Blueprints to Boom: Manufacturing Investment’s Role in the Q2 GDP Rise

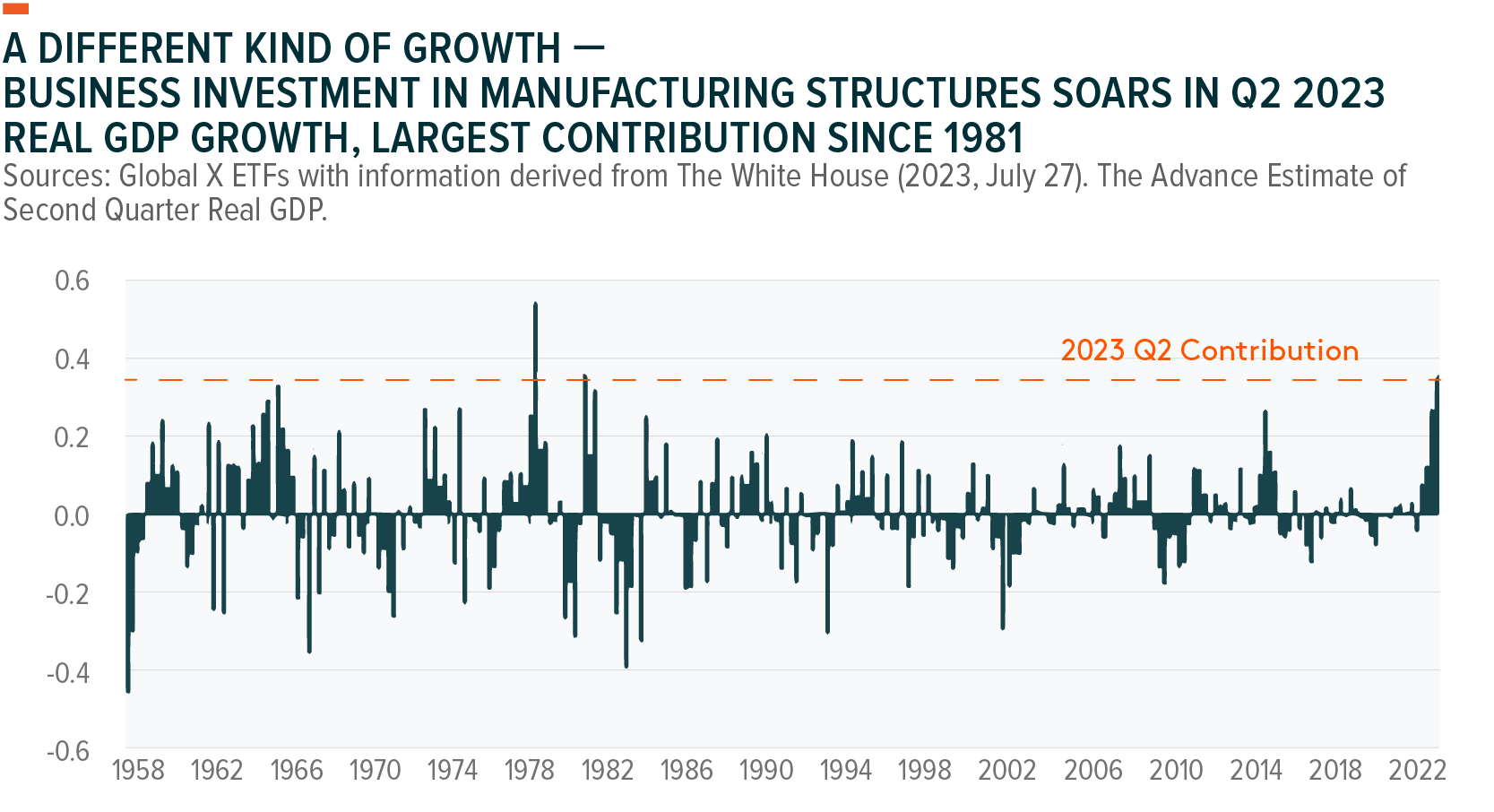

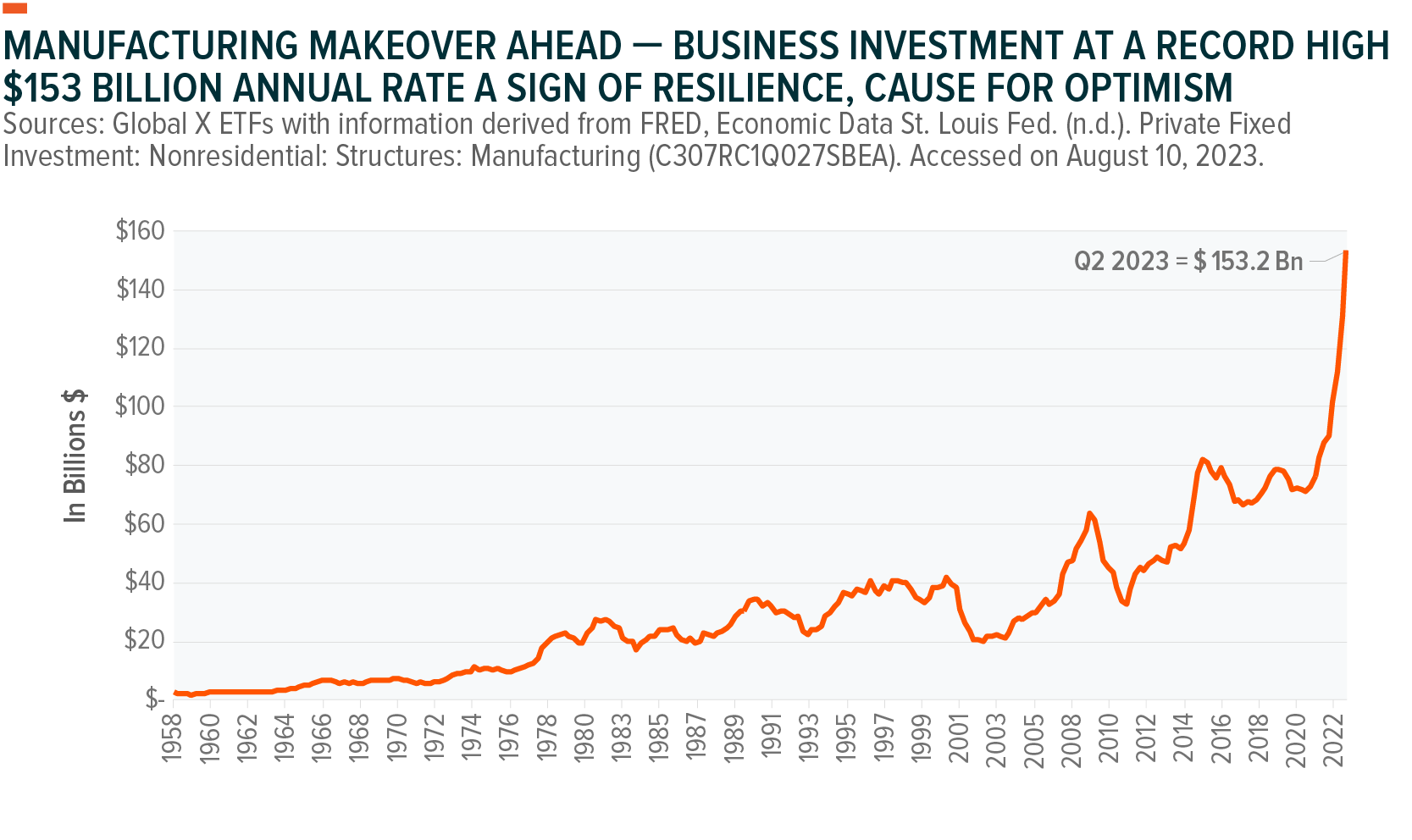

Economic growth that’s not only a result but also a deliberate pursuit is differentiated economic growth. So one item that caught our attention in Q2 real GDP growth printing at a better-than-expected 2.4% was that 0.4% of it derived from private investment in manufacturing structures.1 It was that component’s largest contribution to real GDP growth in more than 40 years, hearkening memories of the 1980s business boom.2 This type of business investment has an innate ability to shape the economy’s trajectory from the factory floor. And with companies increasingly embracing disruptive technologies, we expect diverse investment opportunities to emerge as manufacturing enters a new era.

Key Takeaways

- Business investment added a twist to Q2 real GDP growth in that it brought back memories of a U.S. economy that actively seeks manufacturing growth.

- While consumer spending and government outlays play their integral roles, business investment is the undercurrent to sustained economic growth, including job creation and wage increases.

- We expect these commitments to create opportunities for U.S. infrastructure development companies. For investors, exposure to this long-term, structural theme and the themes that it intersects with can bring meaningful growth potential to portfolios.

Business Investment Pulsates in Q2

As the sum of all its economic activities, GDP is the heartbeat of an economy. A window into the strength of that pulse is GDP growth, being the sum of consumer spending, business investment, government spending, and net exports (exports minus imports).

Consumer spending is the bellwether in the U.S. economy, constituting nearly 70% of nominal GDP, and consumers continued to spend in Q2 despite still-high inflation and interest rates. Spending grew by 1.6% in real annualized terms, propelled by a still-strong labor market.3 It was another example of a resilient consumer helping the economy to defy recession odds.

Business investment represents only 13% of nominal GDP, but it punches above its weight in terms of impact because it can mold economic growth by fostering job creation and enhancing household earnings.4 For example, back in the 1980s, construction employment grew by 19% even with two recessions early in the decade.5 So business investment contributing 0.4% in Q2 is a notable input when looking at how the economy may trend.6 On a nominal basis, business investment was at a $153 billion annual rate in Q2, the highest ever.7

Making Sense of Manufacturing Growth Today and Tomorrow

Business investment plus recent legislative efforts like the Inflation Reduction Act (IRA), the CHIPS and Science Act (CHIPS), and the Infrastructure Investment and Jobs Act (IIJA) bode well for U.S. manufacturing. This confluence sets the stage for a potentially transformative boom era for manufacturing and a burgeoning opportunity for infrastructure development companies.

- Construction & Engineering Services: When manufacturing companies invest in expanding or upgrading their facilities, they create demand for construction projects. New manufacturing structures, factories, and plants require design, construction, and engineering services. For example, Jacobs Solutions is the leading advanced manufacturing company in areas like semiconductors and data centers. On their latest earnings call, the company mentioned that their vertical that benefits from investments in the areas like life sciences, semiconductor, and electric vehicle supply chains “posted a sixth consecutive quarter of double-digit revenue growth.”8

- Key Raw Materials: Manufacturing structures require raw materials such as steel, cement, glass, plastics, and more. Nucor Corp, a leading steelmaker, mentioned on their most recent earnings call that the “steel market for the remainder of the year will remain healthy, driven by strong manufacturing investment and infrastructure spending.”9 From federal initiatives alone, Nucor estimates incremental demand of 5–8 million tons per annum for steel over the next decade.10

- Industrial Transportation: Manufacturing growth increases the need to transport goods to and from manufacturing facilities. Norfolk Southern Corp, a premier U.S. transportation company, highlighted on their latest earnings call that they “see strong levels of nonresidential construction as reshoring and infrastructure projects increase, which will drive strength in metals and construction volume.”11 For example, of the $70+ billion in investments announced for the battery supply chain in North America during the past 18 months, nearly a third is located in Norfolk Southern’s network. Included in the network is the $3 billion EV battery plant that General Motors and Samsung recently announced that they will build in Indiana.12

- Large-Scale Equipment: The demand for large-scale equipment and machinery is closely tied to manufacturing expansion. When companies invest in manufacturing structures, they often require specialized machinery and equipment to facilitate their production processes. Terex, a global manufacturer that designs and produces heavy machinery and equipment for industries such as construction, mining, transportation, and utilities, has a backlog of $3.7 billion, which is three times the company’s historical average.13

Conclusion: Designs on a New Era in Manufacturing

Whether by building advanced factories that incorporate AI, automation, and next-generation connectivity, or by modernizing existing units, we believe that the future of manufacturing is an economic growth story. That this growth story is by design and built for the long term puts a different spin on it relative to recent history. For investors, we expect this business investment to create compelling opportunities across the U.S. infrastructure development theme and the companies that make it go, from the factory and beyond.