Views From the Ground: Colombia

We recently visited Colombia for meetings with corporates across the country, local pension funds, government officials, and a site visit at Puerto Bahia (the third largest port in Colombia). After a remarkable recovery post COVID-19 that saw Colombian GDP grow 11% and 7.5% in 2021 and 2022, respectfully, the country now faces an interesting juncture as growth decelerates.1 Corporate investment has declined, driven by political uncertainty, and consumers who have supported the market are starting to tap out given a high key interest rate of 13.25% that is needed to tame inflation. Furthermore, market liquidity has dried up, while the MSCI Colombia Index consists of only two issuers after Ecopetrol’s exit in November 2022.2 This is putting the Colombian market at risk of reclassification to frontier market status, which would likely drive further passive outflows. On the other hand, inflation is dropping, positive real rates are expanding, and we believe the economy is heading to an attractive position ahead of a monetary easing cycle. The Colombian equity market presents many interesting opportunities, especially given cheap valuations, with the market recently trading at ~5.6x P/E versus a long-term average of ~11.2x.3 The country boasts world class exploration and production (E&P) companies that also trade in the U.S. and Canada. In our view, attractive valuations and low liquidity have created an environment that could present opportunities for potential corporate actions, including additional U.S. listings, privatizations, and the unbundling of cross-holding structures at major companies in Colombia within the Grupo Empresarial Antioqueño (GEA) conglomerate. The country also acts as a tech hub in Latin America and could see future carve-outs and listings.

Key Takeaways

- A recent trip to Colombia left us with a clearer assessment of the opportunities there, from attractive valuations and falling inflation to expanding real interest rates and potential corporate actions.

- Energy remains an important part of Colombia’s economy, and we were encouraged by the growth potential we saw for exploration and production companies.

- Colombia is an emerging tech hub in Latin America, with exciting innovations in fintech, prop-tech, and beyond.

Macro Normalization: A Process of Gradual Adjustment

Due to expectations for lower oil prices, as well as lower tax collections, the government recently unveiled its medium-term fiscal framework that prioritizes a process of “gradual adjustment.” Consensus expectations call for rate cuts to start in 4Q23 as inflation is anticipated to decline towards 9% by yearend.4 However, in speaking with locals, we agree that El Niño could act as an upside inflation risk, similar to 2015/16, when the weather pattern hurt crop yields and pushed food prices higher. The government expects inflation to normalize toward its 2-4% target range by 2025.5 The country also faces a fiscal deficit of ~4.2% of GDP, down from 7.5-8% in 2022, on the back of recent tax reforms from both the current Petro, and previous Duque, Governments, and should gradually decline towards a much more manageable 2.8% over the long term, per government projections.6 Colombia’s current account deficit (CAD) is forecast to decline to ~4% as economic activity decelerates.7 Despite expectations for gradual improvement in the economic outlook, uncertainty over potential reforms, coupled with still high rates, is affecting capital formation in the short term, and is the main driver behind the declining capex and CAD in the country.

We also note that though private consumption is declining off a high base, government consumption increased 5.3% q-o-q in 2Q23 and was 13.2% ahead of 4Q22.8

Political Uncertainty Impacting Investment and Liquidity

In 2022, Colombia followed a similar path as many of its South American peers and elected Gustavo Petro, the first far left leader in modern Colombian history. After his victory, all major asset classes in Colombia declined. He campaigned on promises of reforms (tax, pension, labor, health, etc.) and came in with ~60% approval rating. Since 2022, his government has faced gridlock, which has reduced the risk of unorthodox economic policies. Over the next two months, we expect additional details on labor, pension, and healthcare reforms to be announced. The Colombian peso and fixed income markets have rallied off recent dynamics, while equities have been more stubborn on political risk in key sectors of the market, including financials, utilities, and oil & gas (O&G). Uncertainty over reforms has important knock-on effects on the economy. For example, proposed pension reform could see a significant decrease in contributions to private plans, potentially decreasing pension fund activity in the equity market, likely reducing positioning in equities to de-risk, and therefore decreasing market liquidity further. The lower current account deficit, driven by lower imports from corporates, reflects concern towards domestic investment opportunities, with many of the companies we spoke to looking at growth opportunities outside of Colombia in the short term instead. Positively, the trip has shown that although rhetoric can be intense, certain areas of the economy still have plenty of room for growth, even in the face of reforms, while institutional strength has shown to be resilient, as expected. For example, changes in the O&G industry included new tax surcharges based on current market prices as well as a moratorium on new exploration licenses. However, we were told in meetings that the industry has enough currently awarded acreage to drill for the next 10+ years, and on-the-ground operations continue working as usual and hand-in-hand with the local regulators. Institutional strength is a bright spot, as Congress, the Senate, and the Supreme Court have been able to act as a set of checks and balances. Colombia has municipal elections in October, and they will be a good test for the Petro Government’s popularity. An increased balance of power could de-risk unorthodox policies even further, which would likely be supportive for equities.

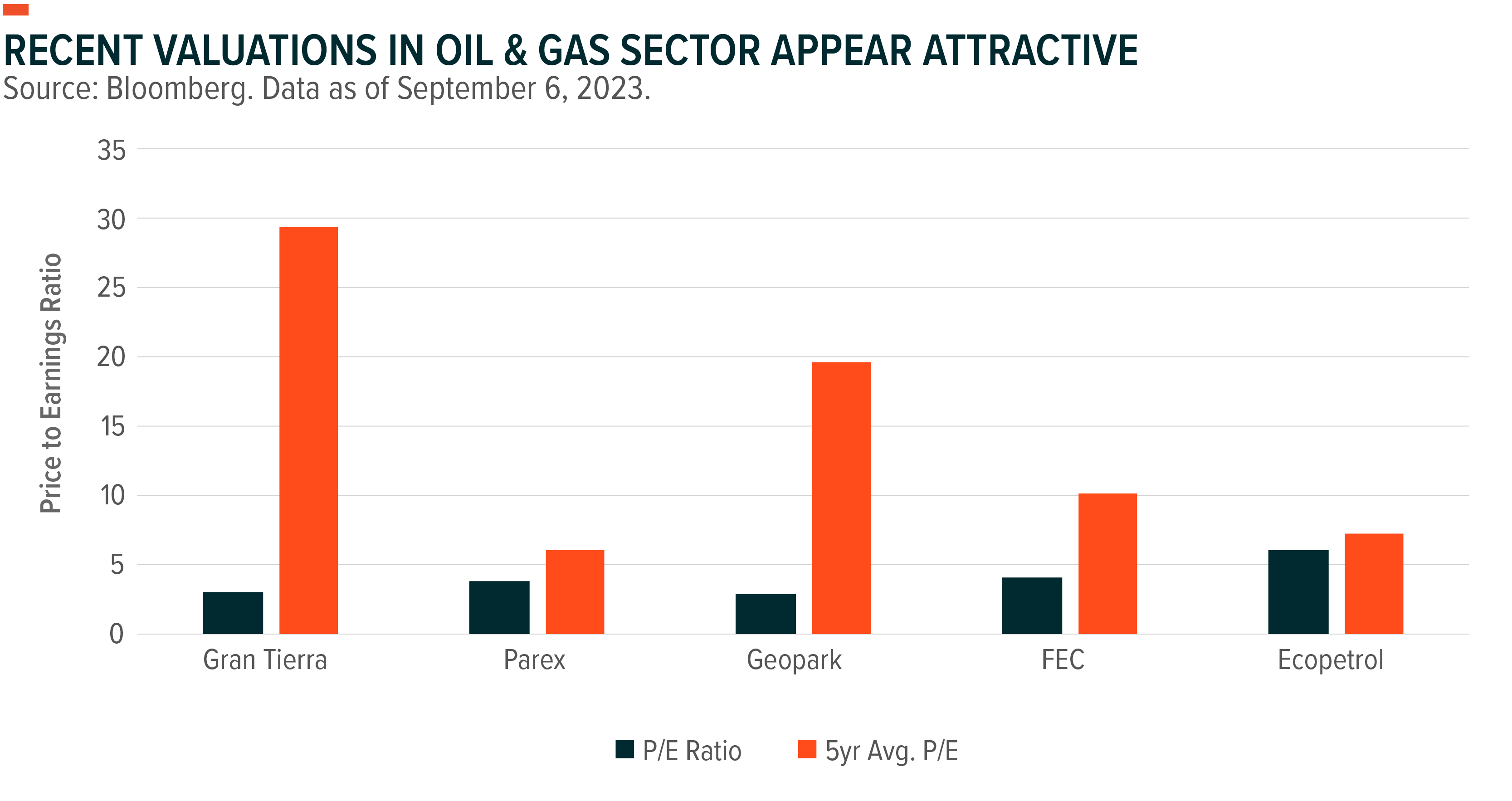

Exciting E&P Opportunities Despite the Negative Press

In Colombia, oil represents ~40% of total exports.9 Furthermore, oil linked revenues are an import source of fiscal income for the government and have represented ~11% of fiscal revenues over the last 10 years.10 At current prices, we estimate that oil revenues will probably represent ~15% of fiscal revenues, and we find that every $10 increase in oil prices represents roughly 30-40bps of GDP in higher fiscal revenues. Although the sector only represents ~5% of GDP, the industry is important for the foreign currency it provides, fiscal accounts and, due to higher spending, also supports GDP, albeit with a lag.11 Current production of ~700,000 boe/d is well below the country’s 2014 peak of ~1mn boe/d.12 It is clear the O&G industry in Colombia is important to the country, but recent tax reform has led to surcharges on the industry depending on oil prices, reducing corporate profitability, and environmental restrictions have led to an end in new exploratory licenses. Despite these headwinds, we see many interesting opportunities, as domestic players now trade at an average P/E multiple of 3.9x (versus 9.1x for international peers) and many either have ADRs in the U.S. or are listed in Canada.13

One company we were excited to visit was Frontera Energy Company (FEC). Recent corporate actions have simplified the company’s operations into three distinct units including (1) a potentially transformational E&P project in Guyana, one of the hottest exploration basins in the world, (2) core Colombian production in domestic and other nearby fields that is forecast to grow towards 50,000 boe/d of production and, (3) midstream assets that include ports (Puerto Bahia) and pipelines.14 The visit to Puerto Bahia was especially exciting, as we were part of the first group of investors to visit the port just as FEC is starting new expansion projects after improving its legacy project finance debt that carried an aggressive amortization schedule from a prior deal when production was over 200,000 bbl/d. The port recently entered into an agreement with Ecopetrol’s subsidiary, Refineria de Cartagena (Reficar), to connect their liquids terminal to Reficar with an 84,000 bbl/d capacity flowline. The port is also analyzing a liquified petroleum gas (LPG) import facility given growing import demand. The location has many advantages, including a deep natural draft and calm waters due to protection from a nearby island in the channel. It is also the first port in Cartagena, which saves shippers two to three hours of shipping time versus competitors and reduces carbon emissions by ~53% of C02 p.a. Puerto Bahia was also awarded “Greenest Port in LatAm in 2019” by Maritime Award of the Americas. Some other potential growth opportunities include green ammonia and methanol production, LPG expansion, additional liquid storage tanks, and container terminal expansion. In short, we see a clear avenue for value appreciation as the market familiarizes itself with the port’s assets and potential for accretive growth.

Cheap Valuations + Low Liquidity + Inefficient Markets = Attractive Opportunities

One of the recurring themes that came up in our meetings was whether companies presented good opportunities for investors or if they could be value traps? Clearly, we are not the only ones that see interesting opportunities in the market, as Jaime Gilinski, the second richest person in Colombia, recently bid to acquire Grupo Nutresa from the GEA and nearly took over a combined $20bn entity with only a ~$3.6bn offer. Cementos Argos accepted $3.2bn from Summit Materials to acquire all of its U.S. operations only a few days after our meeting. What we find on the back of the Gilinski saga is that corporates recognize the domestic market is inefficient, lacks liquidity, and that cheap valuations make quality assets interesting take-out opportunities for deep-pocketed and longer-term investors. In turn, we expect to see improvements in governance, especially around protections for minority investors, which could be positive for the market. Although liquidity is becoming a constraint for many companies and could decline further with a potential reclassification to frontier market status, the Colombian exchange is moving to integrate with the nearby Chilean and Peruvian stock exchanges, with Mexico also interested in joining. However, this is unlikely to be a meaningful long-term solution to the liquidity issue, especially as long as pension funds remain uncertain buyers due to potential pension reform. In turn, we find that ETFs provide attractive options to access these increasingly illiquid markets. We also believe companies will be more interested in listing abroad, namely in the U.S., which could provide additional investment opportunities and potentially greater minority shareholder protections and corporate transparency. In fact, Colombian companies would typically issue preferred stock to avoid losing control, which was punished by MSCI, but today the premium over common shares is now almost completely gone. Given the cheap valuations and limited opportunities for some companies, we also expect a few more companies to delist in order to avoid “Gilinski” type risk of potential unfriendly takeovers.

Colombia as a Tech Hub

Colombia also has interesting opportunities as a tech hub in Latin America. Consider Globant, which has ~21% of its “Globers’” distribution in the country, and Nubank, which entered the country in 2020 after expanding in Brazil and Mexico. Given local tech talent, domestic companies have not been standing still. Several local financial institutions we met with highlighted their digital banks, including Nequi at Bancolombia and Daviplata at Davivienda. We believe these digital banks could come to the market one day and provide interesting alternatives to Nubank for regional investors. Rappi is another tech company that was founded in Colombia in 2015 and has since grown to be a delivery and commerce app across Latin America. Habi, which is a prop-tech unicorn focused on buying, remodeling, and selling houses in Colombia and Mexico, closed a $200mn funding round last year that valued the company at ~$1bn.15 In short, Colombian fintech companies show great promise and, unlike peers in Brazil, incumbent banks in Colombia have reacted quickly to changes in the marketplace and competitive landscape with the largest Colombian banks all having their own fintechs that act as moats in the marketplace, with over 50mn recurring clients that reach nearly 60% of the Colombian population.

Conclusion

The MSCI Colombia Index is at risk of reclassification to frontier market status, liquidity is low, and uncertainty is high. Although not a typical starting backdrop, this combination has resulted in quality companies that trade at extremely depressed multiples as the market has de-rated. This is pushing people to become more active (e.g., Gilinski) and take larger positions. Capital market activity is likely to continue accelerating given this environment. As a result, those with long-term investment horizons that can buy and hold may be able to take advantage of event driven opportunities and could stand out from peers in this environment. Eventually, macro conditions should stabilize, liquidity will likely improve, and governance standards will probably continue to get better, which gives us comfort for the longer-term outlook in Colombia.