Emerging Markets Outlook 2023: Midyear Update

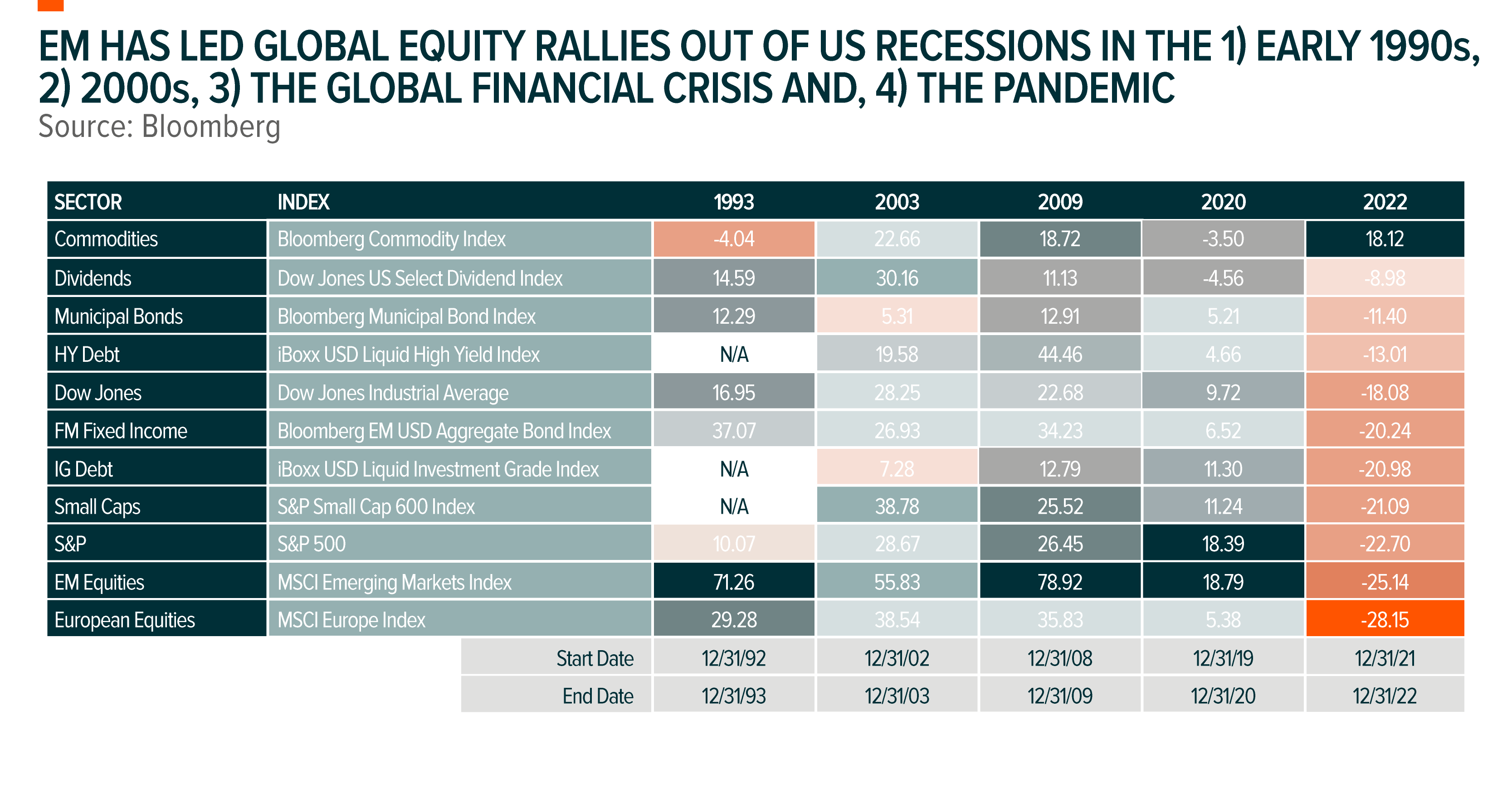

PreviewThe first half of 2023 has brought a bumpy road of positive performance to emerging market (EM) equities. The year began with a bang, as global allocators bought the headlines around China’s reopening but then slowed down as immediate economic data disappointed lofty expectations. However, the key theses are still in play, in our view, and data show that in 87.5% (14 of 16) of up-years for both developed markets (DMs) and EMs since 1990, EMs (as measured by the MSCI Emerging Markets Index) have beaten DMs (MSCI World Index).1 We believe in a second half comeback for several reasons, which we discuss below.

Key Takeaways

- Emerging market stocks appear poised for a catch-up to DM peers based on divergent growth paths, attractive valuations, and U.S. dollar weakness.

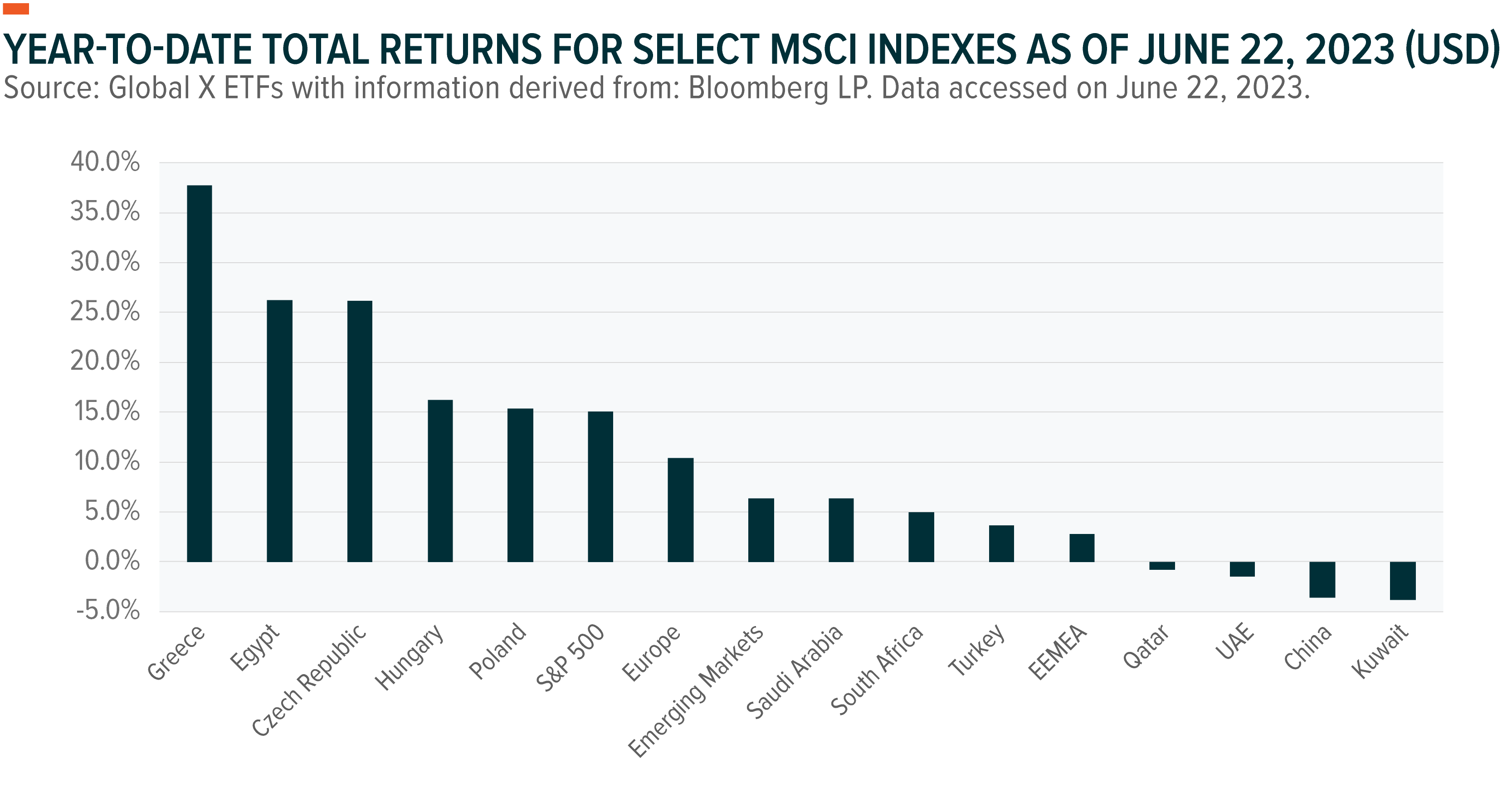

- We see various risks and opportunities across the asset class. From a near-term perspective, the combination of Brazil’s high real rates, low valuations, and position within its monetary policy cycle have created an attractive entry point. India and Mexico continue to present arguably the two best structural opportunities within emerging markets. China still moves with geopolitical headlines, but the Chinese Communist Party continues to side towards stimulus, and valuation multiples appear dislocated with growth and return prospects. We also see opportunities in smaller EM markets, including Greece and parts of Southeast Asia.

- Avoiding pitfalls and monitoring risk remain as vital as finding outperformers across emerging markets. We remain cautious across export-focused markets over levered to the U.S., along with those carrying significant current account and fiscal deficits. Politics and spending go hand-in-hand across markets, and we are keeping a close eye on forthcoming election cycles.

Three Potential Drivers that Could Deliver EM Outperformance

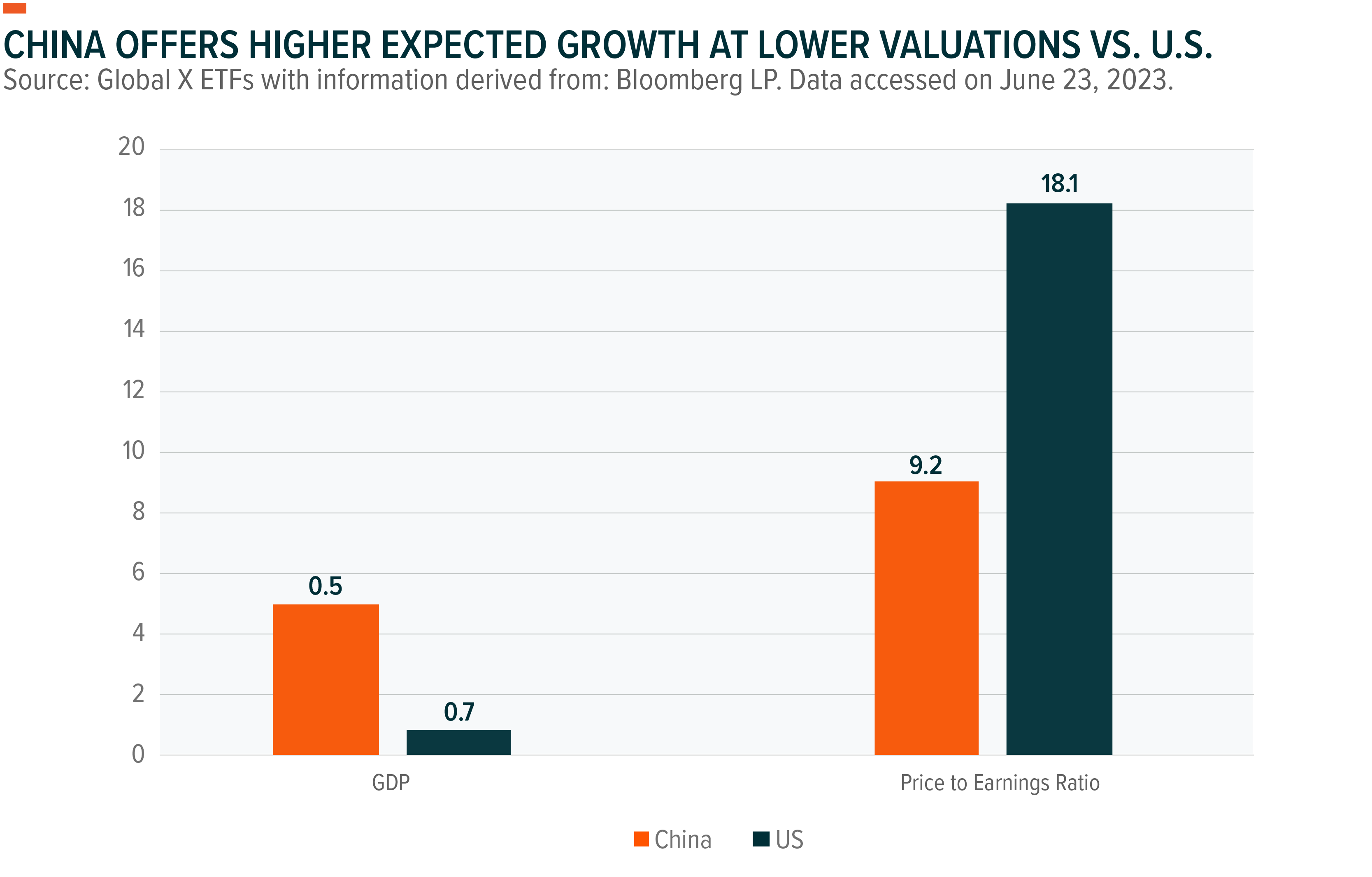

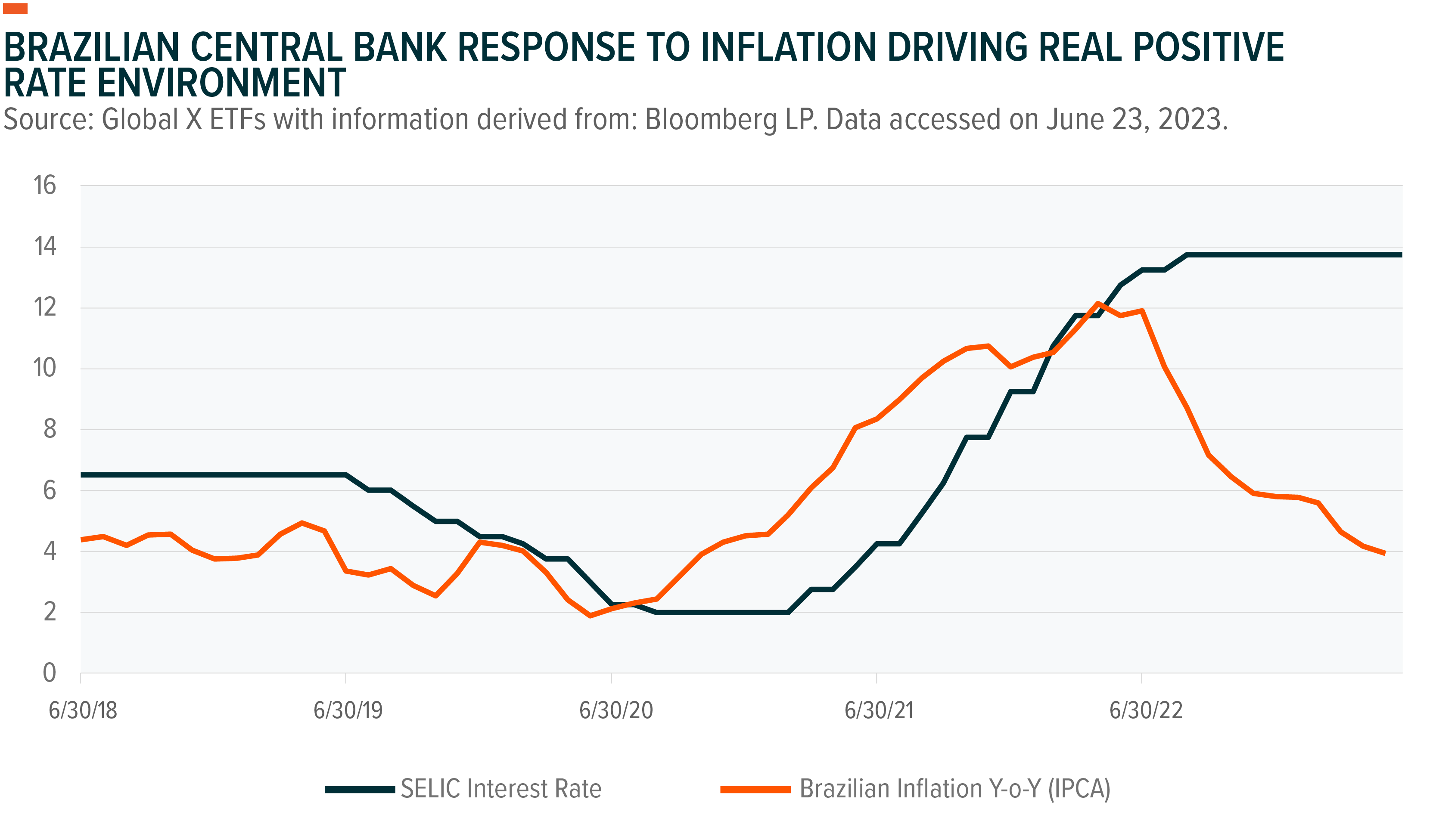

Divergent Growth: We forecast incremental gross domestic product (GDP) growth in the U.S. and Europe to tick down exactly as EM economies begin to heat up. Where central banks across developed markets are taking interest rates close to peak levels in order to cool inflation, EM central bankers sit in a different point in the cycle. Due to extended Zero-COVID policy lockdowns, China lagged the recent global inflationary cycle. China’s inflation hovers around 2%, and the government has been lowering interest rates to stimulate growth.2,3 This, combined with the continued reopening process, could act as a key driver for EMs through the rest of the year. In other parts of EMs, we see countries like Brazil and Mexico, which have raised interest rates and tamed inflation quicker than the U.S. These countries have seemingly decoupled from the U.S. Federal Reserve and may begin to cut interest rates sooner. Higher GDP growth would likely translate into higher earnings and benefit these markets accordingly. In addition, more robust growth could support EM currencies versus the U.S. dollar.

U.S. Dollar Weakness: Aforementioned central bank and government actions are expected to bring both higher growth and higher real interest rates to EM countries. This means that allocators looking for yield or growth could be selling U.S. dollars in order to purchase EM assets. This foreign direct investment would support EM currencies. Stronger EM currencies would likely translate into lower inflation and provide more room for EM central banks to cut rates and stimulate growth.

Valuations: EM equities recently traded at 10.9x earnings and 1.4x book value.4 Both of these levels stand at roughly 8% and 4.3% discounts versus their historical averages.5 They also represent 39.5% and 60.2% discounts against the S&P 500 versus standard 10-year historical average discounts of 30% and 49.6%.6 EM equities have lagged developed market peers for four out of the past five years (MSCI World Index versus MSCI Emerging Markets Index), and we believe that the above catalysts set up an attractive window for mean reversion.7 In the case that we’re incorrect, we think valuations offer a comfortable margin of safety.

Despite these tailwinds and the attractive risk/reward scenario we see, active management remains vital, in our opinion, as the EM asset class also carries pockets of risk. We expect performance within EMs to diverge, with companies that focus on sustainable returns above their cost of capital, proven management teams, and conservative balance sheets outperforming. Generally, we see opportunities for domestic cyclicals in China, tourism beneficiaries across the Association of Southeast Asian Nations (ASEAN), sector leaders in India, banks in Greece, high duration names in Brazil, and broad consumption across Mexico.

Key Events and Trends

Interest Rates and the U.S. Dollar: We see the end of the U.S. Fed rate hiking cycle as an important catalyst for sustainable EM outperformance versus developed markets. Taking off our “outlook hats” and putting our “analyst hats” back on, we can begin from the bottom up. A pause in rates signals confidence in the direction of inflation. This allows analysts to begin pricing in a lower terminal rate. With a lower risk-free rate, we can revisit our models and input lower costs of capital – meaning we can discount cash flows at lower rates, which leads to higher valuation targets.

Additionally, the Fed’s recent pause in its rate hiking cycle could signal forthcoming weakness in the U.S. dollar. Lower interest rates mean that allocators look elsewhere for yield. Subsequently, flows can leak out of U.S. dollar (USD) assets and into higher yielding international countries. Foreign direct investment can strengthen EM currencies, leading to lower inflation and, ultimately, interest rate cutting cycles, which can drive domestic growth. Historically, EM equities have displayed an inverse relationship to the dollar (gaining roughly 4% for every 1% downwards move of the USD). This correlation is due to two main reasons:

- EM countries and the companies within them have historically funded their growth with USD debt. Hence, a weaker U.S. dollar would likely shrink balance sheets, reduce net interest expenses, and lead to positive earnings revisions.

- There is an inverse relationship between the USD and commodity prices, which benefits various EM exporters.

Finally, it’s also important to note that the pause in Fed hikes could lead to higher risk appetites from allocators. The pause signals a favorable economic environment, as it suggests a moderation in inflationary pressure. This could boost investor confidence, increase risk appetites, and lead to flows into EM equities.

An Under Owned Asset Class: EM equities have underperformed the U.S. nine out of the past 10 years (MSCI USA Index versus MSCI Emerging Markets Index).8 This has led U.S.-based allocators to increase exposure to U.S. markets. However, past performance does not guarantee future returns, and we note that investors now seem underexposed to EMs as an asset class. The MSCI All Country World Index holds a 12% EM allocation.9

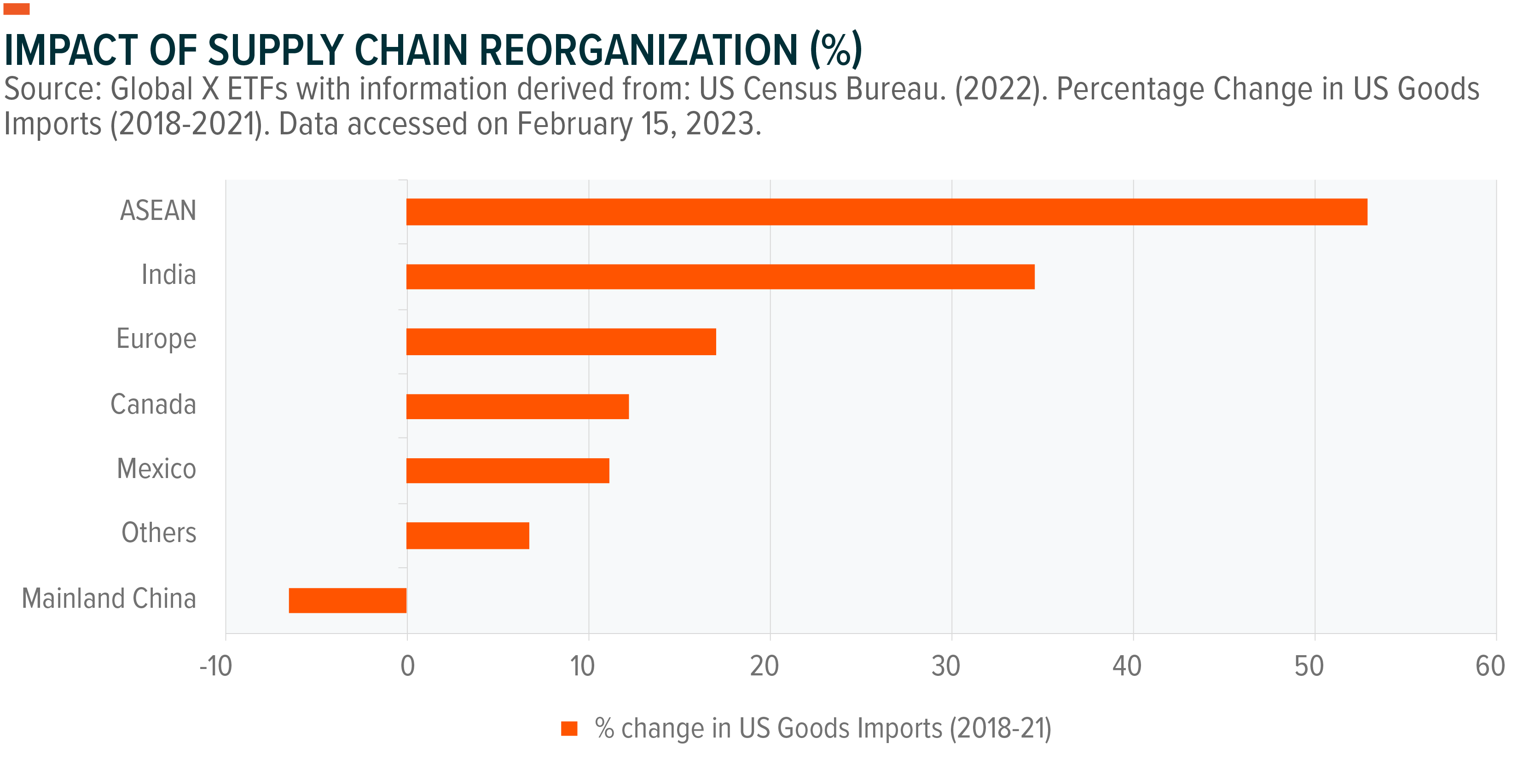

Nearshoring: Nearshoring supply chains has gained steam on the back of the U.S.-China trade war, COVID-19 supply-chain crisis, and increasing production costs. In turn, China’s export dominance is ebbing, creating opportunities for other emerging market countries to fill the gap, including Mexico, India, and Southeast Asian nations. Furthermore, given the scale needed to move supply chains, this trend could be a relevant driver of capital flows for the next decade. China had been gaining share in U.S. imports since entering the World Trade Organization (WTO) in 2001 until the start of the U.S.-China trade conflict in 2018. Since then, companies have started to look at supply-chain security through a lens of geopolitical uncertainty and not just cost savings. For example, the CHIPS Act and Inflation Reduction Act (IRA) in the U.S. focus on tech security within the supply chain. With U.S. imports of goods reaching USD3,277.3bn in 2022, a 5% market share loss in U.S. imports for China would represent a potential gain of around USD165bn in additional trade from other countries.10 Mexico is a key beneficiary of nearshoring, given its large and established manufacturing base, strategic location near the U.S. with lower transport times versus China, and high-skilled but lower-cost labor force, coupled with an updated free trade agreement in the United States-Mexico-Canada Agreement (USMCA). Demand for industrial space in Mexico continues to grow, with approximately one out of every four square feet going towards nearshoring.11 The U.S. imports roughly USD575bn per annum from China versus approximately USD450bn from Mexico, and for each market share point gain in U.S. imports, Mexico’s GDP could climb approximately 2.6%, or some USD33bn.12,13,14 India is another beneficiary from nearshoring as it becomes the “China+1” location. The country benefits from cost advantages and demographic tailwinds. The government has also implemented supportive structural changes, such as a new production-linked scheme that offers revenue-linked subsidies to encourage the growth of manufacturing clusters. In our view, nearshoring is still in its early phases and will remain a relevant topic for years with many positive externalities, including growth of local incomes, which should lead to increased domestic consumption.

Elections: Elections played a major role in performance for some countries during the first half of the year. In Greece, market friendly President Mitsotakis took an absolute majority to secure a second term in office. The victory signals a strong desire for a continuation of economic orthodoxy and for political stability. Recep Erdogan won another term as Turkey’s President, and surprisingly followed suit with market friendly appointments to key economic positions, such as Finance Minister and Governor of the Central Bank, increasing the odds for a return to more orthodox fiscal and monetary policies. Thailand’s progressive Move Forward party pulled off an upset victory in the May election, with its Harvard-educated leader, Pita Limjaroenrat, set to be nominated as Prime Minister by an eight-party alliance. Looking to the second half of the year, Argentina will hold its general election in October in what could be a decisive moment for the future of the country. We also expect increased political headlines and volatility heading towards 2024, due to the plethora of upcoming federal elections, including those in the U.S., India, Mexico, South Africa, and Taiwan.

Asia Overview

Despite the potential challenges of a slowing global economy, we remain optimistic about the outlook for emerging markets, particularly in Asia. China’s reopening rally undershot first half hopes, but valuations remain attractive, and we see green shoots across specific areas. India and Indonesia offer especially attractive medium- and long-term growth prospects. We anticipate that regional growth will continue into 2024, driven by a decline in real interest rates to propel further domestic demand recovery, which we expect will fuel Asian growth outperformance relative to developed markets. We are also keeping an eye on signs of stimulus out of China.

The outlook for Asian markets remains positive beyond China for 2H 2023, with a sustained recovery coming from strengthening domestic demand, nearshoring, and supportive monetary and fiscal policies. While the likelihood of higher growth differentials with developed markets and inflation moving closer to targets should bode well for the region, risks remain from a possible hard landing in the U.S. and/or a pronounced slowdown in China. However, we believe China’s recovery is still underway, with renewed stimulus efforts and broadening recovery in jobs and consumption likely to keep 2023 GDP growth well above the U.S. and Europe.

As we enter the second half of the year, there is a potential risk of overtightening if the Fed continues with interest rate hikes in the U.S. However, in Asia, valuations remain reasonable, and inflation (especially wage-driven) appears to be less of a concern, with most nations in the region moving closer to their target ranges. Consequently, central banks in Asia may not need to tighten monetary policy to the same extent as the Fed. This also means they are better positioned to cut rates quickly should signs of deflation emerge. Overall, if risks do not materialize, we expect strengthening fundamentals and policy easing should help Asia sustain its recovery over the next few quarters.

China

China’s policy pendulum historically swings from tightening to loosening over a shorter time horizon versus typical U.S./European cycles. This reflects the Chinese Communist Party’s (CCP) desire to control the economic backdrop and deliver consistent economic growth. Given its far-reaching powers, the Chinese government has multiple levers beyond traditional monetary and fiscal policies, which means the market should not underestimate the CCP and its potential impact on China’s equity market.

China’s post-reopening recovery has been slower and bumpier than expected, but ongoing recovery will probably remain underway for the remainder of 2023. Within consumption, the service sector has experienced the most significant recovery since reopening, as consumers flocked back to dining and tourism activities. Elevated activity levels should flow into earnings over the next few quarters.

Though the weak job market data amongst younger age demographics has taken headlines, the overall unemployment rate has actually fallen since reopening, showing improvements are underway.15 As job creation continues to increase across the country, we should see more broad-based improvements in consumer confidence and consumption.

However, for consumer and business confidence to meaningfully rebound, the onus is on policymakers to re-establish confidence by implementing measures such as incentives for investment or introducing stimulus initiatives. While lower borrowing rates and the recent tax exemption for electric vehicle purchases beyond 2023 are positive steps, other potential measures include relaxing home purchase restrictions, increasing infrastructure support, or offering targeted consumer incentives. Due to the growth slowdown in 2Q23 and concerns surrounding local government debt, we expect policymakers to maintain an accommodative stance in the upcoming quarters to reduce the negative output gap, with more significant moves potentially coming from the July Politburo meeting.

Parts of China’s economy may need a few more years to fully digest the excesses and rapid growth of the past decade. Still, we remain optimistic about the long-term attractiveness of China’s shift toward higher quality, consumption-driven growth. China’s household saving rate peaked in 2010 and has generally declined since then.16 Similarly, private consumption expenditure as a percentage of GDP bottomed in 2010 and has since gradually increased.17 While the pandemic temporarily disrupted this trend in recent years, the structural trend has not changed. As reopening continues, we expect to see private consumption driving economic growth again this year.

India

India’s structural growth drivers remain intact, supported by favorable structural reforms, strong government spending, and resilient domestic demand. Notably, the government continues to focus on pushing investment-led growth, most recently through the introduction of a revised production-linked incentive scheme (known as PLI 2.0) for the IT hardware sector to attract global players and boost India’s manufacturing industry.

We expect capital spending investments to pick up ahead of the general election in 2024, which could drive further job growth and, in turn, support domestic demand. Subsequently, we expect to see a revival in consumption over the next three to four quarters. While consumption activity has taken a breather in the last year or so, we believe companies will pass on the benefits of lower raw material prices, which could help drive a revival in consumption demand.

In the last three-four years, the Indian government has been harvesting the gains from higher tax collections into public infrastructure spending. An improved economic outlook would also give confidence to Corporate India to kickstart a much-awaited private investment cycle. On the negative side, some pain is likely to be felt from the global slowdown in traditional exporters like IT services, but market-share gains, thanks to “China+1” sourcing, is likely to be beneficial for manufactured goods exports. Net-net, in a growth-challenged world, we believe India will likely emerge as a standout performer in the coming years.

Northeast Asia

The Northeast Asian region, including South Korea and Taiwan, has performed strongly thus far in 2023, thanks to expectations of supply-chain normalization following China’s reopening. Additionally, Taiwanese and Korean tech names have benefited from the recent interest in artificial intelligence (AI). The initial stage of this tech cycle has centered around semiconductor names, as investors are beginning to understand how generative AI will be monetized through chip innovation and demand. While the beneficiaries of the next phase of AI development are not as clear yet, we believe that AI will become increasingly embedded to the point that it unleashes a productivity boom. This could free up the workforce, which could be reskilled and redeployed. In the interim, what is certain is that data and processing capabilities will remain critical for these ever-evolving large language models. For Korea and Taiwan, this exciting new product cycle of AI-tech spending is likely to help drive valuations back to mid-cycle levels.

South Korea

For South Korea, multiple headwinds, namely monetary tightening and weak exports, have suppressed the country’s growth momentum. However, we believe these headwinds are fading and see a gradual recovery taking hold from 2H23. Exports appear to be improving sequentially, with the expectation of further improvements as China and the memory chip cycle recover, while a move past peak monetary tightening suggests a soft landing for the property market. Korea’s private consumption has also been resilient this year, thanks to strong excess savings, despite high interest rates and the rising household debt burden. Though the household surplus ratio is expected to moderate over the coming quarters, we believe a recovery in tourism inflows (especially from China) could provide the next tailwind for Korea’s private consumption momentum to continue.

Taiwan

Like South Korea, the headwinds in Taiwan now look to be fading, thanks to a seemingly soft landing in the U.S. and implications on information technology. However, geopolitical concerns remain an overhang, while there are still risks associated with a potential U.S. recession. Taiwan is highly exposed to the U.S. through revenues and market correlations, which would likely present challenges should a U.S. recession occur. Domestically, we believe retreating inflation pressures and the prolonged external demand weakness could allow Taiwan’s central bank to pause its monetary policy tightening cycle. Though external drag is likely to linger, we don’t expect rate cuts to happen anytime soon. Rather, the government will likely use other tools to support businesses or target groups, should the economic slowdown worsen further.

The Association of Southeast Asian Nations (ASEAN)

Within ASEAN, Indonesia has been the leading outperformer year to date, thanks to its defensive domestic household consumption and ongoing policy reforms to change the long-term posture of the balance of payments and current account. We expect a sustained pace of growth in Indonesia, as the economy enters a steady state of expansion. As inflation decelerates back into the target range, this should give the Bank of Indonesia an opening to be the first central bank in Asia to cut rates, even ahead of the Fed. Lower rates would likely help lift private sector confidence, supporting the recovery in private demand. While the reversal in commodity prices from their 2022 highs likely means reduced support from terms of trade for Indonesia, we note that prices remain well above pre-COVID-19 levels and, hence, probably do not pose any macro stability risks. Meanwhile, healthy private-sector balance sheets also mean there is ample room for corporations and households to leverage up and support the ongoing domestic demand recovery.

In Thailand, growth remained resilient in the first half of the year. However, the country’s election situation remains uncertain, with the Move Forward Party (MFP) facing challenges in forming a coalition government. Depending on the outcome, a potential escalation of political protests could be an added risk and a negative for market sentiment in the near term. However, a successful government formation with a clearer timeline of budget passage and progress towards economic reforms would support Thailand’s economic outlook. Meanwhile, tourism recovery continues to be a key driver of private consumption growth in Thailand, and we expect this trend to sustain through 2H23.

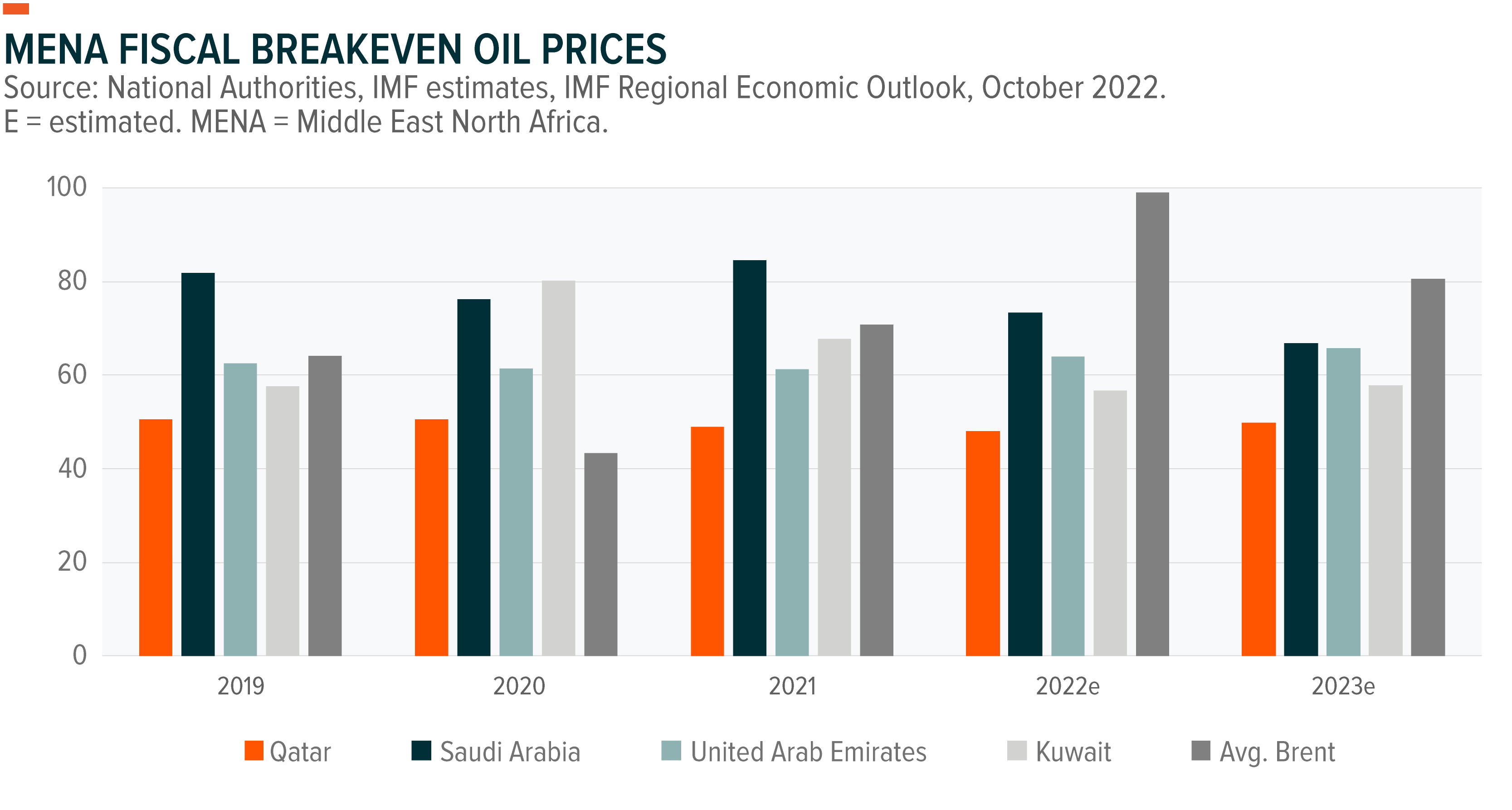

Latin America and Emerging Europe, the Middle East, and Africa (EEMEA) Overview

We believe that both Latin America and EEMEA show pockets of strong performance potential. As the global market outlook remains uncertain, this region could provide balance to asset allocation. In addition, the market (as measured by the MSCI Emerging Markets ex-Asia Index) trades 4% below its historical average along with a 5.3% dividend yield, offering a modest valuation buffer.18 Markets in the Middle East and North Africa (MENA) not only benefit from higher oil prices, but most also carry a USD peg, which protects investors from currency volatility. Most African and LatAm markets also benefit from higher energy and metals prices. Many of these economies are also ahead of the U.S. and Europe in their rate hiking cycles, and we’re beginning to see some de-coupling from the U.S. Fed. With stable currencies and room for eventual rate cuts, domestic cyclical names could also start to look attractive. Broadly speaking, continued tension in Europe and supply pressure on commodity prices, along with an ongoing correction in the U.S. dollar, could act as key tailwinds for the region. Historically, EM equities move up roughly 4% for every 1% move weaker by the USD – and this relationship is especially powerful in Latin America and EEMEA. Supply side constraints leading to a possibly tighter oil market would bode well for Saudi Arabia, the United Arab Emirates (U.A.E.), Brazil, Colombia, and Mexico. A continued recovery in the Chinese demand story could act as a powerful boost to South Africa and Latin America. Better-than-expected economic growth or central bank pivots in the U.S. and Europe would likely serve as powerful tailwinds for Mexico, Poland, the Czech Republic, and Greece. For the medium and long term, we continue to believe that EM-ex Asia presents a strong growth opportunity, due to sound balance sheets, a low earnings base, attractive valuations, and global market positioning. We believe that quality names in the region remain overlooked and that global positioning is ripe for change. We remain overweight in what we see as earnings recovery stocks with quality management teams and sustainable competitive advantages. We continue to look for opportunities where prices have dislocated from fundamentals. In broad terms, we seek companies offering above average growth at attractive valuations, with a preference for high earnings visibility and proven cash flow generation potential.

As a region, Latin America continues to outperform market expectations. We had originally feared the political pendulum’s leftwards swing (Fernandez in Argentina, Castillo in Peru, Lopez Obrador in Mexico, Boric in Chile, Petro in Colombia, and Lula in Brazil), but it appears that these leaders are facing pushbacks within their governments, creating political gridlock, which de-risks the region. Latin American equities (as measured by the MSCI Emerging Markets Latin America Index) were recently trading more than one standard deviation below their historical average multiples and were also offering attractive dividend yields.19 The region also benefits from higher energy and materials prices. We expect a soft landing or mild recession in the U.S., coupled with mid-single digit Chinese GDP growth, which should boost Latin American growth and support current account balances. Perhaps most importantly, central banks in the region have been prudent in raising interest rates to fight inflation well ahead of the Fed. This has created a strong interest rate differential, which has, and should continue to, protect currencies through global market volatility. We’re now seeing a decoupling, which implies that Latin American central banks could cut interest rates well ahead of the Fed. We believe that Latin America presents a dynamic investment landscape where active management, a focus on quality, and sound risk management are paramount.

Brazil

We believe that multiples of the Brazilian equity market now offer a valuation buffer that provides a margin of safety for the inherent unknown in forecasting cash flows. The MSCI Brazil Index trades at 1.3x book value and 7.7x earnings with a 7.3% dividend yield.20

In addition, the Brazilian Central Bank (COPOM) has raised interest rates 13 times since early 2021, front running the Fed and getting inflation under control sooner than most emerging and developed market peers. With the SELIC (Brazil’s key interest rate) at 13.75% and the IPCA (inflation) at 3.94%, Brazil now offers the highest real interest rates in the world.21 This should attract allocators looking for yield, support the currency, reduce inflation, and ultimately allow the central bank to begin cutting rates again and spur growth. The popularity of floating rate debt in Brazil makes any cutting cycle especially powerful for positive earnings revisions.

We are also growing cautiously more comfortable with Brazil’s political picture. Though President Lula’s rhetoric continues to suggest government intervention in the private sector, central bank influence, and increased spending – it appears that Brazil’s institutions are holding up and offering a system of checks and balances. The government’s recent fiscal package was more balanced than expected, and the market was happy to see congress push back on certain aspirational proposals. In addition, the central bank has remained autonomous and seemingly brushed off the President’s complaints around interest rates being too high.

In terms of risks, we’re monitoring the government’s potential willingness to use state owned enterprises (SOEs) to foster growth.

Mexico

Despite already being one of the best performing markets YTD, with the MSCI Mexico Index climbing more than 26% through June 23rd, we remain constructive on Mexico’s outlook into 2H23 on the back of its strong linkages to the U.S. economy, structural nearshoring story, and strong and independent central bank.22 Despite a potential hard landing in the U.S., remittances to Mexico continue to grow, while labor markets have been surprisingly strong domestically, driven by nearshoring demand for workers and recovery in services post COVID-19 lockdowns. Inflation has also turned a corner, and Mexico’s central bank has already shown evidence of de-coupling from the Fed. As a result, we believe Banxico can begin cutting rates this year. Mexico’s adherence to its fiscal rules has been another bright spot in the investment case. Although we note some caution as we approach Presidential elections in 2024, which could see irrational programs, actions, or spending from the incumbent Morena party as it seeks to shore-up support, there remains a strong willingness to comply with the country’s fiscal framework. As a result, we could see cuts in other spending to offset any new initiatives. Recent pension reform, which will see mandatory contributions gradually increase over time, provides another tailwind for markets.

Colombia

We see a positive picture emerging in Colombia, as the MSCI Colombia Index is trading more than one standard deviation below its historic P/E multiple.23 Also, President Petro’s recent blitz of structural reforms, which touch on everything from the pension system to health and labor market reforms, were not well received by Congress, tempering expectations of additional non-market friendly reforms. This has driven President Petro to make changes within his cabinet in an attempt to regain momentum, which was stopped by allegations of campaign finance infractions. As a result, we expect any reforms that might be approved to be watered down, and less of a fiscal burden, while new Finance Minister Bonilla has remained committed to economic stability and the country’s fiscal rule. Further on the positive side, we see inflation starting to turn in 2H23, which could give scope for BanRep to start an easing cycle before year end, despite facing some of the stickiest inflation within Latin America. Finally, we see upside potential with energy prices, which could support the country’s fiscal balance and help offset some of the government’s planned spending.

Peru

We are sidelined in Peru, as the country continues to face a state of political limbo after the impeachment of President Castillo, which led to many protests throughout the nation. This has prevented the government from passing any positive or needed economic reforms, and we cannot rule out a potential impeachment of current President Dina Boluarte, nor a dissolution of Congress, although the odds of these events occurring appears to be receding. However, the market has been supported by high commodity prices, which have helped keep macro imbalances in check. Any potential stimulus out of China would likely be a boon for Peru, but the lack of clear short-term policy direction and its negative impact on the economy and earnings growth could result in more long-term structural issues, which could carry higher economic costs in the future. Finally, like most of LatAm, Peru is experiencing disinflationary trends, which should allow the central bank to start easing in 2H23.

Chile

Following the election of left-leaning President Boric, Chilean politics continue to move to the center. The people voted to reject the proposed radical constitution in 2022, with the newly elected center-right Constitutional Congress now set to unveil a muted new proposed document later this year. The consumer price index remains on its disinflationary trend, lending support to the central bank to begin cutting interest rates in the second half of the year. Despite the short-term weakness in prices, the long-term structural demand outlook for “green metals” remains intact. This could help support Chile’s account balances moving forward, as the country is a major producer of both copper and lithium.

Emerging Europe, the Middle East, and Africa (EEMEA) Overview

EEMEA has seen a dispersion in market performance YTD on the back of different regional drivers. Emerging Europe has fared the best, outperforming both the S&P 500 and the MSCI Emerging Markets Index. In general, MENA has marginally lagged, and South Africa and Turkey have fared the worst, due to idiosyncratic drivers. In broad terms, the region is facing headwinds from restrictive monetary policy that will likely be a drag on investment. Although headline inflation is starting to recede, services inflation has remained sticky and may keep central banks from cutting rates sooner. However, we think MENA countries appear well positioned to withstand the current depressed oil price environment, which we expect to improve ahead, while structural reforms continue to support our positive view on the region as a whole. Currency pegs have provided some stability, as well. Emerging Europe is set to benefit from lower inflation, likely leading to future rate cuts from central banks that would encourage markets to grow again. Greece is poised to benefit from a strong expected tourism season, declining unemployment, and a potential reclassification to Investment Grade rating status, which would likely help the market rerate further. We also see Greece as a key beneficiary of E.U. recovery funds. Finally, we are starting to see green shoots of positive reforms in both South Africa and Turkey. The former has taken steps to address its legacy energy issues with electric utility Eskom; has watched its pragmatic central bank proactively respond to inflation; and sees potential stimulus from China on the horizon. Meanwhile, Turkey looks ready to take the bitter medicine of implementing a proper fiscal framework that would be able to tame inflation and put the country back on a path to growth after a macro adjustment.

South Africa

A mix of commodity price deflation, political uncertainty, and power shortages weighed on South Africa’s economic growth and equity market during the first half of 2023. Power shortages, known locally as load shedding, remain very severe and are expected to worsen over the coming quarters, essentially capping the country’s domestic growth potential. Although reforms have helped expedite private sector investment in the country’s energy generation capacity, we don’t see this meaningfully compensating for state owned enterprise Eskom’s failures in the short to medium term. Inflation has also proven sticky, pressing the Reserve Bank to extend its hiking cycle to ease price pressures and ensure credibility, which has come at the expense of growth and has had an outsized impact on the South African consumer (approximately 55.5% of the population is classified as poor).24 On the positive side, tourism may continue to rebound, with overseas arrivals by air still 20% below 2019 levels according to Statistics South Africa. South Africa’s abundance of natural resources positions the economy and the market to benefit from a potential China stimulus sparked rally in commodity prices. Although valuations appear inexpensive, we remain cautious on South African equities heading into the second half of 2023.

Turkey

Turkey presents a complicated situation. On one hand, President Erdogan just won reelection, which implies a continuation of unorthodox fiscal policies and a lack of central bank independence. Erdogan has ruled with economic interventions for close to two decades, which has often put Turkey in precarious positions. Counterintuitively, Turkey was the best performing equity market in the world in 2022 as a result of these economic challenges. Local retail money drove the rally, as interest rates were cut to 9%, while inflation rose to 80%.25 This resulted in a significant loss of purchasing power, and locals could not find a store of value for their money. One would first think to convert one’s lira to other currencies, but the government intervened with a foreign exchange protection deposit regime, which kept the lira steady, making a hard currency option less attractive. During the year, the lira actually strengthened from 18 per USD to 11, before starting to weaken again.26 Ultimately, the equity market turned into Turkey’s most popular inflation hedge.

Now that Erdogan has secured the executive branch again, we are keeping an eye on potential course reversal. Within days of securing his office, Erdogan gave an inauguration speech where he said that the current constitution was “a product of the (1980) coup” and that it needed to be replaced with “a libertarian, civil and inclusive one” that would strengthen democracy. He also named Mehmet Şimşek as his finance minister. Şimşek, a former Merrill Lynch strategist respected by the market for his defense of orthodox economic views, is a familiar name for the Turkish leader. He worked as both a finance minister and deputy prime minister in past Erdogan cabinets but stepped down in 2018 during Turkey’s transition to an executive presidential system that gave Erdogan sweeping powers.

An economic U-turn from the new regime could draw international investors back into Turkey, but it could also lead locals to pull their money out of equities and back into banks, as interest rates move up to fight inflation.

Greece

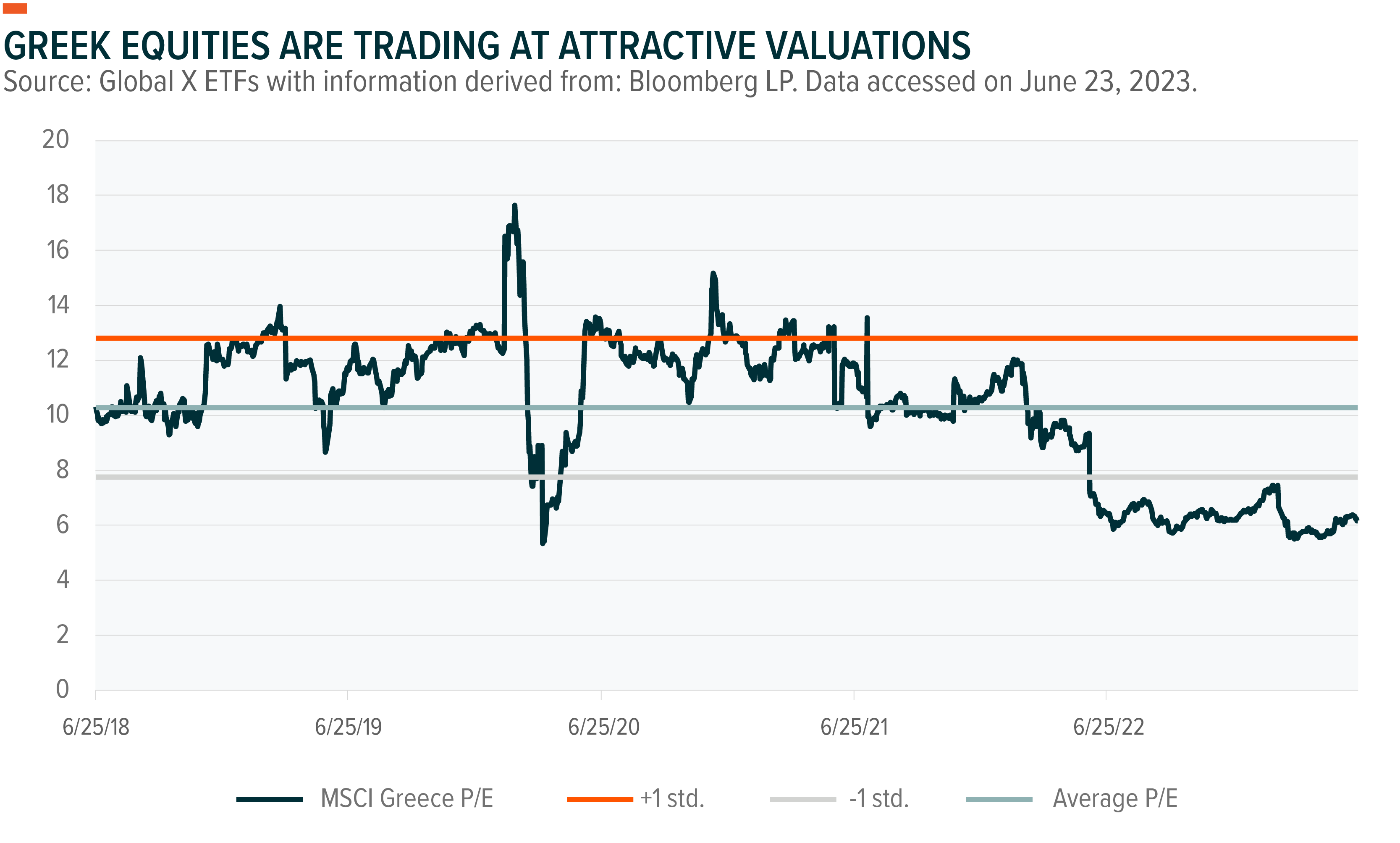

We remain positive on Greece as one of the best momentum stories in EMEA. Greece not only presents significant valuation discounts versus its own (suppressed) historical average and against other EM markets, but it is also expected to benefit from political and economic momentum.

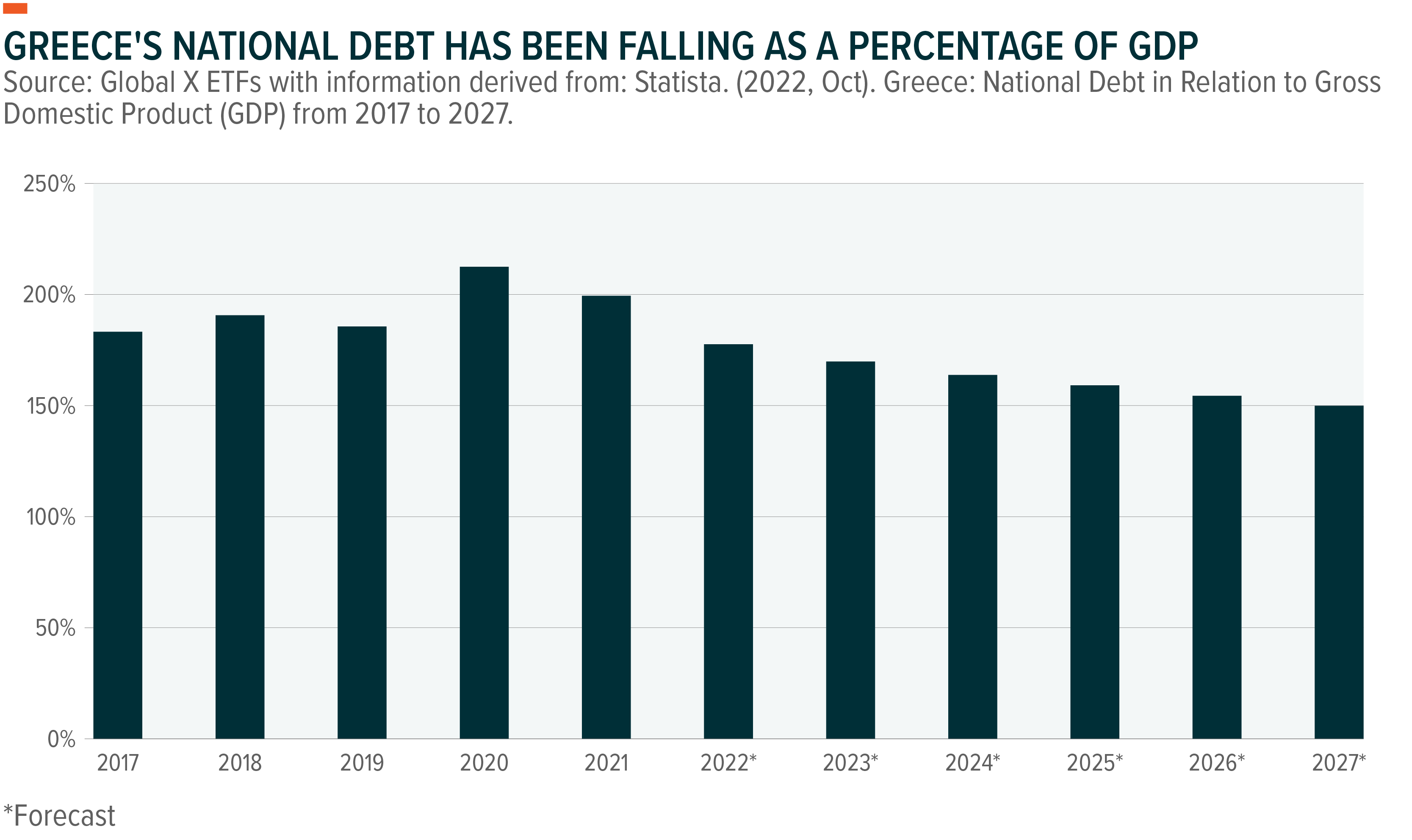

Greek voters recently delivered an absolute majority victory for the incumbent and market friendly New Democracy Party. This victory implies continuity of economic policies that have turned Greece around over the past three years. A continuation of fiscal orthodoxy could open the door for a potential sovereign upgrade to Investment Grade by the end of the year. Such an upgrade would likely lower costs of capital in Greece, which would 1. Induce lending, investment, and growth and 2. Allow analysts to reduce their discount rates and increase their valuation targets.

Additionally, while various countries across the world currently need to tap the brakes on growth in the face of inflation, Greece is entering a capital expenditure cycle aided by years of underinvestment and Recovery & Resilience Funds (RRF) seeping into the economy. RRF is the centerpiece of the E.U.’s recovery plan. It supports a way out of the COVID-19 crisis and aims at preparing Europe for digital and sustainable transitions. In order to receive financing, E.U. Member States have to prepare plans that set out the reforms and investments to be funded with the RRF. Such plans, called “national recovery and resilience plans,” have to be assessed by the European Commission and approved by the Council. Greece has been a first mover in this program and expects over EUR 30bln (roughly 15% of GDP) through 2025.27

Last, tourism represents roughly 20% of Greek GDP and officials are expecting a return to 2019 levels this year, driven by a strong U.S. dollar and significant pent-up demand coming from a re-opened China.28 We were in Athens mid-week off-season in March and saw at least seven daily flights from the U.S.

CE3 (Czech Republic, Poland, and Hungary)

A weak consumer environment dragged on growth in the Czech Republic in 1H23, driven by declining real wages, while investment declined due to lower construction activity, as high rates impacted the sector. Despite the headwinds, the MSCI Czech Republic Index was up nearly 31% YTD through June 23rd.29 On the positive side, declining food price dynamics, along with decreasing consumer prices, led to a decline in headline inflation. In turn, we see room for the central bank to stop hiking in 2H23, which could allow for gradual rate cuts starting in 2024. The country could also be supported by the auto industry catching up on delayed production, potentially helping offset a contraction in domestic demand.

Poland

The MSCI Poland Index has outperformed the MSCI Emerging Markets Index by about 16 percentage points YTD through June 23rd, as the country has one of the highest betas to EMs and Europe within EEMEA.30 It also has one of the highest negative correlations to the U.S. Dollar Index (DXY) globally at roughly -0.7.31 While the backdrop was supportive in 1H23, the drivers for the remainder of the year appear mixed, as the E.U. is expected to slow while the USD stabilizes. On the other hand, local factors could still be supportive. In particular, the country is starting to see real disposable income improving, leading to a possible consumption recovery as headline and core inflation ease and fiscal stimulus comes through ahead of October parliamentary elections. In particular, the government plans to increase child support disbursements by 60%, to PLN800/mo (0.7% of GDP), which could increase private consumption by 1.2%.32 Pensioners are expected to receive a second bonus disbursement in 3Q23 (0.3% of GDP), which could add another 0.5% to consumption.33 Meantime, the labor market remains tight and probably still allows for another minimum wage hike ahead in 2024. This combination should favor discretionary stocks versus staples. Furthermore, despite the YTD rally, valuations are still relatively undemanding at roughly 8.2x P/E, compared to both history and EMs (9.7x and 11.2x respectively).34 On the negative side, the financials heavy market still faces downside risk from the ongoing Swiss franc loan saga and potential credit holiday extension, although both risks should be well understood by the market by now.

Hungary

Hungary has recently seen improving GDP growth, while inflation continues to slow. This is expected to allow monetary conditions to ease and will likely benefit OTP Bank Group, which accounts for more than 50% of the MSCI Hungary Index.35 Similar to Poland, Hungary has also outperformed EMs by about 15 percentage points YTD, but trades nearly two standard deviations below historical levels, at approximately 5.2x P/E, and more than a 50% discount to EMs.36 The cost of equity increased on the back of higher risk premia after the start of the Russia-Ukraine war, driven by Hungarian company direct exposure to the region. Coupled with macro and regulatory risks, exposure from OTP has been stable since 2021 and should be well flagged to investors, implying some room for risk premiums to decrease. On the downside, foreign exchange volatility could keep the Hungarian National Bank cautious and delay easing, while access to E.U. funds could continue to be delayed.

The Middle East and North Africa Overview

After benefitting from last year’s rally in oil prices, the roughly 40% decline in the price of crude from the March 2022 high through mid-June 2023 presents a headwind for the MENA region.37 Although this will likely lead to slower year-over-year GDP growth, oil exporting countries used the previous year to build up their fiscal balances, while fiscal breakeven points remain well below historical levels. Past and continued social and economic reforms should help lessen the impact of lower oil prices while also driving long-term sustainable growth. The region also benefits from USD pegs, while credit growth could accelerate if the Fed moves towards cutting rates. Despite active capital market activity over the past year, the IPO pipeline remains robust, which could help increase the region’s weight in the MSCI Emerging Markets Index while also providing a deeper market for active stock selection.

Saudi Arabia

Lower oil prices and volumes will likely weigh on Saudi Arabia’s growth in the second half of 2023, especially after the country announced the unilateral 1mn barrel-per-day (bpd) cut beginning in July. This is expected to result in the country’s fiscal balance turning negative for the year, falling from the 2.8% level seen in 2022.38 On the positive side, the government remains committed to reforms to meet its “Vision 2030” agenda, which should help drive consumption growth. Tensions between the Kingdom and the U.S. continue to ease following visits from President Biden and high rankings U.S. officials, such as Secretary of State Blinken. From a positioning standpoint, investors remain heavily underweight the country, while continued capital market activity and the subsequent increase in index weight could drive further inflows.

The United Arab Emirates (U.A.E.)

The United Arab Emirates saw explosive growth over the past year, but the two largest Emirates, Dubai and Abu Dhabi, remain well positioned heading into the second half of 2023. Dubai’s economic growth outlook remains robust, in our view, benefiting from social reforms leading to population growth, tourism, and the city gaining relevance as a regional hub. Abu Dhabi’s economy also stands to benefit, despite weaker energy prices, with the Emirate catching up to Dubai in implementing reforms and developing a non-oil economy. We see the U.A.E. as uniquely positioned to benefit into the second half of the year as tourism and the real estate market remain robust, while the government continues to prioritize economic growth.

Kuwait, Qatar, and Egypt

Kuwait’s bank-heavy index performed well since being upgraded to emerging market status in 2021. However, the outlook is less certain, with valuations stretched and earnings growth set to slow alongside GDP growth, as potential FOMC rate cuts later in the year could weigh on bank profitability. Besides weaker energy prices, Qatar’s economic growth prospects remain subdued in the short term, due to a slowdown in the non-oil economy, which saw a boost in recent years, due to the buildout for the 2022 World Cup. Egypt remains a complex investment case, with foreign exchange risks clashing against the recent International Monetary Fund agreement and lower commodity price support for the current account balance.

Frontier Markets Watch List

Argentina: The outlook for the Argentinian economy will be largely driven by the results of the October Presidential election, with the conservative Juntos por el Cambio coalition looking to take the presidency from the Peronist Union por la Patria (former Frenta de Todos) coalition. Leading up to the election, we expect the current Fernandez Administration to continue its path of unorthodox fiscal and monetary policy, giving way to further hyperinflation. The Peronists have overseen a difficult stretch for the Argentine economy, and voters seem to be looking for change. Any change in leadership could signal a stabler macroeconomic and political backdrop, which could result in a rush of foreign direct investment into the country.

One area where we see outsized potential is lithium. Argentina sits in the “lithium triangle” and contains roughly 10% of the world’s reserves.39 As a result, if Argentina can drive investment into the country, it stands to benefit from the long-term electric vehicle demand boom.

Vietnam: The combination of Vietnam’s increasingly important role in global supply chains, along with a rebound in tourism and a potential soft landing in the U.S., could lead Vietnam to post high mid-single digit GDP growth in 2023. From a longer-term perspective, we note that more than half of the Vietnamese population is expected to enter the global middle class by 2035, unlocking more disposable income and driving a self-fulfilling cycle of consumption-led growth.40 However, near-term risks remain. The country has seen a setback in demand, as the government’s anti-graft campaign led to a reduction in investments. In addition, though a long-term beneficiary of domestic consumption, Vietnam’s economy remains heavily reliant on exports, making it vulnerable to a slowdown in developed market growth.