Inflection Points: Listening to Earnings, But Hearing Implied Growth

Earnings seasons usually provide important data, both on how companies faired in the prior quarter and perhaps more importantly what they expect for the coming 12 months. These one-year forecasts can have a meaningful impact on prices, but investors may benefit just as much from looking past these short-term estimates and focusing instead on the long-term growth expectations embedded in market value. Sometimes, simple tools can be quite powerful. A compelling framework that investors can use to identify expectations associated with an investment theme is terminal growth, or market implied long-term growth. Moving beyond a myopic focus on short-term estimates and revisions offers an analytical and intuitive way of assessing opportunities.

Key Takeaways

- Growth investments typically draw a premium in a slowing economy as a scarce asset, but evaluating growth expectations can help identify pockets of opportunity.

- Terminal growth rates, or market implied long-term growth, is one framework that investors can use to assess expectations associated with investment themes.

- Potentially attractive themes with terminal growth estimates that seem relatively low include Robotics and Artificial Intelligence, Internet of Things, Cybersecurity, and U.S. Infrastructure.

Growth Becomes a Scarce Asset

Most of the Federal Reserve’s (Fed) work is likely in the rear-view mirror, though some modest hikes are possible from here. This is good news for stocks. Empirically, equities are not particularly sensitive to the level of interest rates, but they do react to changes in rates.1 Raising rates from 0% to 5% in a matter of 13 months created a meaningful headwind, but another 25 or 50 basis point hike should not be a drastic a shock.2

Investor attention in the coming months may shift from rates to growth. With rates leveling off, markets may become increasingly sensitive to the decline in U.S. economic growth. Current consensus is for real GDP growth to drop from 2.1% in 2022 to 1.1% in 2023 and 0.8% in 2024.3 Against this type of backdrop, companies that can sustain higher levels of sales and earnings growth may, and often do, seem defensive as fewer companies report revenue and earnings growth.

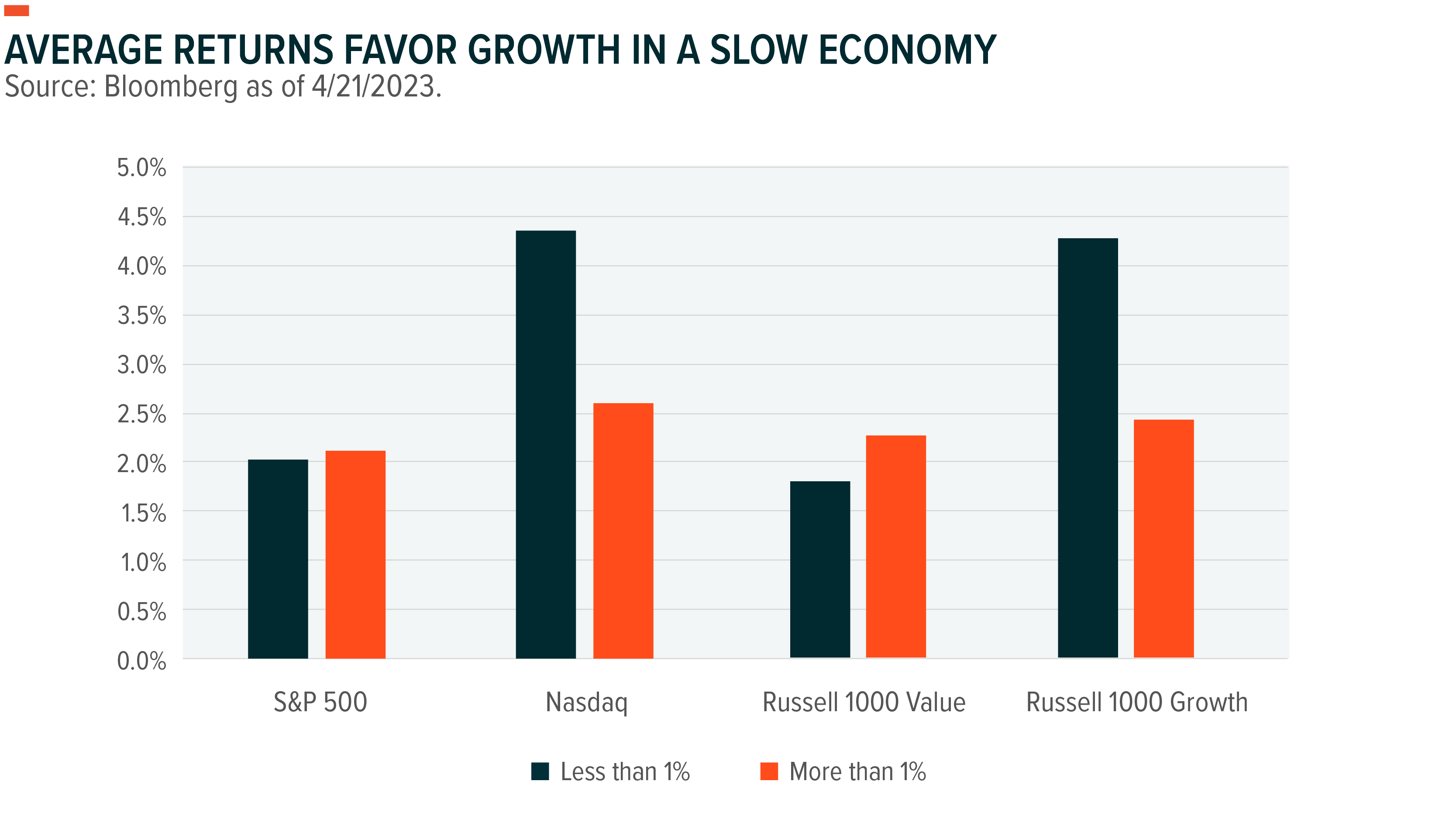

Growth stocks become a scarce asset in a slowing economy and typically outperform the broader indexes. When real GDP growth is above 1%, the S&P 500 average quarterly return is 2.1% and the Nasdaq return is 2.6%.4 When GDP growth dips below 1%, the S&P 500 return falls to 2.0%, but the Nasdaq’s return rises meaningfully to 4.4% (see chart). The same pattern is true for the Russell 1000 Value and Russell 1000 Growth indexes. Companies that continue to grow in a sluggish economy may command a premium.

Valuation from a Terminal Growth Perspective

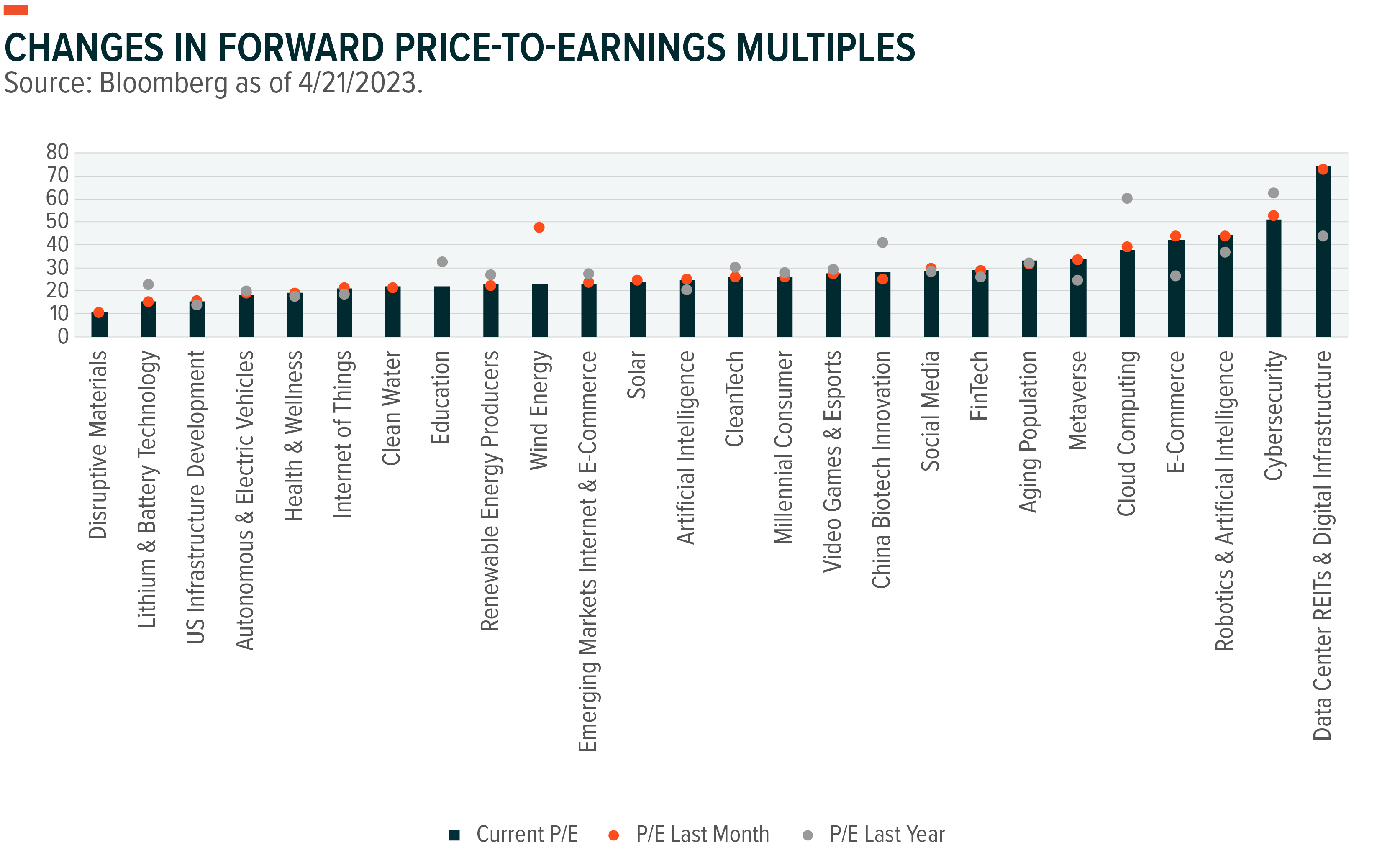

Identifying reliable valuation metrics for growth companies and themes is a persistent challenge. That investors favor these assets and often bid up price make this challenge that much more complex. Price to earnings ratios, both forward and historical, offer a relative valuation snapshot, but some growth companies may not deliver positive earnings as they reinvest to sustain rapid increases in sales. For those companies and the themes that they comprise, price to sales (P/S) can be an alternative. The question that arises is what multiple seems reasonable on P/E or P/S relative to the broader market.

In the current environment, we continue to like themes where companies have above-trend growth and positive earnings.5 These firms are less likely to require financing at today’s higher rates and can still invest to grow the top line. As profitable growth stocks get bid up, and interest rates start to drop, early-stage growth may look more attractive.

Expected growth offers another way to assess the opportunity associated with growth assets. Many investors focus on consensus expectations for one or two years out on sales and earnings. While equities are generally sensitive to changes in these short-run growth expectations, it’s actually long-term or terminal growth rates that typically exert greater influence on market value.6 Interestingly enough, short-term forecasts get much more attention than these embedded long-term growth rates.

The long-term market implied growth rate can be a powerful way to assess whether a company or theme is over, under, or reasonably priced. Calculating terminal growth rates is just a reformulation of the traditional discounted cash flow model.7 The current market cap represents the net present value. An investor can discount the one- and two-year consensus estimates, remove those from the current value of the firm, and then use the weighted average cost capital to assess the terminal growth rate that consensus is assuming at current prices.

Having an estimate of market expectations for long-term growth associated with a theme allows us to leverage analysis and intuition in assessing valuation. For example, if the market assigns a terminal growth rate of 8% on a particular basket of companies, but market research forecasts 12% annual growth for a decade, then that set of companies may be undervalued and represent a good opportunity. By contrast, if the market prices in 20% long-term growth for a segment forecast to grow at 12%, then those companies would seem richly priced. We tend to naturally think in terms of growth rates, and distilling the growth rate from market price offers an intuitive alternative to multiples.

Pockets of Opportunity Remain Despite Strong Start

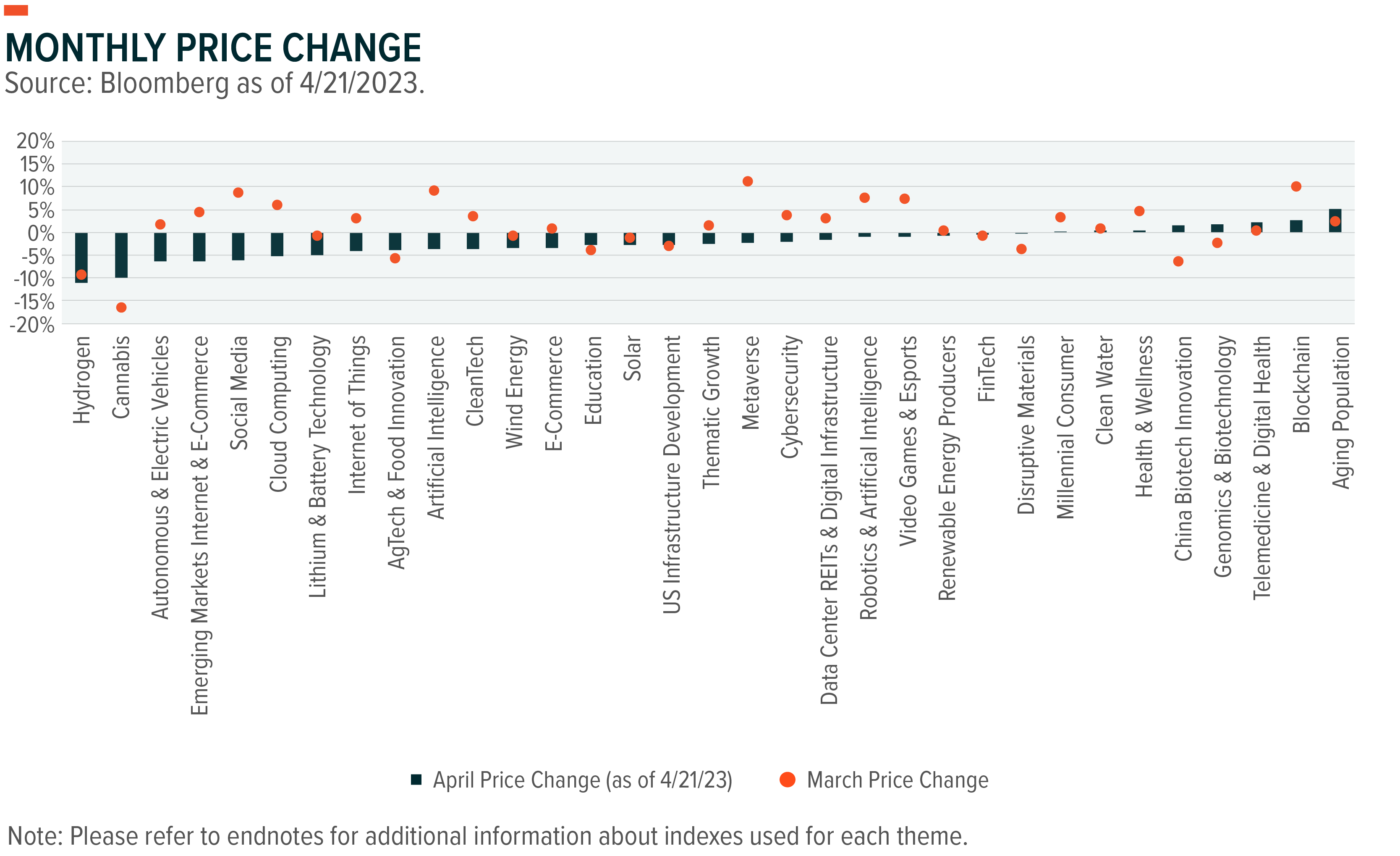

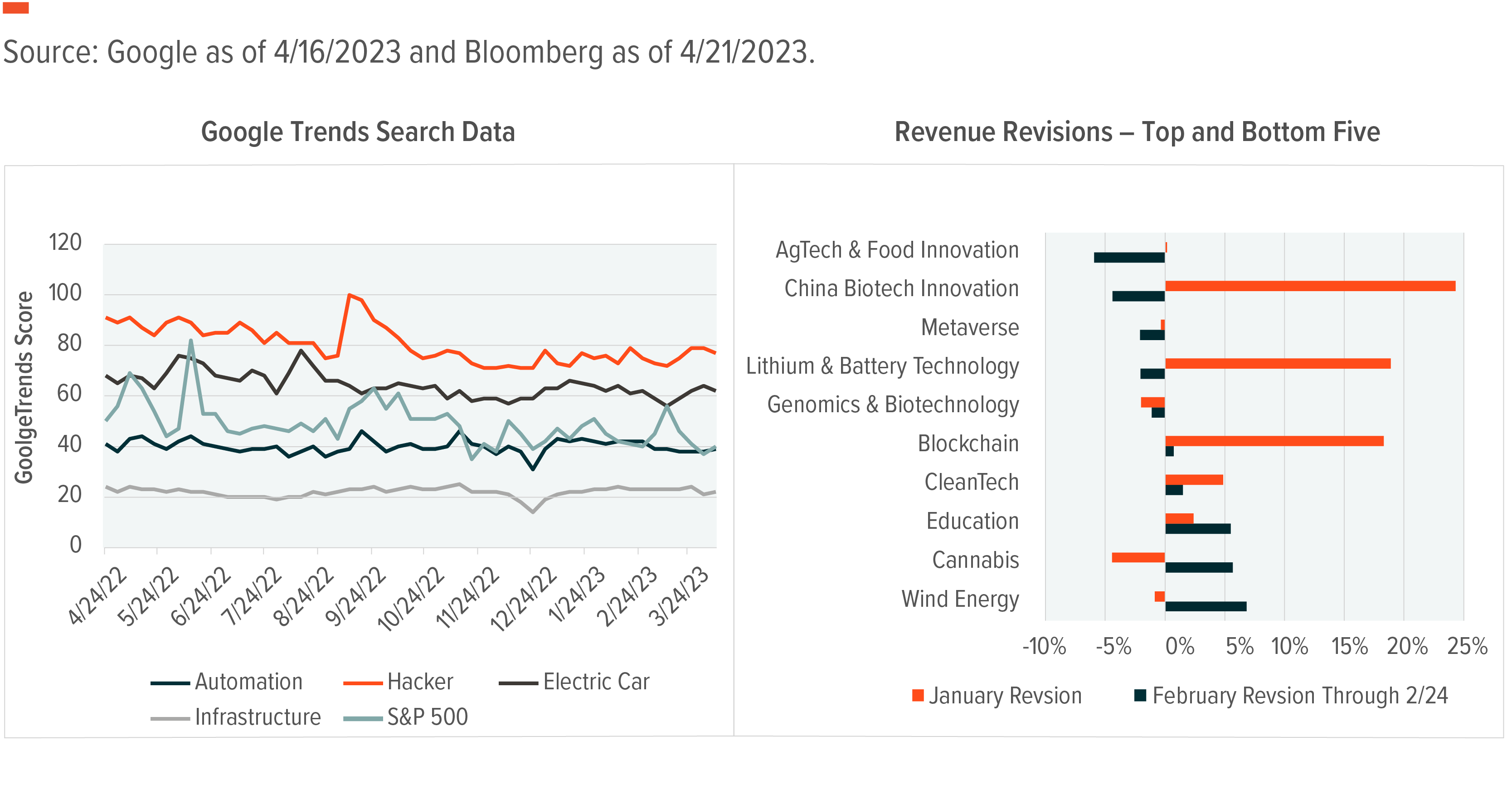

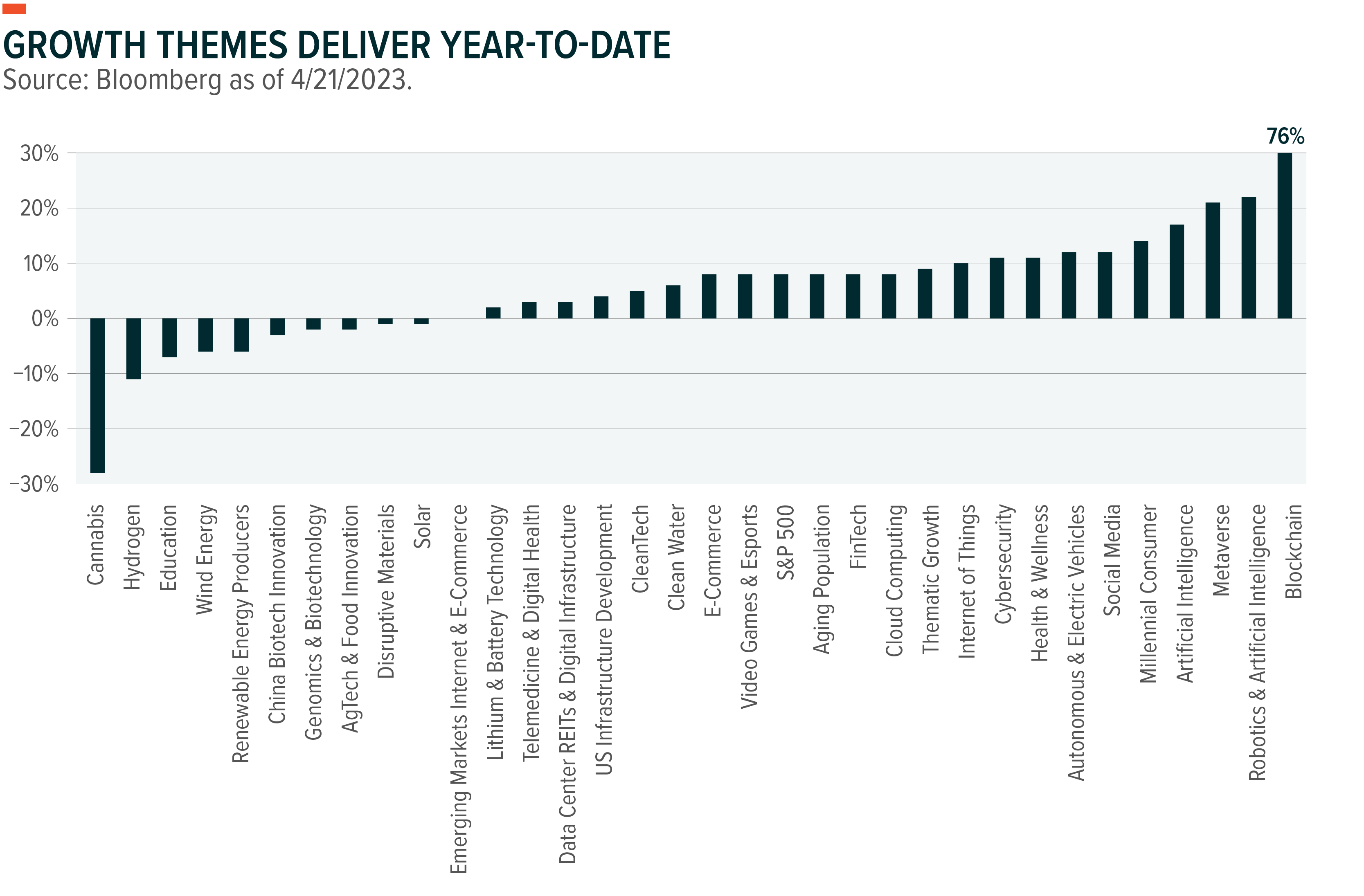

Many of the themes that we track delivered strong returns year-to-date. While growth indexes like Nasdaq outperformed the broader S&P 500, the story is broader than Big Tech (see chart). Themes such as Artificial Intelligence, Cybersecurity, and Millennial Consumers beat the index with no Big Tech exposure.8

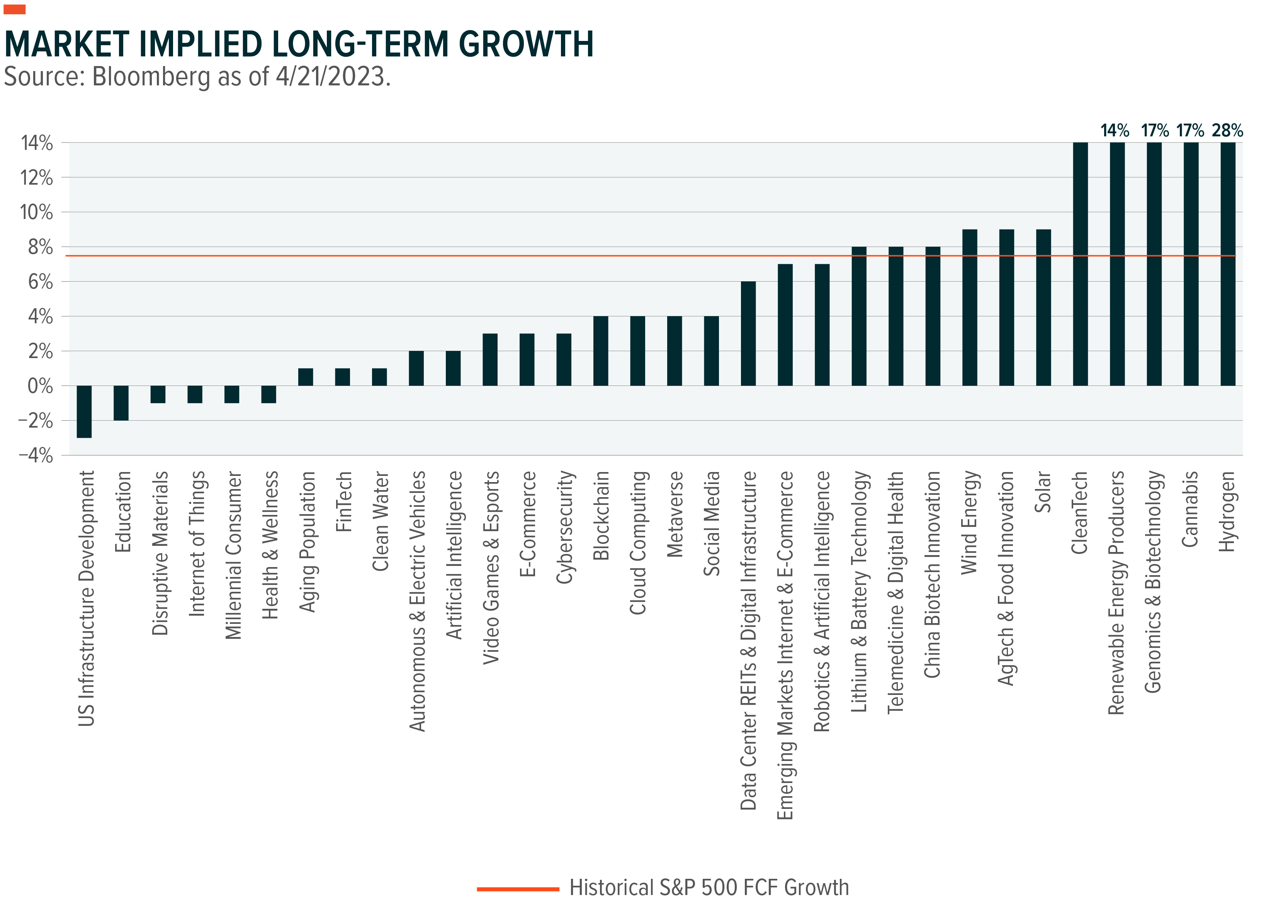

With 25 of 33 themes up on the year, implied long-term growth rates offer a way of assessing whether the market is pricing in full potential or whether there might be areas that still look attractive. The distribution of expected terminal growth is relatively wide across themes. The highest expected growth is Hydrogen near 29%, and the lowest is currently U.S. Infrastructure with expectations for -3%.9

Historically, S&P 500 companies average 7% free cash flow growth annually, which provides a benchmark against current market implied growth rates.10 Of course, we can also look at research that forecasts growth for each individual theme. Based on current market pricing, pockets of opportunity exist across a range of themes (see chart).

For example, Robotics and Artificial Intelligence has implied growth of just over 7%, or just above the S&P 500 long-term rate. This estimate seems low considering the booming interest in AI and ChatGPT, and new emphasis on automation given challenges associated with labor supply tied to demographics and onshoring production. For Robotics, market research forecasts call for sales growth of 10.5%.11

Perhaps even more interesting is the Internet of Things (IoT) theme currently priced for contracting cash flows in the long-run despite market research forecasting 16% annual device sales growth.12 IoT sensor technologies are likely a critical layer between the physical and digital worlds, as they translate the physical into a language that AI and robots can react to. This exposure could represent an undervalued way of riding the AI and ChatGPT wave.

Cybersecurity seems relatively well priced based on terminal growth estimates. Cyber stocks struggled in 2022 for a few reasons. First, the broader market decline affected their performance. Second, cyber stocks were included in the basket of stay-at-home/remote work stocks that investors bid up aggressively in 2021, and they likely needed to revalue. Third, sales estimates fell in late 2022 as analysts feared companies might slash cyber budgets rather than lay off workers to control costs in a slowing economy.13 But that has not happened, and analyst estimates have been rising. With a long-term growth rate below 4%, the Cybersecurity theme is priced to grow slower than the broader market historically and well below industry estimates 13%.14

Consumer-related themes may be a contrarian option. Expectations for Consumer Discretionary companies were relatively muted to start the year given concerns about high inflation and a resulting slowdown in consumer spending. Few analysts had an overweight on the sector.15 The strong performance of consumer themes year-to-date is likely tied to under-ownership. Themes such as E-commerce and Video Games & Esports have expected growth rates of 2–3%, which seem relatively low.

U.S. Infrastructure also seems relatively attractive based on long-term growth expectations. The theme currently prices in a contraction of 3% per year in the terminal value, which seems out of touch with key trends such as onshoring and government spending. In 2021 and 2022, the U.S. government passed nearly $2 trillion of infrastructure-related spending across three bills.16 Disbursement will likely work into company forecasts over multiple years, and these firms seem poised for free cash flow growth rather than contraction over the next decade.

Focusing on themes with seemingly low growth rates has certain appeal. But there can be good opportunities among themes with higher estimated terminal growth rates, provided that the industry is poised to grow even faster. The Lithium & Battery Technology theme is a prime example. If the transition to EVs continues at the current pace, the theme’s long-term forecast for 8% annual growth may be low, and the companies in the theme may be able to grow faster. Agtech, priced at 9% growth, is another theme that may prove too low relative to industry estimates of 13% growth.17

Themes with low rates seem like the easy jump shot, but they aren’t the only way to go. Consider those along with themes where the market implied rate of growth is below expectations for the industry. Thanks for hearing.

Inflection Point Theme Dashboard