One Year In, the Inflation Reduction Act’s Influence on CleanTech Is Just Getting Started

Since its passage in August 2022, the Inflation Reduction Act (IRA) has been instrumental in boosting cleantech growth prospects in the United States. Wide-ranging measures in the IRA, particularly renewable energy and cleantech manufacturing tax credits, helped spur over $270 billion in investments throughout the wind, solar, and battery value chains.1 And many of the IRA’s initiatives are only beginning to ramp up. In our view, the impacts of this bill, hailed as the single largest investment in climate and energy in U.S. history, are likely to continue creating compelling investment opportunities in climate-related industries for years to come.

Key Takeaways

- The IRA includes nearly $370 billion in clean energy tax credits and non-tax funding for climate change and energy efficiency efforts over the next decade, and we expect the impact to be transformative.2,3

- More than 80 new or expanded cleantech facilities have been announced as a result of domestic manufacturing being a key focus in the IRA.4

- In our view, the IRA’s reach is increasingly global with other governments implementing similar policy measures to remain competitive in cleantech.

The IRA’s Long-Term Tailwinds for CleanTech Are Taking Shape

Tax credits for clean energy generation, including wind, solar, and geothermal power, as well as low-carbon hydrogen, energy storage, and cleantech manufacturing, are among the Inflation Reduction’s most significant measures. Buyers of qualified new and used electric vehicles (EVs) can also benefit from tax incentives. Importantly, many of these tax credits are uncapped and do not begin to phase out until 2032.5,6 Therefore, by one estimate, cleantech subsidies in the IRA could actually total more than $1.2 trillion in total government funding, pointing to the potential for significant long-term growth opportunities for companies throughout cleantech themes.7

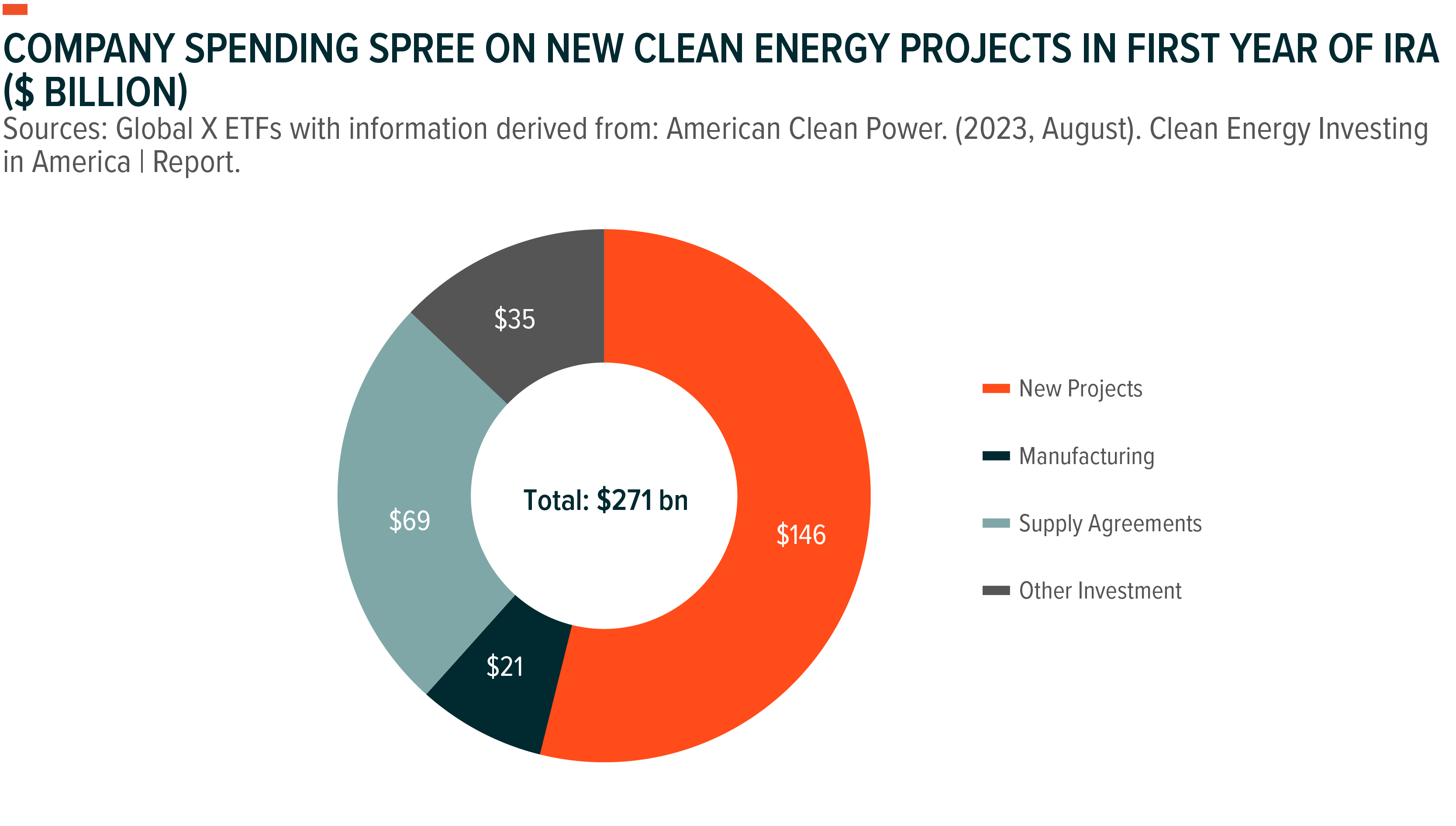

IRA-driven private investments from companies magnify the bill’s potential long-term benefits. In the IRA’s first year, companies announced over $271 billion in new investments for renewable energy projects, cleantech manufacturing, and supply agreements.8 The solar power value chain alone announced over $100 billion in private sector investments, according to a study by the Solar Energy Industry Association (SEIA).9 By 2032, company investments in renewable energy could total over $2.9 trillion.10

These investments are also likely to translate to significant growth in clean technologies. According to SEIA, the IRA could drive an additional 160 gigawatts (GW) of solar power capacity growth over the next 10 years, with U.S. solar capacity forecast to more than quadruple from the amount currently installed.11 Annual EV sales in the U.S. are forecast to increase from 978,000 units in 2022 to 9.4 million units in 2030.12 With the uptick in cleantech adoption, U.S. economy-wide emissions are projected to decline 43–48% below 2005 levels by 2035, compared to 27–35% without the IRA.13

CleanTech Manufacturers Are Expanding Their U.S. Footprints

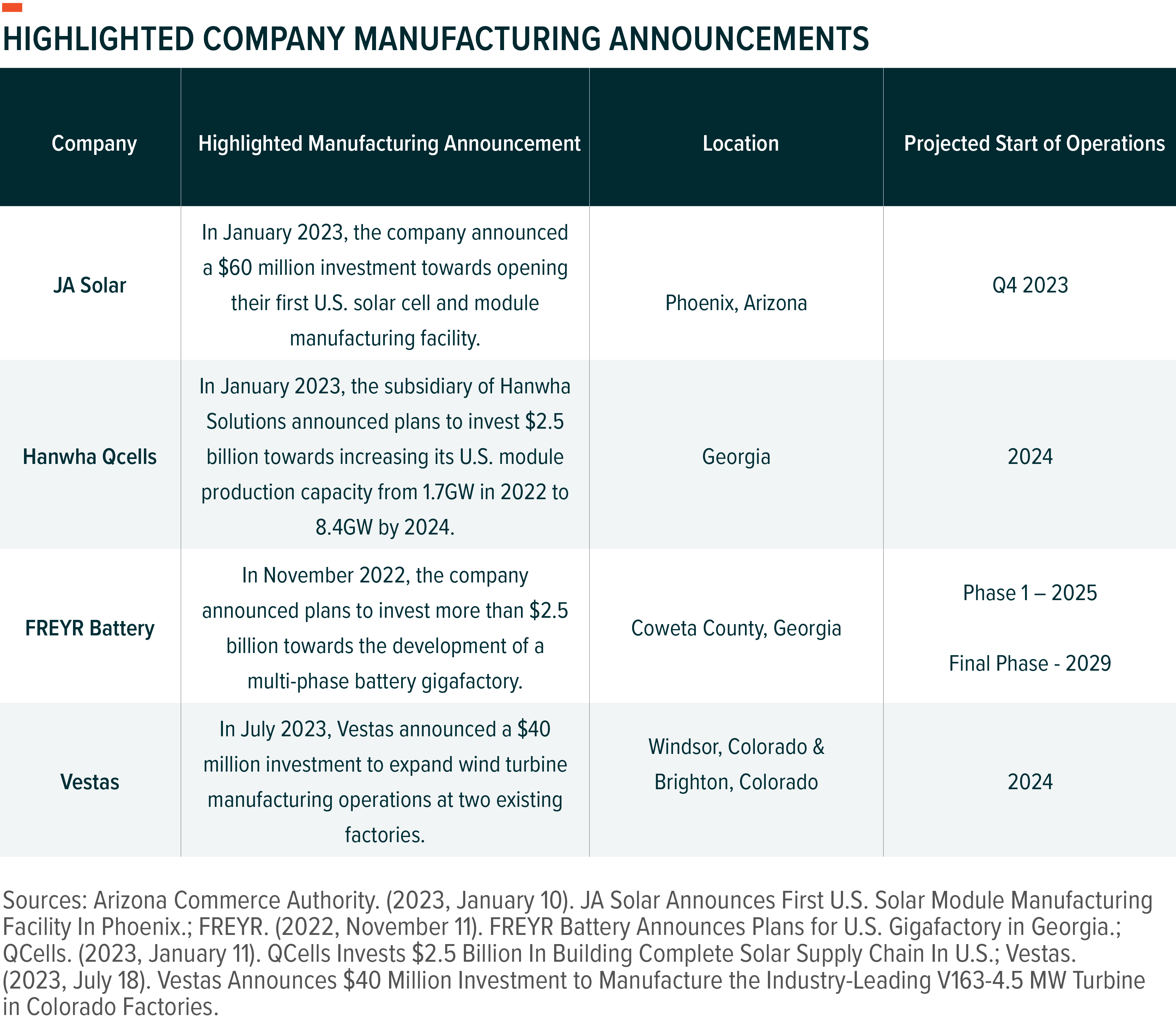

CleanTech manufacturers stand out as a key segment that can benefit from the IRA’s tax credits as well as the forecasted additional clean energy growth. Manufacturers of solar power, wind power, and energy storage components show the impact that the IRA can have, as in the last year they announced over 80 plans to expand or build new U.S. production capacity.14 The solar power sector is leading the way, with more than 50 new or expanded facilities announced since August 2022. Combined, these facilities could add more than 70GW of solar power equipment manufacturing for modules, cells, trackers, wafers and other components.15

Notably, in July 2023 U.S. thin-film solar panel manufacturer First Solar revealed plans for a $1.1 billion investment to open a fifth factory in the United States.16 This facility is the continuation of a trend for First Solar, as it brought the company’s total investment in its U.S. manufacturing to more than $2.8 billion over the past year. The company cites the IRA as a main factor in these decisions.17 Canadian Solar, Enphase, Meyer Burger, Hanwha Qcells, JA Solar, and Jinko Solar also announced investments since August 2022.18

Albemarle, Microvast Holdings, Inc., Hanwha Solutions, LG Energy Solutions, and FREYR Battery are among the companies involved in the 14 grid-scale battery storage facilities announced. CS Wind, TPI Composites, Vestas, and Ørsted are some of the companies included in the 17 U.S. wind manufacturing facilities that were announced in the past year.19

There has also been significant activity from EV battery manufacturers and original equipment manufacturers (OEMs). The IRA’s incentives for battery tech and EVs encouraged OEMs including Toyota, Ford, BMW, General Motors, and Hyundai to invest billions to strengthen their U.S. EV supply chains.20 For example, Toyota is investing nearly $6 billion towards a battery manufacturing site in North Carolina.21 Additionally, a joint venture between Ford and SK On, a South Korea-based battery producer, will use a $9.2 billion loan from the Department of Energy to build three EV factories across the country.22 Investments over the past year are projected to help U.S. EV manufacturing capacity grow from 641,600 vehicles in 2022 to more than 4.6 million vehicles by 2026.23 U.S. Battery manufacturing capacity is forecast to grow from being able to supply batteries for just over 1 million EVs in 2022 to over 12 million by 2027.24

The IRA’s Helping to Strengthen CleanTech Policy Abroad

In our view, the IRA’s impact extends beyond U.S. borders and has governments around the world using it as a model for their own policies, particularly its measures to boost domestic manufacturing.

The European Union introduced the Green Deal Industrial Plan in February 2023, which aims to build on earlier climate change-related policies and “enhance the competitiveness of Europe’s net-zero industry.”25 As part of this plan, the European Commission proposed the Net-Zero Industry Act in March 2023, which aims to ensure that the region’s clean energy manufacturing capacity can meet at least 40% of the EU’s demand by 2030. Included in the act are measures designed to accelerate permitting and reduce barriers for companies that manufacture renewable energy system components, EV batteries, battery storage systems, carbon capture and storage technologies, hydrogen technologies, and grid technologies.26

Japan’s parliament enacted a green subsidy program in May 2023 that could unlock $1 trillion in investments for low-carbon infrastructure over the coming decade.27 The program aims to help accelerate Japan’s clean energy transition by providing bonds to projects and nascent technologies that could benefit from public-private partnerships, such as low-carbon hydrogen and ammonia.

Canada’s 2023 federal budget, titled A Made-In-Canada Plan, introduces an expansion and extension of the country’s clean energy tax credits that are similar to those in the IRA. A 30% Clean Technology Investment Tax Credit (ITC) will now phase out in 2034 instead of 2032.28 Also, now the ITC can be applied geothermal energy projects in addition to solar power, wind power, and energy storage. Other tax credits in the budget are a Clean Electricity ITC for projects from tribal communities, municipal utilities, and Crown-corporations, as well as a Clean Hydrogen ITC and a Clean Technology Manufacturing ITC.29 In our view, these tax credits could boost demand for the development of renewables, energy storage, and green hydrogen systems in the country.

Conclusion: The IRA Lives Up to Its CleanTech Hype in Year One

The first year of the IRA revealed the wide range of companies that can benefit from the ongoing green energy transition, including project developers and manufacturers throughout the renewable energy, hydrogen, and EV supply chains. In our view, increasingly positive policy landscapes, both in the United States and around the world, can help minimize barriers to cleantech adoption and accelerate its growth trajectory. With potentially trillions of dollars in cumulative investments likely to be created over the lifespan of the IRA, we believe year one was only the first chapter of the many opportunities that can emerge over the short and long terms.30