Three AI Thoughts Beyond the Headlines

Mentions of artificial intelligence (AI) in first quarter 2023 earnings calls surged 77% and that number is likely to rise in the coming quarters.1 The potential to help improve corporate productivity and expand margins has AI grabbing headlines, and investors are paying attention. Robotics & AI companies have outperformed the S&P 500 by 21%.2 While AI’s emergence has received significant media attention, we’re still in the early stages of adoption with more storylines likely ahead. In my view, investors may want to consider these three angles, which are not discussed as much in popular coverage.

Key Takeaways

- Existing Cloud Computing companies with sales teams and corporate clients may be well-positioned to monetize AI by acting as distribution networks, either acquiring companies or licensing the technology. In this sense, the Tech sector starts to look more like the pharmaceutical space.

- Chips and sensors companies may offer a compelling hardware play in AI adoption as Internet of Things firms act as the connective tissue between the physical and digital worlds.

- Commercial rather than consumer adoption is likely to lead the AI boom. As a result, this next investment wave may look different than the consumer tech wave of the past few years.

Cloud Computing and the Pharma-ing of Tech

Cloud Computing companies may turn out to be the primary distribution mechanism for AI software. With access to large amounts of data, small teams can code algorithms, but building a large sales force may prove inefficient and costly for AI companies. Conversely, Cloud Computing companies have existing scale in hardware, processing, and sales, in addition to active client bases.

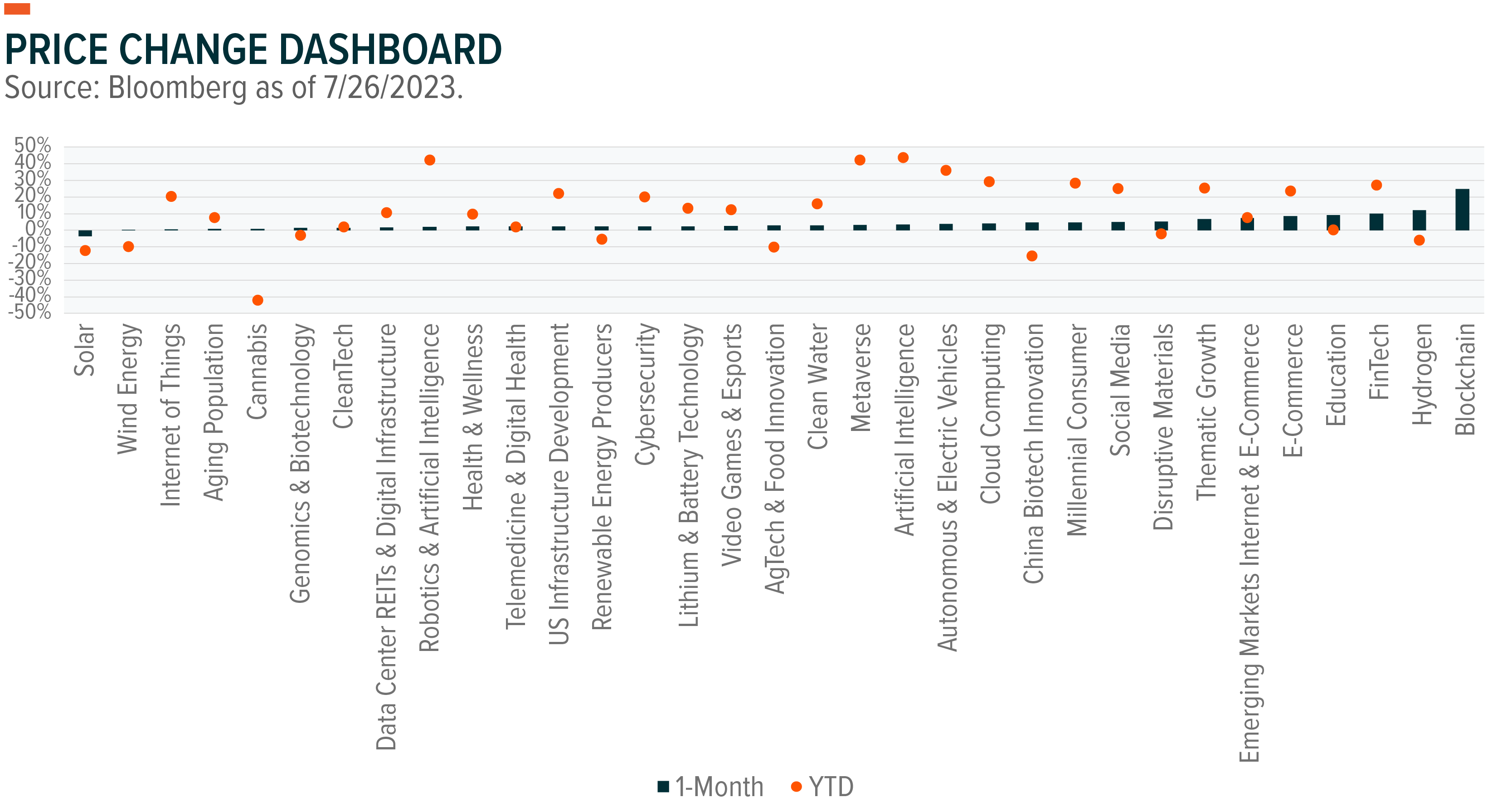

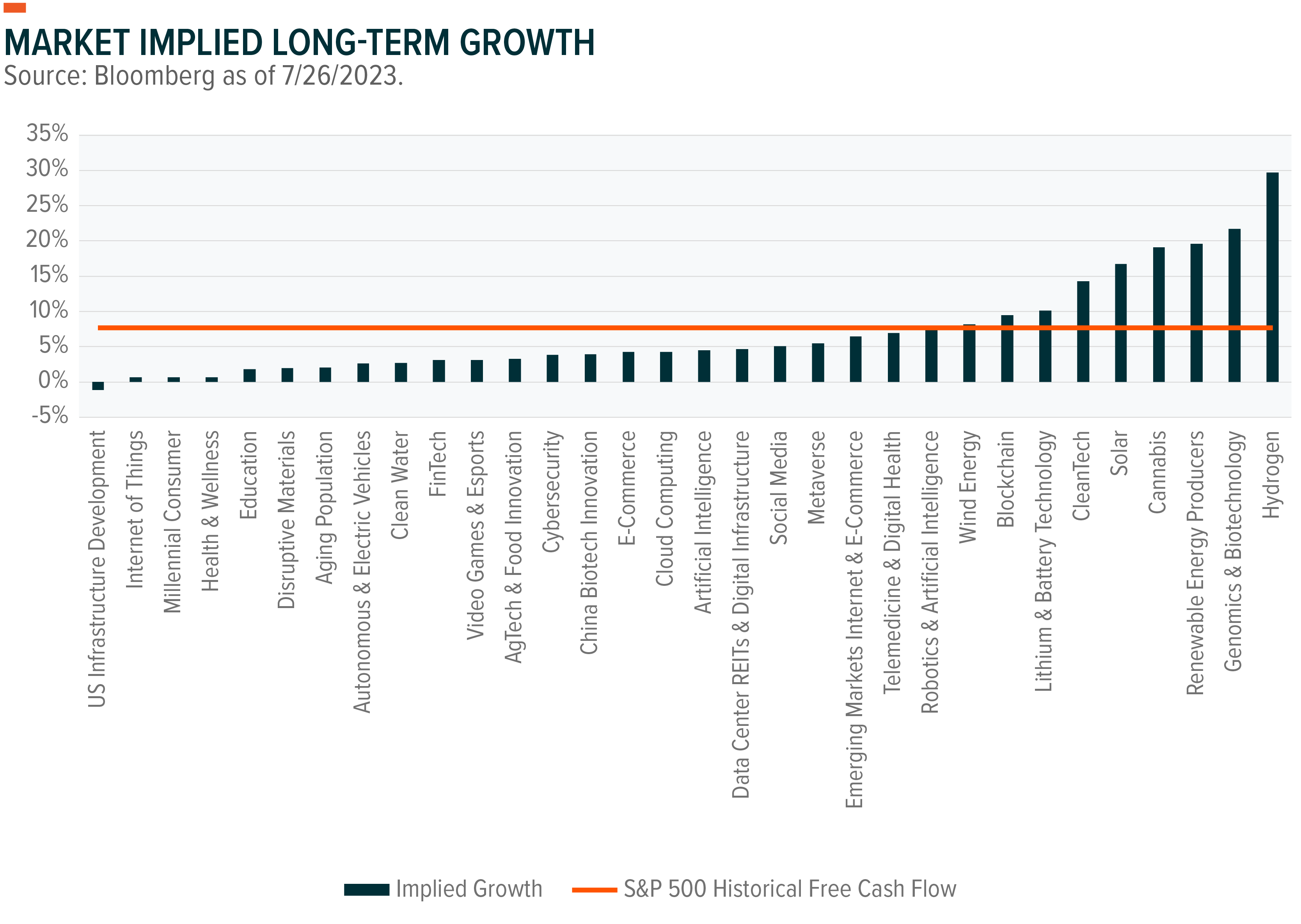

AI companies that create algorithms may be attractive acquisition targets for Cloud Computing companies. Cloud Computing players may also have opportunities to license AI technology and use their existing customer base and distribution network to sell it. Offering an AI service may help them add value and build pricing power. With Cloud Computing companies currently priced for 4% long-term growth, they could be a means for investors to capture growth in AI (see Dashboard).

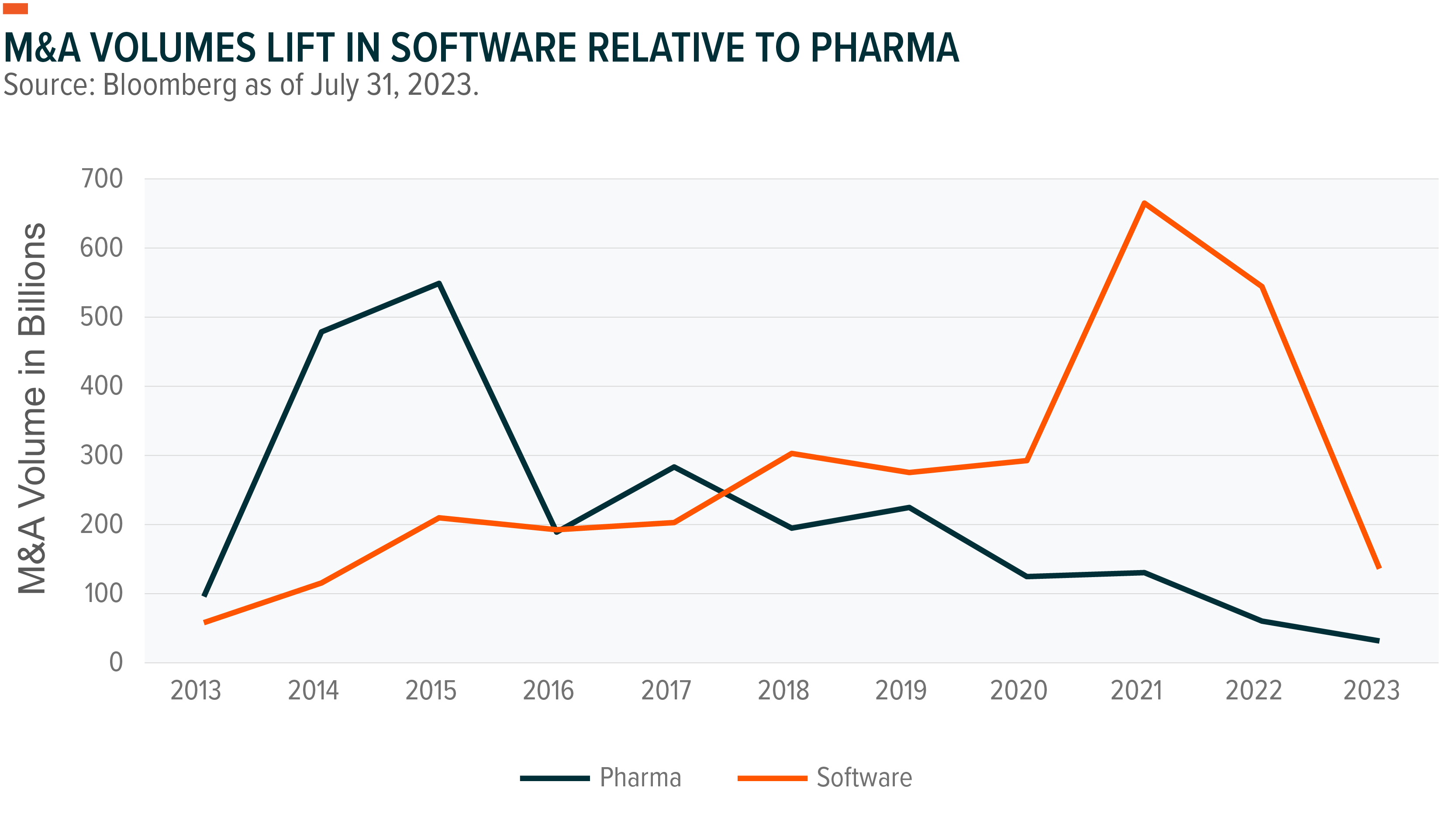

Dynamics like these could shift tech to look more like the pharmaceutical landscape. In pharma, much of the research and development (R&D) occurs at small companies, which are frequently acquired by large players with scale and distribution capabilities. This business model may be a growing trend in the Tech sector. For years, M&A volume in pharma dwarfed that of software, but in recent quarters deal value and volume in software are higher (see chart).3

Internet of Things Translate Physical into Digital

Perhaps the most powerful implantation of AI is increased automation of manual activity. Even in our interconnected and technology-driven world, in 2020, only 31% of manufacturing companies had a single fully automated process.4 Humans still feed significant information and instructions into machines. If AI can drive more efficient processes, they will need to absorb and analyze data. Internet of Things companies can provide the hardware layer in those processes.

Even before the AI boom, sales for Internet of Things devices was already forecast to grow by 16% annually.5 Corporate use of AI to improve business processes may only accelerate demand for chips and sensors. While many people associate the Internet of Things theme with fitness trackers or home security systems, Consumer Discretionary only accounts for 6% of the allocation in the index.6 The two largest sector allocations are Technology and Industrials.

From Consumer to Corporate Tech Boom

The technology boom over the last 10–15 years is best described as consumer-led. Smartphone penetration in America went from 20% in 2010 to 89% in 2022, bringing with it a series of new business models, such as ride sharing and food delivery services.7 The highest-yielding cash flow companies in the world, Apple and Google among them, were part of this expansion.8 The success of consumer-led growth is familiar to investors. Corporate tech, or business-to-business (B2B), is a different story.

AI will likely prove more beneficial to companies in controlling costs and finding new efficiencies than for consumers who only ask for a new workout plan or recipe every few months. While the technology has vast consumer potential, the list of AI applications in business is long: advertising, search, translation, medical testing, medical devices, cybersecurity, procurement, inventory management, hiring and talent acquisition, and customer service, to name a few.9

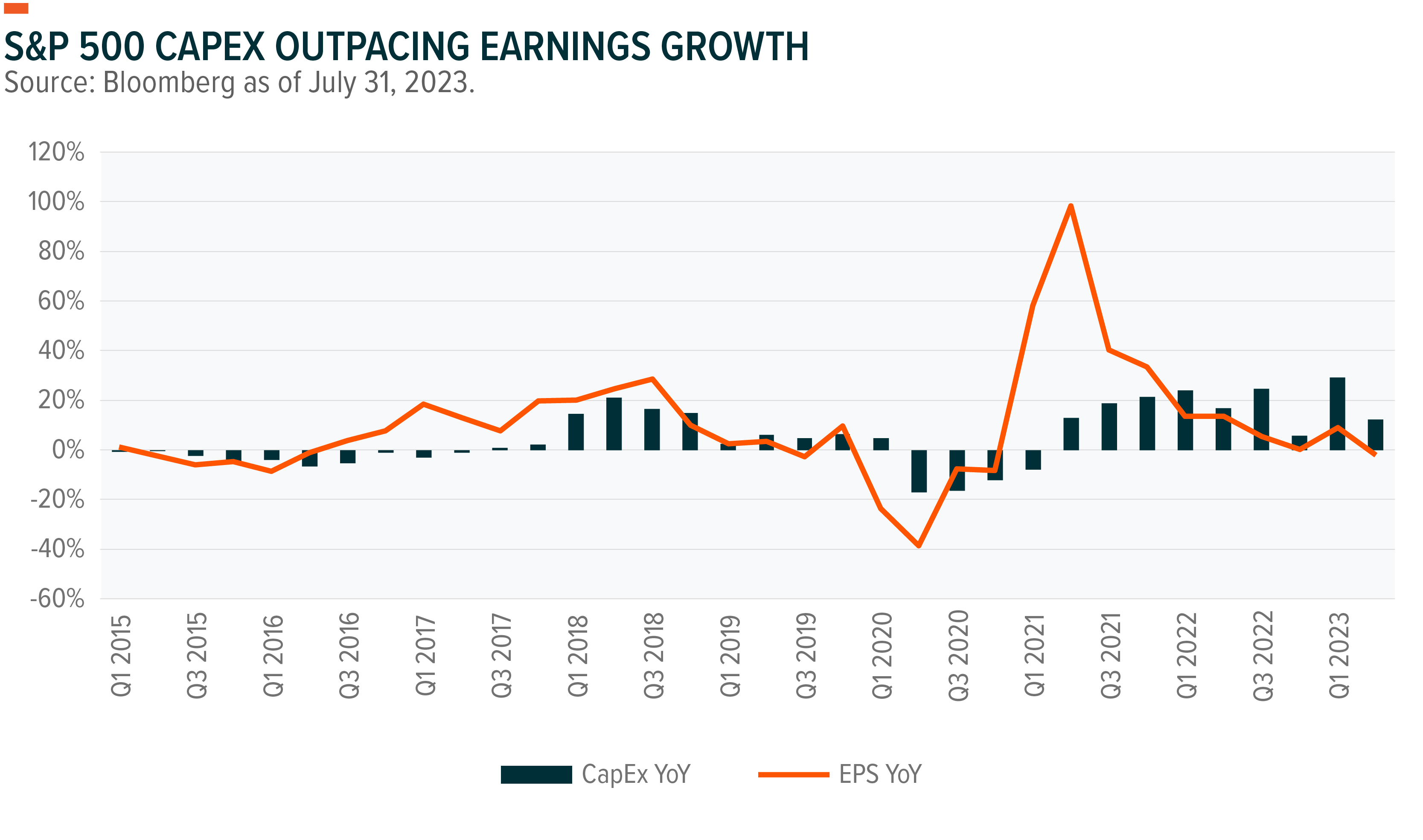

In June, ChatGPT announced that searches declined by almost 10%, the first decline since making the technology publicly available.10 That perhaps signals consumer interest may be waning somewhat. Conversely, companies are racing to invest in AI and explore how they can use the technology effectively. Capital expenditure growth remains strong since the pandemic, and this reinvestment goes beyond Big Tech (see chart).11 Companies across sectors with different businesses are trying to put the technology to use.

The transition from a consumer-led tech sector to a corporate-led tech sector may mean sources of economic and earnings growth over the next decade look a little different than the last. In my view, investors should keep this dynamic in mind as they evaluate positioning for the rest of 2023 and early 2024.

Inflection Point Theme Dashboard