CIO Insights: The Recession is Dead, Long Live the Recession

Editor’s Note: Conversational Alpha® (CA) is a vehicle we use for deeper and more relatable discussions about portfolio construction. In that sense, it represents both a journey and a destination. This report is a periodic look at journeys and destinations that investors may want to consider.

For the better part of the last two years, recession talk wasn’t just persistent, it had an air of inevitability to it. As the effects of fiscal and monetary packages began to wear off, and the Federal Reserve moved to slow the economy with 525 basis points of rate hikes, concerns about an economic downturn loomed. However, Q2 2023 GDP came in at 2.4%, topping consensus expectations at 1.8% and the Atlanta Fed’s GDPNow model had Q3 real GDP growth at a healthy 3.9%.1 Fed Chair Jerome Powell went so far as to say that the central bank no longer forecasts a recession.

Several factors may help explain that plot twist and the current economic resilience. Falling inflation is one. Headline and core personal consumption expenditures (PCE) inflation, the Fed’s favorite inflation measure, rose by only 0.2% month-over-month (MoM) in June. That result left headline up 3.0% year-over-year (YoY) and core up 4.1%, its smallest increase since September 2021.2 Another factor may be the sheer scale of policy interventions in recent history contributing to longer-than-average U.S. cycle expansions, and maybe even rose-colored glasses about the current economic situation.

Despite everything that’s happened since 2020, and 2008 for that matter, today, the U.S. consumer is more confident, the labor market is robust, and the housing sector remains strong. Clearly unfazed by the recession talk this year is the stock market, and these segments are contributors. As their resilience helps defy fears of a recession, markets have been able to focus on growth and emerging themes like Artificial Intelligence (AI) and the industrial renaissance.

Still, I think it’s important for investors to stay clear-eyed about potential challenges in these segments and the economy overall. Our current view is that if a recession appears at all, it will be mild and is largely priced into market expectations. While it appears we’re in the late stages of the Fed’s tightening, the San Francisco Fed’s proxy rate is well above the fed funds rate and the 2-year yield dipped below the policy rate, leading to a deeply inverted yield curve. Normally, an inverted yield curve’s track record of predicting recessions is pretty solid. And the latest twist to track is Fitch’s downgrade of U.S. Treasuries, which may help the Fed by pushing up yields and curbing the consumer’s voracious appetite.

Remember, this cycle isn’t typical. But like all cycles, I believe investors have opportunities to differentiate their portfolios relative to their investment goals.

Conversation Starters

- Consumers are spending and sentiment has been rising, but bills can pile up quickly.

- Despite its strength, labor isn’t the timeliest indicator in economic cycles.

- Housing prices show that buyers are ignoring higher mortgage rates, for now.

- Portfolio Considerations: Stay flexible as the rally broadens, still favor quality positioning.

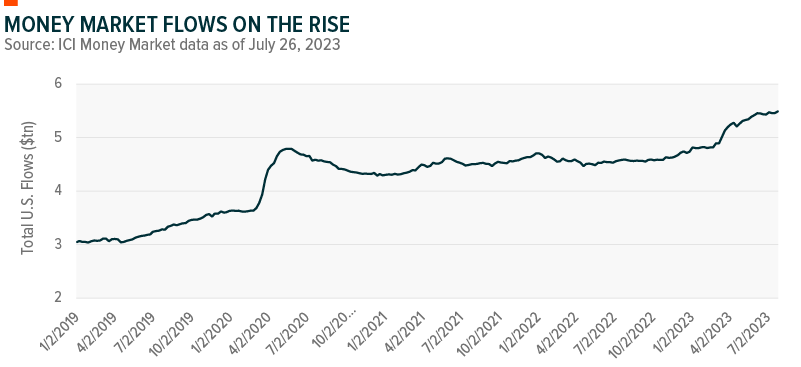

- Moving On… Let’s Chart: Money market funds show there’s ample cash lying in wait.

Watch the Consumer Consume

Consumers kept their wallets open again in Q2, likely emboldened by slowing inflation and stabilization in the labor and housing markets. Durables spending, which is cyclical, can be a telltale sign of how consumers feel, and in June durable goods orders increased 4.7% MoM, the fourth straight monthly gain. Consumer sentiment is improving, and workers perceive a lower chance of job loss over the next five years and lower inflation expectations over the next year.3

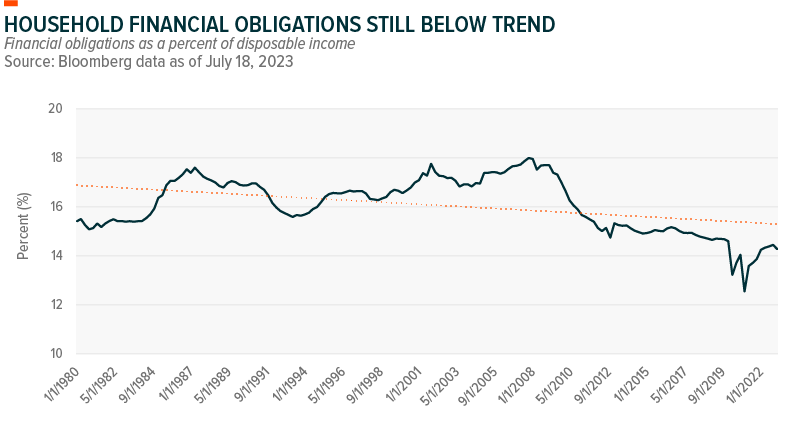

While spending softened in May, a positive trend in personal income and an uptick in real disposable income could cushion consumption for longer. The financial obligations ratio increased over the past year, but it remains well below historical levels, as seen in the chart below. Another factor supporting consumers is that they largely deleveraged since the 2008 financial crisis.

A risk is that underlying price pressures remain sticky, especially if rising wages don’t keep up with prices. Higher housing prices coupled with high mortgage rates could further dent affordability. Another potential headwind is that Americans with federal student loans, and there are a lot of them, will start making interest payments in October when a three-plus year moratorium ends. The savings rate ticking higher in May is a good sign, but notable is that the cumulative excess savings (above pre-COVID levels) of roughly $600 billion is on a downward trend from its early-2021 peak, potentially indicating that the consumer is stretched.4

Everyone’s Working, But Labor Lags

The labor market remains tight, with approximately 1.5 job opportunities available for every unemployed person.5 Businesses continue to face challenges in finding skilled labor, and shortages in the service industry are likely to sustain hiring activities in the coming months. However, leading indicators show signs of a slowdown in job postings and softer wage growth.

Nonfarm payrolls (NFP) expanded by 187,000 in July, a figure that, while below estimates for 200,000, is encouraging for policymakers.6 This NFP number aligns with Job Openings and Labor Turnover (JOLTS) data, which shows employment is finally slowing, or at least appears to be slowing. The print creates an intriguing dynamic of slow NFP growth, strong wage pressure, reduced job openings, and lower quit rates. Yet another consideration is the massive increase in productivity, perhaps reflecting a more structural shift in employment. Together, these factors paint a nuanced picture of the current job market, reflecting the challenges and opportunities that workers and employers face.

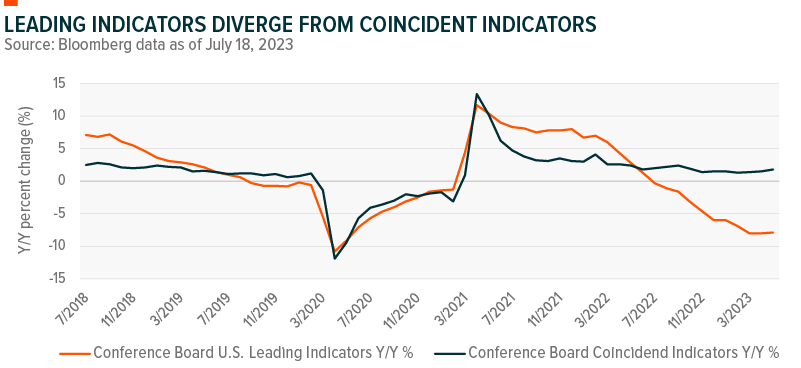

Something that we’re watching closely is the significant divergence between the sharp decline in the Conference Board’s Leading Economic Index (LEI) Indicator and its somewhat stable Coincident Economic Index (CEI), which the chart below shows. Historically, labor is a lagging indicator in economic cycles, so there may be some time before the full effects of tighter policies spill over into weaker employment and consumption patterns. If the U.S. avoids a recession, it’s possible that leading indicators bottom out without a substantial decline in coincident indicators.

Some economists attribute the delay in the economic response to policy measures to the longer-than-average economic expansions over the past century. Such prolonged expansions might have an impact on the timing and magnitude of policy-driven shifts in the labor market.

High Mortgage Rates Have Yet to Dent Demand

After a challenging year, single-family home prices are on the rebound, climbing steadily for the past three months. Remarkably, sales show an upward trend as buyers press on despite higher interest rates. Many other recent buyers showed a shrewd sense of timing, or at least good luck, in taking advantage of historically low 2.5–4% rates in 2020 and 2021. They evaded the sharp spike to 6–7% last year, and their timing has played a pivotal role in keeping mortgage delinquencies at bay.7

Supply is another factor. Currently, low supply in the U.S. housing market seems to be acting as a catalyst for new construction, evident by the recent surge in permits, starts, and completions. As this resurgence depends heavily on the capacity of consumers to withstand the impact of those higher interest rates, it may be best to keep enthusiasm in check.

For now, the housing market shows positives trends, including residential spending. More broadly, increased capital spending on public infrastructure and manufacturing is another reason for the economic resilience. These developments have, in part, contributed to the outperformance of industrial and homebuilding stocks this year.8

Portfolio Considerations: Quality Positioning for a Broadening Rally

A recession may be near, far, or not at all. Uncertainty is nothing new for investors. In my view, it’s important to stay flexible and diversified with quality positioning. Market breadth is improving, and we anticipate a broadening cyclical rally. Exposure to select cyclicals and emerging themes can differentiate a portfolio. We’ve only mentioned AI once in this piece, but it’s been a driver, and we expect its impact to be broad. (Insights on AI here and here.) It’s encouraging to see laggards like small caps and financials gain footing, which could be a sign that pullbacks might not be as severe. Also, bonds can still play a role in this late stage of the hiking cycle.

Let’s Chart: When There’s Cash at Bay, There’s Fuel for Equities

Investors flocked to money market funds this year, chasing higher yields and relative safety. The trend continued for the week ending July 26, 2023, as total U.S. money market fund assets increased by $28.3 billion to $5.5 trillion.9

As recession fears ease and the Fed ends its rate hike cycle, there’s ample room for cash to flow into equities, and it appears that there’s appetite. All U.S. ETF equity segments had inflows in June, and all of them show net inflows year-to-date. Also defying recession fears are developed ex-U.S. funds, which posted a record 36th consecutive month of inflows in June.10