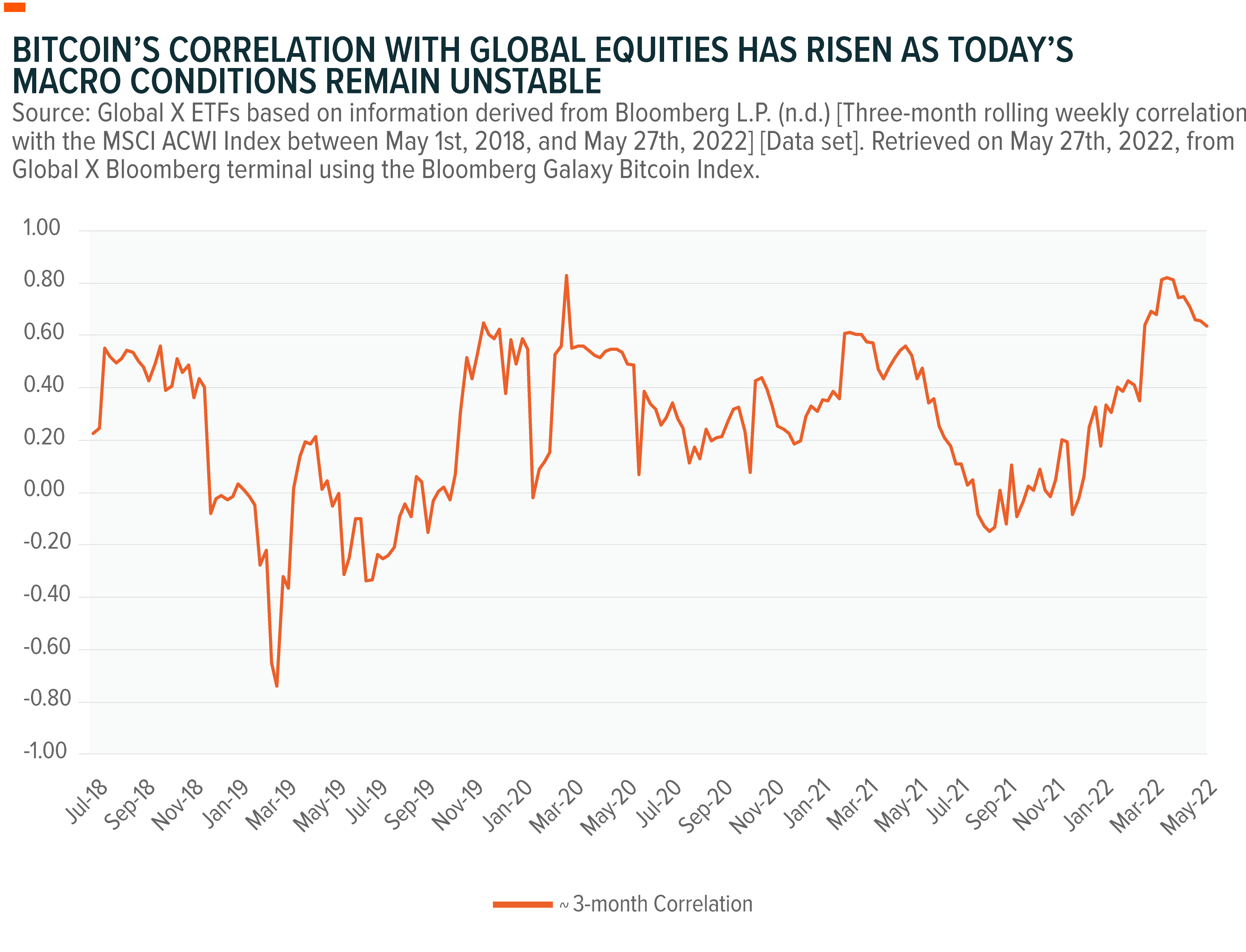

The chart below illustrates that the correlation has jumped since the end of 2021. BTC may be highly correlated to risk assets, like equities, in volatile periods, and we believe that investors should be aware of this correlation.

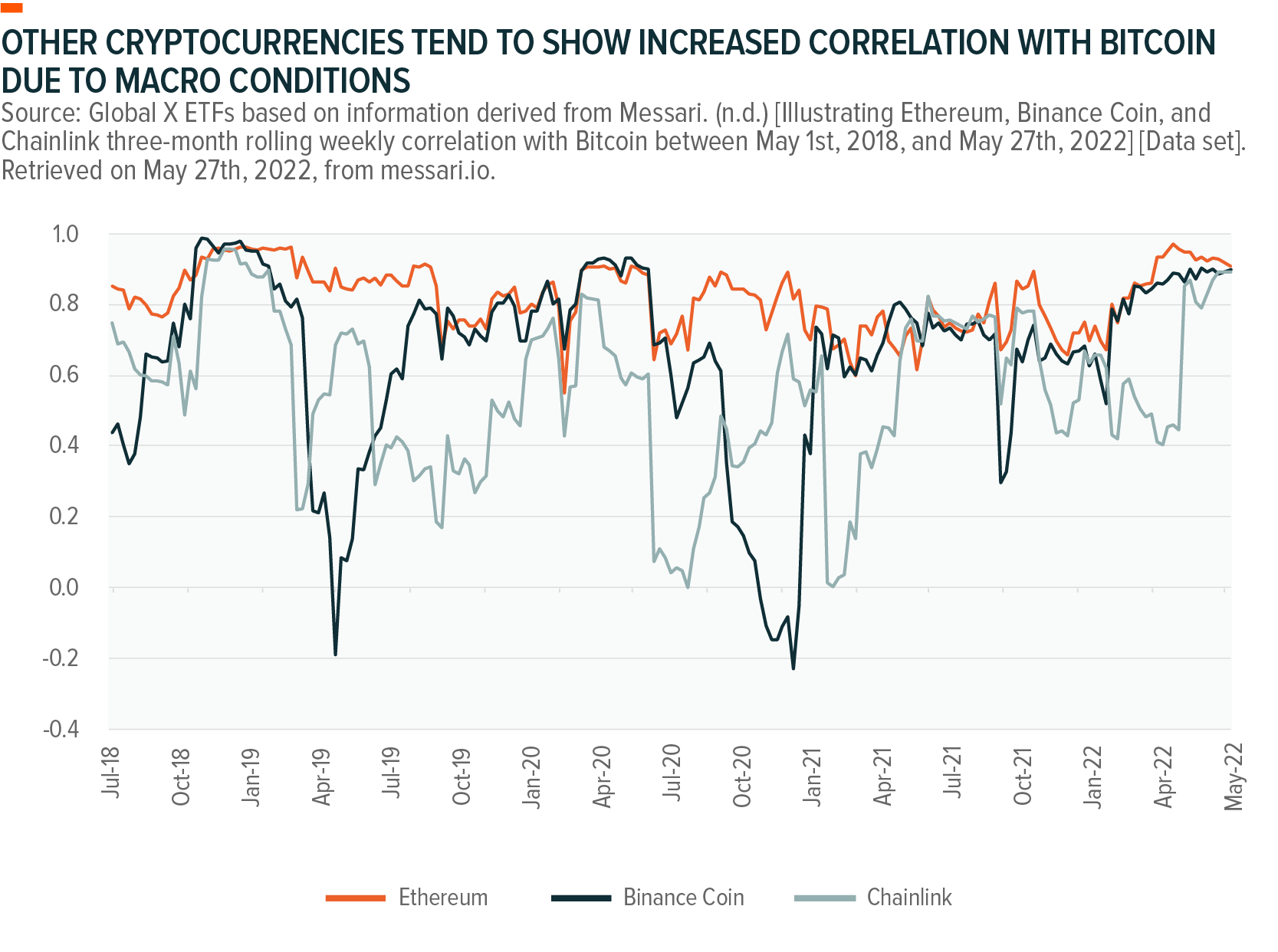

Most major cryptocurrencies tend to move in tandem with each other, especially over short time frames. Today, most of the leading blockchain ecosystems follow BTC’s price closely, with the likes of ETH and Binance Coin (BNB) displaying correlations above 0.8. Smaller cap cryptocurrencies, such as Chainlink (LINK), tend to show lower correlations with BTC but move within the same general direction historically.

Cryptocurrencies are unlikely to offer the same low correlation that they have historically, but we also do not expect them to maintain the high correlations that they are showing today. Such a trajectory in potential correlations can be considered normal as cryptocurrencies move out of their silo and become more embraced and integrated with the global financial system. Further development of the digital asset ecosystem and investor adoption by profile over time are some of the factors that will determine correlations to other asset classes, and even among alternative cryptocurrencies and tokens.

How Digital Assets Can Fit in a Portfolio

Considering the current landscape and adoption, financial advisors and investors demonstrate increased interest in cryptocurrencies. As cryptocurrencies continue to mature within the digital asset class, we believe that they can offer diversification potential and use cases to groups of investors, depending on their objectives. Speak with your financial advisor to determine what, if any, exposure may be appropriate for you.

Cryptocurrencies in a Conservative Portfolio

In our view, cryptocurrencies do not fit a traditional conservative portfolio due to their exposure to volatility and novelty risk. Cryptocurrencies are still in their early stages of development and distributed ledger technology is evolving rapidly. For example, the leading cryptocurrencies today could become outdated over time. Investors looking to reduce risk in their portfolio should likely avoid cryptocurrencies until these assets have a more robust track record or regulatory schemes offer more complete guidance.

Cryptocurrencies and/or Digital Assets in a Growth Portfolio

We believe that a small 1–5% weight on more developed cryptocurrencies, such as BTC and ETH, may be appropriate for certain growth portfolios. Our conversations with financial advisors suggest that many growth-oriented investors are interested in exploring small allocations to the most developed cryptocurrencies, and we expect interest to increase as conviction in the space grows.

Additionally, the market has expanded its offerings to allow investors looking for correlated and diversified products to generate regulated exposure. These financial products provide indirect exposure to the asset class and may present an alternative and compelling opportunity for growth-seeking investors. These include exposure to public companies that are set to benefit from distributed ledger technology and synthetic products such as bitcoin futures.

Recent datasets, cryptocurrencies’ increasing integration within the financial system, access to novel products, and the conviction in the technology allow portfolio managers and investors to build a case towards digital asset exposure as part of a growth portfolio diversification strategy. Their long-term potential diversification benefits relative to global equity and commodity exposures could make cryptocurrencies and correlated products relevant as part of a strategic asset allocation framework.

Cryptocurrencies for Speculative and Engaged Investors

Investors with a high-risk tolerance who are interested in high growth opportunities could explore native cryptocurrencies of smart contract platforms, such as Solana, Avalanche, Cosmos, and Polkadot. In an effort to maximize the return potential, investors could also consider staking. Most smart contract protocols, including those mentioned above, use PoS consensus, which requires locking up or staking coins to secure the network.

For investors looking for passive income opportunities, staking can be attractive because participants can potentially receive mid-single-digit to lower double-digit Annual Percentage Yields, depending on the platform.12 The easiest way to participate in staking is by delegating your coins to a validator , who typically charges a small percentage of the total yield obtained. It is important to choose a trusted network validator because if a validator node decides to tamper with the network, there is a risk of getting your stake slashed . If the validator behaves correctly, the risks of staking are low. When staking, it is also important to consider lock-up periods .

For investors with exceptional risk tolerance, DeFi enables any market participant to fulfill roles such as market-making and lending/borrowing, which were traditionally exclusive to centralized institutions like banks. It is possible to earn fees from users of a protocol as a reward for contributing to the protocol’s operations, a process known as yield farming . Methods to farm yield in DeFi include providing liquidity to decentralized swap protocols, lending tokens via a lending/borrowing protocol, or staking to earn liquid tokens.

Providing liquidity to earn yield can be done via decentralized exchanges (DEX) such as Uniswap, the market leader by users and volume. Uniswap is a decentralized application that allows individuals to act as a market maker by depositing liquidity into trading pools, earning transaction fees. Additionally, investors can participate in DeFi lending using protocols such as Aave, a decentralized, non-custodial liquidity and money marketplace for borrowing and lending digital assets. Aave allows users to lend and borrow assets against collateral for a fee. The lender receives a portion of these fees in the form of interest.

With numerous DeFi strategies now available, it is important for participants to understand the mechanisms behind these platforms, the unique risks each strategy presents, and what the lack of protection from a regulatory perspective could mean for their investment.

The Growing Investment Case for Digital Asset Allocation

The peer-to-peer nature of cryptocurrencies and their programmability via smart contracts can streamline the movement of capital and allow for decentralized ecosystems that can disrupt established industries. That their infrastructure is user-owned creates unique opportunities for investors to participate in an early-stage asset class with a significant runway for growth.

For growth and speculative-seeking portfolios able to take on the risk of these nascent assets, we believe that cryptocurrencies, and their associated infrastructure assets, may be appropriate. In the current market landscape, BTC and ETH can potentially even act as equity diversifiers, given their lower correlation with broader equity indexes over medium duration horizons. In our view, that cryptocurrencies can bring potential diversification benefits to a portfolio shows how far they come, and where the digital asset class could go in years to come.

Investing in Digital Assets Through Regulated ETFs

An exchange-traded fund (ETF) is another way for investors to access exposure to blockchain technology as well as the broader digital asset space, without having to keep custody of the assets. The Global X Blockchain ETF (BKCH), for example, seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, digital asset transactions, blockchain applications, digital asset hardware, and digital asset integration. Today, public miners are a strong constituent within the fund. However, as blockchain adoption grows, the fund may access the greater benefits of blockchain technology throughout multiple sectors. Blockchain technology powers digital assets, but it also has the potential to revolutionize many of today’s data infrastructure and processes. The idea around BKCH lies within the diversification of participants that could leverage both the growth of digital assets as well as the disruptive power of distributed ledger technology and the efficiency, transparency, and security it provides.

Alternatively, the Global X Blockchain & Bitcoin Strategy ETF (BITS) provides a novel approach to gaining exposure to regulated bitcoin futures. BITS is an actively managed fund that takes long positions in U.S.-listed bitcoin futures contracts combined with exposure to BKCH. The development of futures contracts for bitcoin is a relatively recent development that offers investors indirect exposure to this cryptocurrency. BITS combines owning these bitcoin futures contracts with exposure to blockchain equities through BKCH. We believe investors can consider using either of these funds to achieve digital assets exposure, depending on their objectives.

Related ETFs

BITS: The Global X Blockchain & Bitcoin Strategy ETF is an actively-managed fund that seeks to capture the long-term growth potential of the blockchain and digital assets theme. The Fund takes long positions in U.S. listed bitcoin futures contracts and invests, directly and/or indirectly, in companies positioned to benefit from the increased adoption of blockchain technology. BITS will not invest directly in bitcoin, and it currently delivers exposure to blockchain companies through other ETFs, including the affiliated Global X Blockchain ETF.

BKCH: The Global X Blockchain ETF seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.