CIO Insights: AI Giants and More in ’24

Editor’s Note: Conversational Alpha® (CA) is a vehicle we use for deeper and more relatable discussions about portfolio construction. In that sense, it represents both a journey and a destination. This report is a periodic look at journeys and destinations that investors may want to consider.

As I consider messaging for the year ahead, I believe that investors can find satisfaction in the resilience of the U.S. economy, decreasing inflation, weakening labor stats, and long-term interest rates down materially from their peak. Add it all up, and a soft landing is not out of the realm of possibilities. We expect a gradual slowdown in economic growth rather than an abrupt drop.

The S&P 500, despite a fall pullback, is up nearly 22.3%.1 Outside of a few mega-cap names that investors can’t seem to get enough of. U.S. stocks seem reasonably priced, contingent on sustained lower inflation and adept management of borrowing costs in a higher interest rate regime. As we head into 2024, investors have cause for optimism. Increasingly favorable market conditions suggest the potential for continued growth for the AI giants and a long-awaited broadening of market breadth.

Conversation Starters

- Growing compute capacity has AI and the Magnificent Seven on the fast track.

- Bullish sentiment trends higher, market breadth widens.

- 2023’s market leaders may get some company in 2024.

- Portfolio Considerations: Peak rates offer investors thematic clarity.

- Moving on… Let’s Chart: Spotlight on bright sides for small caps.

AI Puts All Eyes on the Magnificent Seven

While not a new phenomenon, human interaction with AI skyrocketed in 2023. AI’s rapid advancement is attributable to compute capacity increasing by 55 million times over last 10 years.2 Launched in 2022, OpenAI’s large language model (LLM) GPT-3 took about 18 months to train. By comparison, it would take the newest supercomputer from Nvidia about 4 minutes to train a GPT-3 equivalent.3 The changes are happening so fast that it’s nearly impossible to predict what AI will look like next year, let alone in 5 years. But to us, it’s clear that we are only at the early stages of this technology.

The Magnificent Seven’s4 leap into AI paid off in 2023. These stocks gained 102% on average for the year through December 11, while the other 493 stocks in the S&P 500 only added 9.9%.5 This performance is largely justified with year-over-year earnings growth for these stocks at nearly 50%.6 Also, at 28%, these seven stocks now comprise the largest share of the S&P 500 by total market cap of any seven stocks.7 This composition led to the significant divergence in performance between the S&P 500 at 22.3% and the S&P 500 Equal Weight at just 9.2%.8

Signs of Widening Market Breadth Emerge

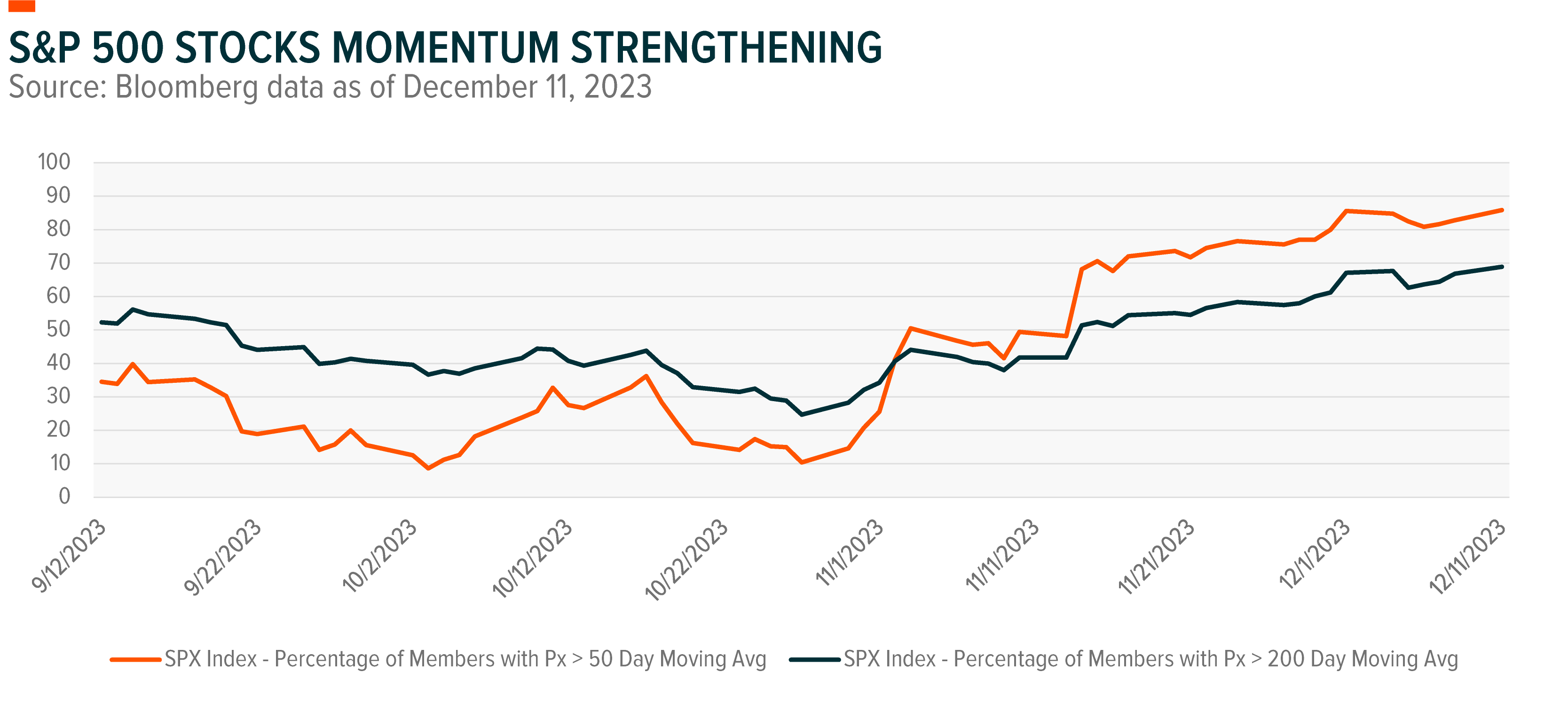

The Magnificent Seven and the Tech sector continued to perform through December, but many other stocks sprung higher on the hope that we are at peak interest rates. Shorter- and longer-term breadth factors turned positive, and as of December 11, about 85% of stocks in the S&P 500 were above their 50-day moving averages.9 Also encouraging is that about 65% of S&P 500 stocks were trading above their 200-day moving average, nearly tripling since the end of October.10

With recession probabilities and inflation receding, consumer confidence and investor optimism is higher, potentially setting the stage for cash sitting on the sidelines or in money markets to enter the market. Bullish sentiment, or the expectations that stock prices will rise over the next six months, increased to 45.3% as of November 22, well above the historical average of 37.5%.11 In November, consumer confidence rose for the first time in four months.12

Heading into 2024, we expect sentiment to remain high and fuel equity performance to widen further. One key factor that can drive this widening is the anticipated recovery in corporate earnings. In Q2 2023, profits fell 6% year-over-year, and less than half of the 11 US sectors delivered positive growth in the first half of 2023.13 Consensus forecasts that all sectors should return to profitability by Q2 2024.14 Falling inflation should bolster corporate profit margins.

Conditions Turn More Favorable for Some Under-Loved Segments

The Magnificent Seven can still perform and deliver strong growth in 2024, but the subsiding headwind of rising yields can bring more market segments into the growth mix. Among them, bond proxy sectors and other long duration equities such as small caps and thematic equity are becoming more attractive.

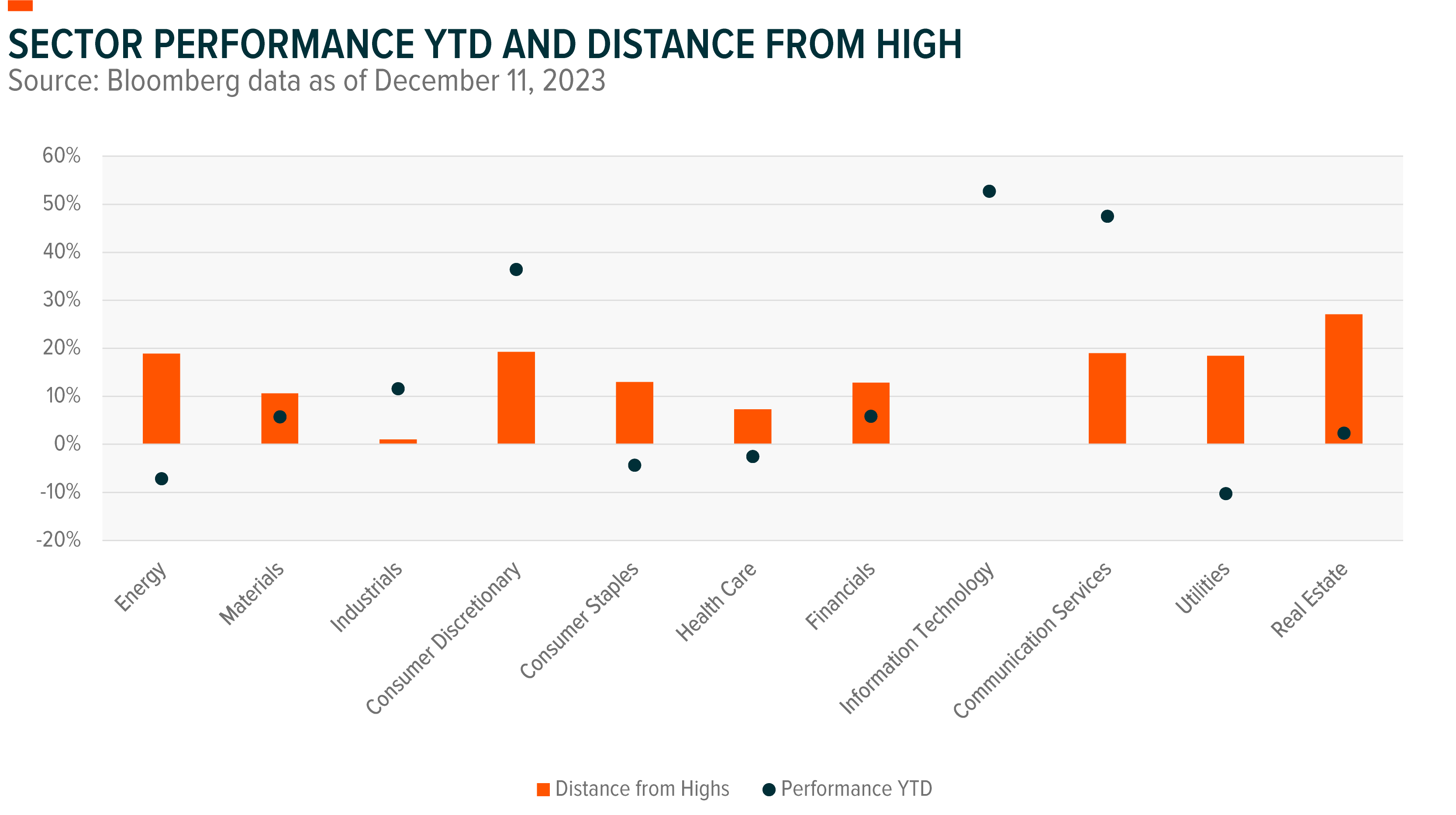

Small-cap stocks are still 25% off their high, but consensus expects the Russell 2000 to average 5.3% revenue growth in 2024, above the 4.3% average and 54 basis points above the S&P 500’s pace.15 Small-cap underperformance also trickled into thematic equity in 2023, so a recovery in small caps should provide a tailwind to thematic equity.

Many low volatility and defensive sectors, such as Utilities and Consumer Staples, also underperformed in 2023. Currently, these sectors are about 18% and 13% off their highs, respectively.16 Similarly, we think the easing rates headwind and the low volatility characteristics of these sectors could lead to outperformance. A smooth cooling in the economy that allows the Fed to cut rates next year should help as well.

Portfolio Considerations: Themes Find Footing Across Time Horizons

Peak rates allow investors to be more forward-thinking and look for opportunities in areas of the market that have been under significant pressure. Consumer and corporate balance sheets being well positioned to weather higher rates helps in that effort.

In this environment, we believe that Healthcare and Renewable Energy could be themes of interest for longer-term investors. After struggling in 2023, these themes can benefit from lower interest rate volatility. At the same time, we believe momentum can accelerate for themes like AI, Cybersecurity, and U.S. Infrastructure. In particular, increased corporate spending to reduce inefficiencies can boost the AI and Cybersecurity themes, and the fiscal policies passed over the last several years can continue to propel the U.S. Infrastructure theme.

Let’s Chart: Easing Inflation a Boost for Small-Cap Season

Small-cap stocks had a rough go of it through most of 2023. The Russell 2000 Index is on pace to trail the S&P 500 by about 1400 basis points, the widest margin since 1998.17 One reason for the underperformance is that margins for small-cap companies tend to be impacted more by inflationary pressures. Another reason is that these companies lean more on financing to run their businesses.

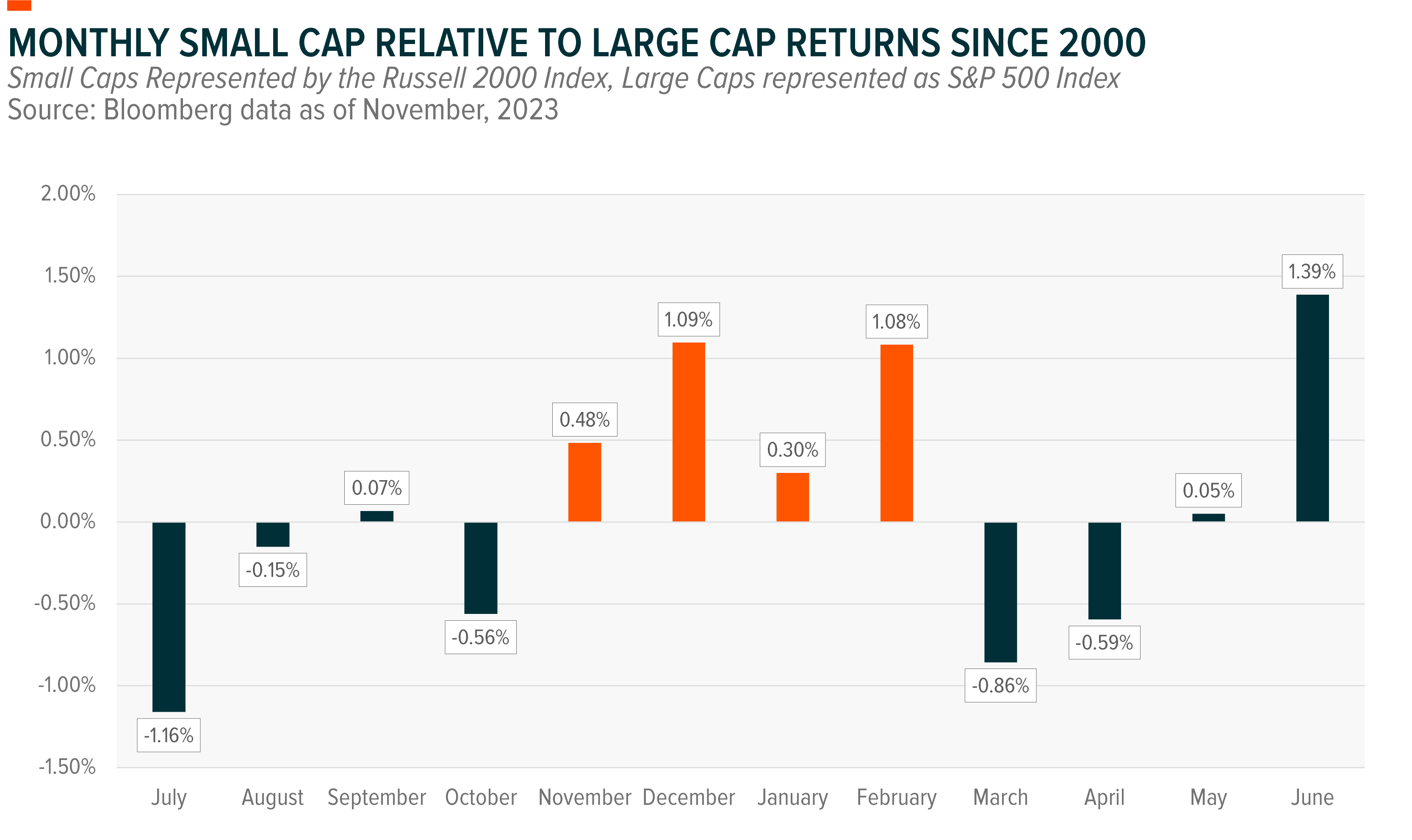

It may be a different story for small caps heading into 2024, though. Slowing but still positive growth and declining inflation could present an opportunity. Seasonality may provide an additional tailwind. Historically, small cap stocks outperform from November to February.